Complying with origin rules critical for garment exports

|

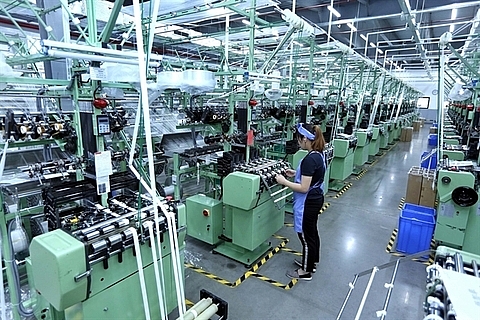

| A clothing production line of the Best Pacific Vietnam Co in the northern province of Hai Duong. VNA/VNS Photo Danh Lam |

Lower-than-expected export revenue last year showed the industry was facing problems in participating more deeply in the global value chain and expanding exports to niche markets.

Le Tien Truong, general director of Viet Nam National Textile and Garment Group (Vinatex), said 2019 was a difficult year for the industry with export revenue of US$39 billion, $1 billion lower than its target.

Despite many expectations for the industry due to the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP) and the EU-Viet Nam Free Trade Agreement (EVFTA), Truong said it was critical for the sector to make moves to comply with origin rules to enjoy the preferential tariffs in the trade deals.

Truong said Viet Nam needed to invest in fabric production to meet origin requirements when exporting to CPTPP and EVFTA countries.

This would not be easy because Viet Nam must compete in terms of designs, quality, prices and delivery time with other major fabric producers like China and India, Truong said.

Truong said investing in fabric production needed careful consideration in terms of production scale because Viet Nam’s garment industry uses less than 1 billion metres of woven and knitted fabric every year, or 18 per cent of global exports.

If fabric production targeted only Viet Nam, production scale would be too small while investing in large-scale production and competition with China and India must be taken into account, Truong said.

Truong said that Vietnamese garment firms should work with global giants to establish value chains and invest in production to meet their demands.

According to Nguyen Xuan Duong, chairman of Hung Yen Garment Corporation, at this time in previous years, his company had orders and contracts up until the end of the second quarter.

However, this year was different, Duong said, adding that many partners only signed short-term contracts. He said they seemed to be more cautious and were watching for developments of the US – China trade war.

A report from the Ministry of Industry said many garment firms had only 80 per cent of the order volume for 2020 as they did the same time last year.

Vu Duc Giang, president of the Viet Nam Garment and Apparel Association, said Viet Nam’s garment and textile sector must speed up reforms with innovations in designs, management, fabric production and building brands.

Giang said that this year, the sector targeted export revenue of $42 billion, which would require firms to invest in raw material production to meet rules of origin in trade deals.

The association’s statistics showed the garment and textile industry ran a trade surplus of $16.62 billion in 2019, up $2.25 billion compared to the previous year.

New fabric factory

The Viet Tien Garment Joint Stock Corporation (VGG) has signed up with Luenthai and Newtech to establish the Viet Thai Tech fabric factory, which is expected to supply fabric for the garment and textile industry.

Chairman of the Viet Nam Textile and Apparel Association Vu Duc Giang said this project aims at proactively sourcing raw materials, shortening production and delivery time, as well as meeting strict quality requirements from customers in the garment industry.

The project has a total investment of $20 million, of which the first phase of the project is $12 million and the second is $8 million. It’s expected to be inaugurated and go into operation on June 30 this year.

Giang, who is also Chairman of VGG, said the factory will contribute to solving the shortage of fabric resources which is now a big obstacle for the garment and textile industry of Viet Nam.

Giang suggested that Viet Thai Tech should quickly set a target of factory deployment, investment in equipment and technology, so it can supply fabric for VGG and export markets by September this year.

The factory will be built according to US green standards and will be the first green standard fabric factory in Viet Nam. It’s expected to meet the fast-changing requirements of the global fashion industry.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Iran war to modestly impact Vietnam (March 05, 2026 | 08:00)

- Middle East tensions drive cost pressures for seafood exporters (March 04, 2026 | 13:56)

- PV Gas reduces LPG deliveries amid Middle East conflict disruptions (March 04, 2026 | 09:23)

- JAPEX withdraws from LNG terminal project in Haiphong (March 03, 2026 | 11:57)

- Agency of Foreign Trade warns of trade disruption due to Middle East conflict (March 02, 2026 | 17:11)

- Vietnam manufacturing sees improved growth (March 02, 2026 | 16:27)

- Businesses bouncing back after turbulent year (February 27, 2026 | 16:42)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

Tag:

Tag:

Mobile Version

Mobile Version