Changes needed for global banking post-coronavirus

|

| Kevin Martin - Global COO Head of Digital Transformation, Wealth, and Personal Banking, HSBC |

Life for many of us has changed beyond recognition compared to just a few months ago – and one of the biggest changes has been the need to do electronically what we have historically done face-to-face: video conferencing for meetings, shopping online, restaurant delivery, day-to-day banking, and so on.

The question is how much of this change will prove to be permanent versus how much is temporary. If COVID-19 was to end overnight, would old patterns of behaviour return or would new habits become permanent?

For the banking industry the answer is probably more towards permanent change. There is also a lot of news coverage – including featuring HSBC – talking about how the pandemic has driven established banks to accelerate their digital programmes. There’s some truth to this: we’ve had to prioritise services and journeys that enable customers to complete their highest volume service journeys remotely, and this can be as simple as resetting pins, changing loan terms, paying for the groceries or filling in forms electronically.

|

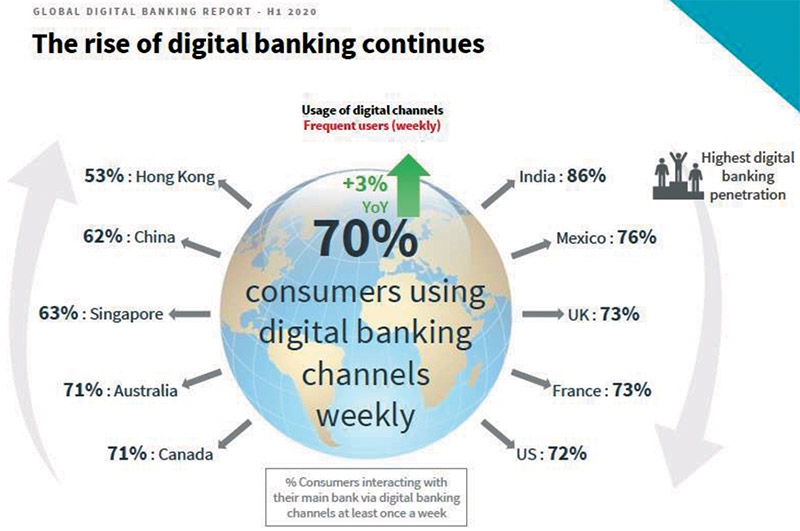

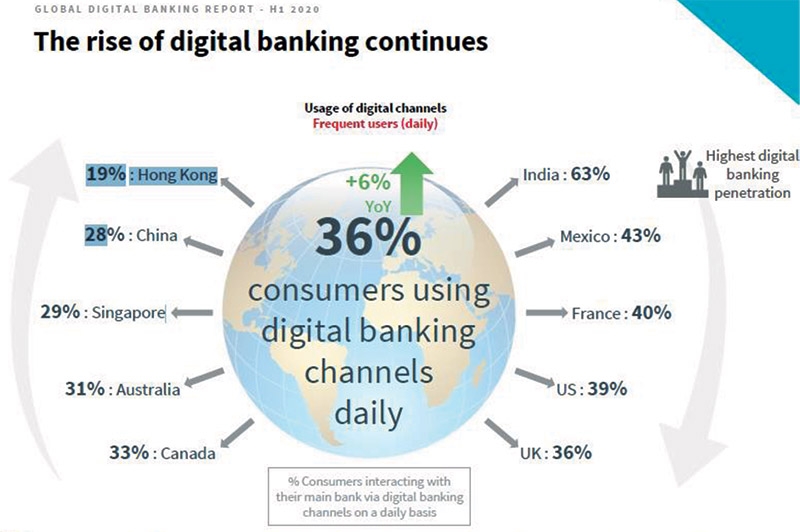

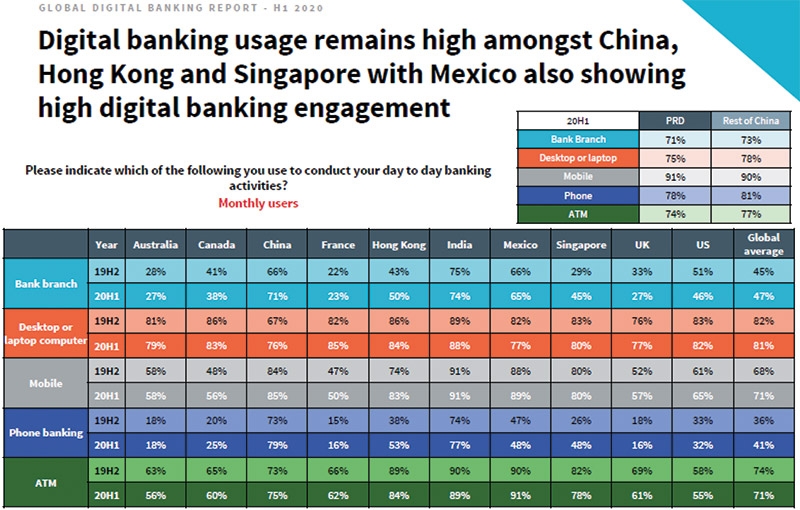

According to research by RFi, 71 per cent of consumers globally are now using digital banking channels weekly post-pandemic – a 3 per cent on-year increase – while daily use climbed 6 per cent in the same period. Hong Kong saw a steep nine percentage point rise in monthly users of mobile banking between the second half of 2019 and the first half of this year – jumping from 74 to 83 per cent of respondents.

But it is also clear that COVID-19 alone has not suddenly caused the shift to digital, in most cases it has simply accelerated it. Customer behaviour patterns have been shifting for years as more and more people use digital ecosystems to shape their lives. The banking industry has been part of this change, but in most cases historically not a leader.

So if we were to make some predictions about what banking will look like post-pandemic, they might look like the following. Firstly, even more day-to-day banking transactions will be completed via digital channels.

The transition towards digital was inevitable for routine activities – checking balances, payments and transfers, paying a bill, even credit card applications. Many of these activities are habits, and once habits are embedded they are unlikely to change. After COVID-19 even more people bank this way – routine activities will stay digital.

|

Next, customers will still go to branches and turn to people for important life moments.

Even as the pandemic fades people will still have a psychological need for human interaction at important life moments. People need to feel reassured when it comes to life events like sending a child overseas for education, managing generational wealth transfers, establishing a wealth plan, bereavement or buying a home.

This means we can expect some return to “normal” post-pandemic – and branches will continue to make up a significant proportion of this type of activity. What remains to be seen is how far people will be willing to use video platforms as part of this interaction, which may in turn depend on factors such as long social distancing persists. People will value the convenience of a nearby branch compared with a scheduled video call for different reasons but the ubiquitous use of Zoom is likely to accelerate how face-to-face is conducted.

|

| The international banking group HSBC |

Thirdly, bank branches will become more like service lounges. The way branches look and feel will change. Branches will become less about rows of tellers managing daily transactions, which can now be done online – and more like service lounges. Agents will be on hand to guide customers through transactions on their own devices, and space will be broken up into more casual seating areas for deeper private conversations. Changing the layout of branches in this way will also support any ongoing social distancing.

Next up, regulatory collaboration on digitisation will accelerate. COVID-19 enabled regulators and banks to work together to rapidly help customers keep banking during the early outbreak of the pandemic – examples of which include collaboration to increase the availability of video banking services in some markets. We predict that this cooperation will accelerate further still as increased digitisation persists and evolves into new areas like AI and machine learning.

|

Finally, established banks will become more like challenger banks beyond their home markets, and partnerships will accelerate. Increased digitisation for customers will also drive increasing partnerships between banks and platforms like online retailers and social platforms, so that you can bank where you spend or socialise. Separately, we are seeing new digital entrants to retail banking markets around the world, but we also predict that as digital platforms become more scalable, and established international banks will begin to challenge through digitally-centric offerings both inside and outside their home markets.

The benefit of both changes for consumers will be clear: more choice. For the established banks it is an opportunity to compete in new markets, segments, and marketplaces.

It is unlikely that normality will be exactly the same as life before. The situation has made us focus as a society collectively on a range of ways of new solutions to familiar problems in order to help live our lives during a pandemic – and some of these will be permanently embedded. But while some parts of service industries like banking will change, the human element will persist – particularly where complexity is involved and reassurance needed

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Mobile Version

Mobile Version