CEO confidence in growth down

For PwC's 16th Annual Global CEO Survey, 1,330 interviews were conducted in 68 countries during the last quarter of 2012. By region, 449 interviews were conducted in Asia Pacific, 312 in Western Europe, 227 in North America, 165 in Latin America, 95 in Central & Eastern Europe, 50 in Africa and 32 in the Middle East.

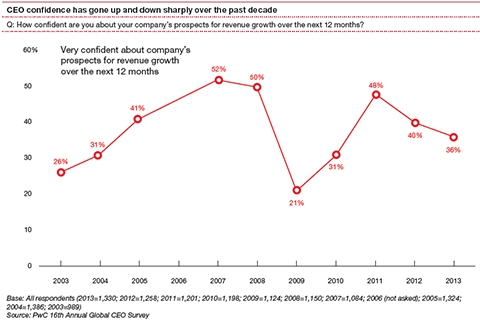

According to the survey, only 36 per cent of CEOs worldwide are ‘very confident’ of their company’s growth prospects in the next 12 months That's down from 40 per cent who were 'very confident' of short term growth last year and 48 per cent in 2011, but still above the lows of 31 per cent and 21 per cent in 2010 and 2009.

Looking at the economy generally, 28 per cent of CEOs say the global economy will decline further in 2013, and only 18 per cent predict economic improvement; 52 per cent say it will stay the same. While the CEOs’ outlook remains gloomy, the forecast is an improvement on last year when 48 per cent of CEOs predicted the global economy would decline in 2012.

CEOs in Western Europe were least confident of short term revenue growth. Faced with ongoing recession, just 22 per cent of Western European CEOs said they were very confident of growth, down from 27 per cent last year and 39 per cent in 2011. Confidence in short term growth also declined in North America to 33 per cent (42 per cent in 2012) and in Asia Pacific to 36 per cent (42 per cent in 2012). Even in Africa, seen by many as the next high-growth economy, CEO confidence in company growth slipped to 44 per cent, from 57 per cent last year.

Latin American CEOs, however, bucked the trend. Their short term confidence rose to 53 per cent of CEOs, up slightly from last year.

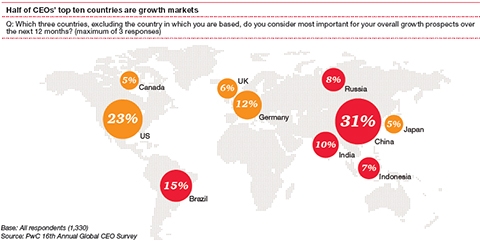

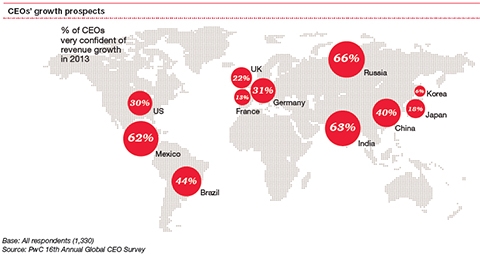

At the country level, confidence varied widely: CEOs are most confident in Russia where 66 per cent are very confident of revenue growth in 2013, closely followed by India (63 per cent) and Mexico (62 per cent). They were trailed by countries including Brazil (44 per cent), China (40 per cent), Germany (31 per cent), the US (30 per cent), the UK (22 per cent), Japan (18 per cent), France (13 per cent) and finally Korea, where only 6 per cent of CEOs are very confident of revenue growth in the year ahead.

Longer term, overall CEO confidence remained stable; 46 per cent of CEOs worldwide said they were very confident of growth prospects in the next three years, about the same as last year. CEOs in Africa and the Middle East were most confident of long term growth, at 62 per cent and 56 per cent respectively. In North America, 51 per cent were 'very confident' of long term growth, while 52 per cent in Asia Pacific were very confident. Long term confidence was weakest in Europe at 34 per cent.

Releasing the survey results on the first day of the World Economic Forum annual meeting in Davos, Dennis M. Nally, chairman of PricewaterhouseCoopers International, said:

“CEOs remain cautious about their short term prospects and the outlook for the global economy. However, given the high levels of concern among CEOs about issues - such as over-regulation, government debt, capital market instability - it is no surprise that CEO confidence has declined in the last 12 months,” Nally said.

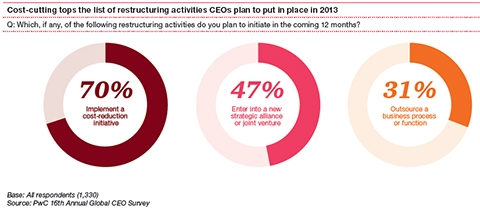

"We find CEOs working to deal with the ongoing risks. Strategically, CEOs continue to refine their operations, looking to cut costs without reducing value as they manage through sluggish times.

They are seeking growth opportunities organically, avoiding large outlays that could strap resources for the future. Most important, they have a clear focus on customers, collaborating with them more closely than ever on programmes to stimulate demand, loyalty and joint innovation."

As the difficult economic conditions persist, CEOs are generally more worried about a wider range of issues than they were a year ago. Top of the list, a concern among 81 per cent of CEOs about continuing uncertainty over economic growth.

Sending a clear message to governments around the world, other key CEO worries are the government response to the fiscal deficit (71 per cent), over-regulation (69 per cent) and lack of stability in capital markets (61 per cent). CEO concerns about over-regulation are at their highest since 2006. When asked directly about the government response to the regulatory burden, CEOs are even more blunt, with just 12 per cent agreeing that their government has reduced the regulatory burden in the last year.

When asked about the major threats to their business growth, CEOs also cited the increasing tax burden (62 per cent), availability of key skills (58 per cent) and the cost of energy and raw materials (52 per cent).

CEOs remain relatively cautious on plans for increasing headcount for this coming year. 45 per cent of CEOs plan to recruit in 2013 (down from 51 per cent in 2012) while 23 per cent plan to reduce the size of their workforce.

The full survey report with supporting graphics can be downloaded at www.pwc.com/ceosurvey.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version