Banks eye rosier prospects in Q1

According to a forecast released by MB Securities (MBS) on April 2, estimated business results in the first quarter in banking seem buoyant.

|

Among the banking sector’s top performers, VPBank took the pole position in Q1, with its profit figure soaring nearly 180 per cent during the period, and its full-year profit is forecast to eye a 90 per cent spike.

Similarly, Ho Chi Minh City’s commercial lender OCB had a 44.4 per cent jump in its Q1 profit and a forecast 29 per cent jump in full-year profit.

Corresponding figures for major state lender VietinBank are a 44.4 per cent jump in Q1 profit and a forecast nearly 16 per cent hike in full-year profit.

Southern lender Sacombank would post a 31.6 per cent hike in Q1 profit and a forecast 20.3 per cent jump in full-year profit, while HDBank’s Q1 profit would inch up 26.8 per cent and its estimated full-year profit to soar 31.5 per cent.

State lender BIDV is to witness a 16.8 per cent hike in its Q1 profit and a forecast 23.4 per cent jump in full-year profit.

| Despite modest credit growth which just expanded 0.26 per cent as of March 25, the banking sector’s profit picture proves rosier compared to diverse other sectors. |

Military-run MBBank is estimated to count a 14.8 per cent hike in its Q1 profit, while its estimated full-year profit would go up 14.5 per cent on-year.

Leading state lender Vietcombank would count a 2.6 per cent hike in Q1 profit, and an estimated 7 per cent hike in full-year profit.

Corresponding figures for Techcombank are a 12 per cent hike in Q1 profit, and a 26.2 per cent jump in full-year profit, whereas ACB would have its Q1 profit to surge by 8.2 per cent and full-year profit to expand by 19.5 per cent on-year.

MBS, however, noted that several banks could witness a less rosy picture in Q1, as VIB might post a 3.5 per cent drop in profit during the period, yet its full-year profit might still go up 19.8 per cent, or tech-driven TPBank would count 11.2 per cent drop in Q1 profit, yet its full-year profit could surge 13.4 per cent.

Elsewhere, LPBank revealed that the bank reaped $116 million in Q1 profit. With such a positive figure, at its upcoming AGM slated to take place on April 17, the bank would submit to the shareholders a plan to count $395 million in full-year profit, showing a 35 per cent jump on-year.

For OCB, at its upcoming AGM on April 15, the bank envisages passing a plan to post $286 million in full-year profit, up 66 per cent on-year.

Techcombank is set to hold its AGM 2024 on April 20 with an 18.4 per cent jump in its full-year profit to reach $1.12 billion.

Despite modest credit growth which just expanded 0.26 per cent as of March 25, the banking sector’s profit picture proves rosier compared to diverse other sectors.

This has partly been reflected in the performance of banks on the stock market, with 23 out of 27 tickers of listed banks going up in the past quarter.

Among them, Techcombank had the strongest price increase of nearly 42 per cent in Q1 of this year, reaching VND46,800 ($1.95) per share at the closing session on April 3, and is heading towards its peak of around VND55,500 ($2.30) per share established in July 2021.

If compared to the bottom last November, this ticker has soared more than 52 per cent, equal to 1.5-fold in five months.

In addition, many other large-cap bank stocks also eyed a sharp increase in price, including MBBank up 36 per cent, VietinBank up 31 per cent, BIDV up 21 per cent, and Vietcombank rose 19 per cent.

Phan Duy Hung, director and senior analyst at Vietnam Investors Service and Credit Rating Agency JSC (VIS Rating) commented that after 2023 with economic growth slowing down and a surging bad debt ratio, the banking sector's profit landscape is expected to rebound strongly in 2024.

That is because better business conditions and a low-interest environment have contributed to boosting customers' debt repayment capacity as well as asset quality.

The sector's return on average asset ratio shall increase thanks to improved net interest margin and loan growth, thereby strengthening banks’ internal capital generation capabilities.

Hung added that diverse government policies and new regulations to promote investment and domestic consumption shall take effect, thereby contributing to boosting business activities and improving the money flow from businesses.

“We expect the sector’s bad debt ratio to cool down to 1.7-1.8 per cent this year from a five-year peak at 1.9 per cent at the end of last year. The risk from the real estate sector shall be cushioned as legal issues are gradually tackled and businesses have better access to loans,” said Hung.

| Positive prospects for Vietnam’s stock market this year The market's uptrend will continue to be consolidated in the first trading session of the Year of Cat. |

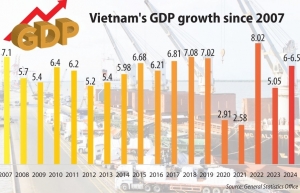

| Global banks high on GDP prospects With a recovering economy in 2023, Vietnam has earned upbeat growth projections from international organisations for this year. |

| Rubber firms look to rosier future Rubber producers are anticipating a brighter future this year, leveraging a pickup in prices and consumer demand. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

- IFC to grant $150 million loan package for VPBank (February 13, 2026 | 09:00)

- Nam A Bank forms position as strategic member at VIFC through three key partnerships (February 12, 2026 | 16:39)

- Banks bolster risk buffers to safeguard asset quality amid credit expansion (February 12, 2026 | 11:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

Tag:

Tag:

Mobile Version

Mobile Version