Asian shares tumble on Greece fears

Big losses in Europe and on Wall Street on Friday fuelled the selling pressure, while the resignation of a key European Central Bank committee member also depressed sentiment.

Big losses in Europe and on Wall Street on Friday fuelled the selling pressure, while the resignation of a key European Central Bank committee member also depressed sentiment.

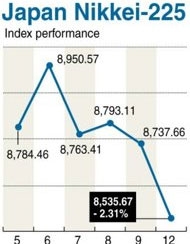

Tokyo fell 2.31 per cent, or 201.99 points, to a 29-month-low of 8,535.67, with exporters again feeling the most pain as the euro sank against the yen. After the closing bell Toyota's credit rating was cut by Fitch, which blamed the strong yen.

The euro hit 104 yen in Toyko trade, its lowest level since mid-2001, compared with 107.66 yen on Friday. By 0800 GMT it had strengthened slightly to 104.27.

It also fell to $1.3560 from $1.3649 Friday. The dollar was lower at 76.80 yen against 77.58 yen.

The euro's weakness also weighed on other markets, with Hong Kong tumbling 4.21 per cent, or 836.09 points, to 19,030.54, and Sydney ending 3.72 per cent, or 156.2 points, lower at 4,038.5.

Singapore was off 2.71 per cent in the afternoon.

Seoul, Shanghai and Taipei were closed for public holidays.

Greece -- which earlier this year was given the green light for a second bailout -- on Sunday announced two billion euros in budget cuts demanded by the EU and the IMF for its rescue package to avoid a default.

EU economy commissioner Olli Rehn welcomed the move and said a team would head to Athens in the next few days to discuss a new tranche of Greece's first rescue package agreed in 2010.

However, European finance ministers are split over how to deal with obstacles holding up the second 160-billion-euro bailout for Greece, agreed in principle in July.

And Germany's Economy Minister Philipp Roesler pointedly said, in a column for publication on Monday, that Europe could no longer rule out an "orderly default" for Greece.

On Saturday, Der Spiegel magazine reported that the German government was preparing two contingency plans in the event of a Greek default.

Adding to the eurozone crisis was the resignation of Germany's European Central Bank executive committee member Juergen Stark, who was against the bank buying the bonds of under-pressure countries.

Bank watchers suggested his exit showed the ECB was deeply split over its approach to handling the sovereign debt crisis.

"It's very clear to us that this situation in Europe is not going to end well and the now plummeting euro is trying to tell you that some sort of Greek default and subsequent European bank recapitalisation programme is imminent," said Bell Potter managing director Charlie Aitken in Sydney.

Satoshi Tate, a senior dealer at Mizuho Corporate Bank, told Dow Jones Newswires: "We are watching Greece, and only Greece.

"Conditions are getting very serious and everyone is worried how the issue will unfold."

The strength of the yen -- which is also sitting at near record highs against the dollar -- saw rating agency Fitch downgrade car giant Toyota because of its huge exposure to foreign exchange movements.

US stocks plunged Friday after Stark's resignation. The Dow fell 2.69 per cent, the S&P 500 fell 2.67 per cent and the Nasdaq shed 2.42 per cent.

And at the open of European trade Monday markets tumbled. London's benchmark FTSE 100 slumped 2.39 per cent, Frankfurt's DAX 30 index shed 2.44 per cent and in Paris the CAC 40 plunged 3.32 per cent.

A meeting Friday of the Group of Seven finance chiefs ended without any concrete conclusions, which also dampened sentiment, said dealers.

"The G7 didn?t seem to comfort the market by noting that they will take all the necessary steps to ensure resilience in the financial markets," noted Emma Lawson of National Australia Bank.

Oil also suffered heavy selling. New York's main contract, light sweet crude for delivery in October, dived $1.71 to $85.53 per barrel in the afternoon.

Brent North Sea crude for October delivery fell $1.17 to $111.60.

Gold was trading at $1,841.20 an ounce at 0800 GMT on Monday, down from $1,874.40 in late trade Friday.

In other markets:

-- Manila ended 1.15 per cent, or 50.02 points, lower at 4,296.05.

SM Investments fell 0.5 per cent to 550 pesos, geothermal power producer Energy Development slid 0.8 per cent to 6.10 pesos and Philippine Long Distance Telephone dropped 1.3 per cent to 2,354.

-- Wellington closed 1.81 per cent, or 60.12 points, lower at 3,263.81.

Fletcher Building dived 2.9 per cent to NZ$7.65, Contact Energy slumped 3.1 per cent to NZ$5.25 and Sky Network Television shed 2.6 per cent to NZ$5.36.

But New Zealand Oil & Gas soared 4.4 per cent to NZ$0.71.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version