Apt rules needed for tourism properties

|

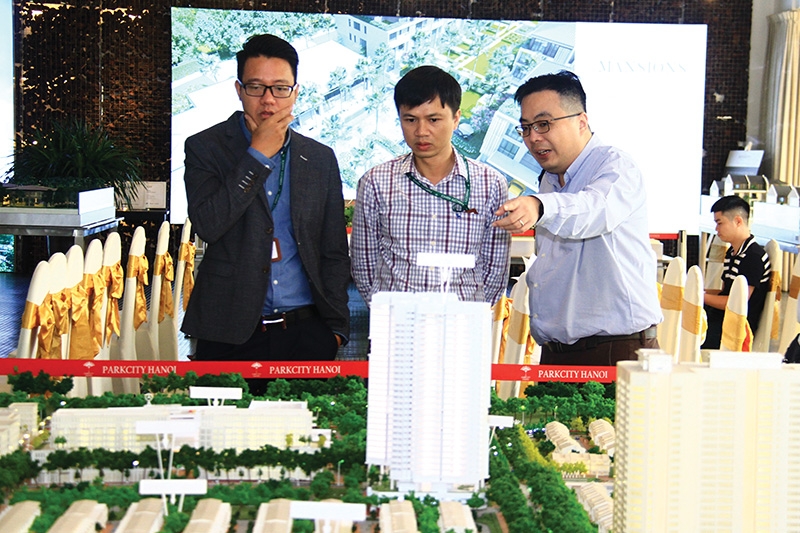

| Buyers must consider a developer’s prestige, financial capacity, and the legal status of each project. Photo: Thanh Nguyen |

A recent conflict between Thanh Do Investment Development and Construction JSC (Empire Group) and buyers of Cocobay Danang project has become an example of the problem at hand, with a solution required in order to ensure the rights of both developers and buyers.

Last week, 400 buyers from Cocobay Danang gathered to express their disagreement about the options Empire Group offered them to solve the dispute.

At the end of 2019, Empire Group refused to pay a committed rental yield of 12 per cent to its buyers starting from January 1, claiming a low occupancy of visitors.

Developers of Cocobay Danang are not expected be able to hand over units to buyers at the committed deadline, which was set to the end of 2020, blaming the delayed process and refusal of rental yield on the current global health crisis.

Empire Group had created a fever in the market in 2016 when it announced a decision to pay a rental yield of 12 per cent in the first eight years for its condotel buyers. Cocobay is one of the biggest condotel projects in Vietnam, located across 31 hectares of land in Danang with investment capital declared at VND11 trillion ($480 million).

This project has been mired in difficulties since the end of 2017 when a range of construction processes was pushed behind schedule and the handover deadline was delayed. After that, Empire Group surprisingly announced a U-turn on paying the committed yield. While many options were offered to buyers, none were satisfactory and the dispute continues to rumble on.

The case of Empire Group is only one among many different issues in the real estate market due to the lack of regulations and overlapping laws.

The biggest obstacle currently, according to industry insiders, is the requirement for completing the legal framework for holiday property, especially for condotels.

The key factor of holiday property was benefit-sharing, with buyers mostly considering holiday property to benefit when taking the property into lease, and keeping it as an asset.

However many buyers have fallen on hard times after paying the whole value but being refused access to the property, along with rental yields not being paid as committed.

Experts warned that before investing into holiday projects, buyers must be careful in developers’ prestige and financial capacity, as well as the legal status of each project.

With more than 30,000 condotel units in the nation excluding thousands of resort villas and officetels, holiday property has much room for growth in line with the development strategy for tourism of Vietnam.

According to lawyer Nguyen Thanh Ha from SBLaw, to wipe out disputes in the real estate market in general and in holiday property in particular, it needs to improve the legal framework covering this segment.

“We know that the regulations for condotels were mentioned in the legal framework; however, we need more detail in order to avoid any disputes raised later,” Ha said.

Ha pointed to regulations on sharing benefits between developers and buyers, the fines if one side breaks the commitment, and the methods in place to force them to obey regulations.

Chau Viet Bac, deputy general secretary of the Vietnam International Arbitration Centre (VIAC) commented that refusal to pay committed rental yield and delay in house handovers are two most common issues in the real estate market.

Also at play are a range of battles caused by developers who had delayed the handover deadline, and the quality of property as previously committed in the contracts.

Over recent years many strikes have occurred in both pipelined and operated projects between developers, management boards, and their residents.

Figures from the VIAC said that 45 dispute dossiers were submitted to the organisation in the first nine months of 2019, four times higher than the previous year.

“Disputes related to real estate market started mostly from the lack of legal regulations and the overlapping between laws and decrees, as well as the refusal to commitment from both developers and buyers,” Bac said.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

- Why Vietnam must build a global strategy for its construction industry (December 31, 2025 | 18:57)

- Housing operations must be effective (December 29, 2025 | 10:00)

Tag:

Tag:

Mobile Version

Mobile Version