Sabeco and Habeco controlling stake may be out of reach for foreign investors

|

| Government policies and the sheer volume of shares may bar foreign investors from taking control of Vietnam's largest brewers |

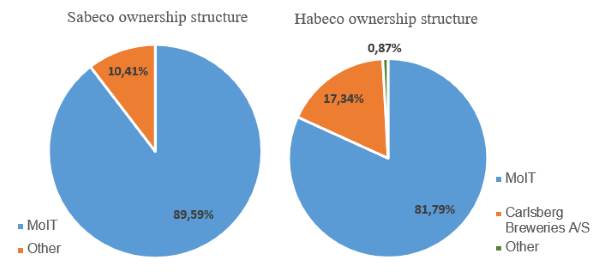

In mid-July, the State Securities Commission of Vietnam (SSC) proposed the Ministry of Industry and Trade (MoIT) to compile the divestment plans with a maximum foreign ownership limit of 49 per cent to be submitted to the prime minister for approval.

This proposal is based on the Decree No.60/2015/ND-CP on amending and supplementing several articles of Decree No.58/2012/ND-CP dated July 20, 2012 on providing specific provisions for the implementation of the Law on Securities and the Law on Amending and Supplementing a number of Articles of the Law on Securities.

If the prime minister agrees with the proposal, foreign investors will lose the opportunity to acquire a controlling interest in the two brewers.

|

Along with legal policy barriers, the capital will be another barrier for foreign investors in the race to seize the stakes in Sabeco and Habeco.

Notably, at the end of the trading session on July 26, 2017, the capitalisation volumes of Sabeco and Habeco were VND151 trillion ($6.66 billion) and VND18.7 trillion ($824.5 million), respectively. Thus, foreign investors will have to spend a respective capital of VND77 trillion ($3.39 billion) and VND10 trillion ($44.09 million) on purchasing dominant stakes.

The state divestment has also attracted numerous foreign investors. According to the latest move, the largest Australian brewer Carlton & United Breweries (CUB) expressed interest in becoming a strategic investor of both Sabeco and Habeco.

Besides, several other foreign breweries have been eyeing Sabeco since it was earmarked for equitisation, such as San Miguel, Heineken, SABMiller, Thai Beverage Public Company Limited (Thai Beverage), Japanese Asahi Group Holdings Ltd., and Kirin Holdings Co.

Regarding Habeco, Carlsberg Breweries A/S, strategic partner, has expressed interest in increasing its holdings in Habeco. However, the purchase has yet to be closed because the Danish brewer keeps offering less than the market price (Habeco is currently listed on UPCoM at VND83,000, or $3.65, per share).

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Vietnam’s industrial output hits seven-year high in 2025 (January 06, 2026 | 17:47)

- From easy money to selective bets: investment prospects for Vietnam in 2026 (January 06, 2026 | 16:51)

- Finance sector lays firm groundwork for 2026 after major reform (January 06, 2026 | 15:30)

- Stock market starts 2026 with growth and governance in focus (January 06, 2026 | 08:45)

- Ho Chi Minh City backs $2 billion AI data centre with dedicated task force (January 06, 2026 | 08:43)

- Vietnam GDP posts second-strongest growth since 2011 (January 06, 2026 | 08:35)

- Double-digit GDP growth within reach with shift to higher-value expansion (January 06, 2026 | 08:33)

- Ho Chi Minh City projects $10.5 billion remittance inflows in 2025 (December 31, 2025 | 18:58)

- Digital shift reshaping Vietnam’s real estate brokerages (December 31, 2025 | 18:54)

- New decree sharpens enforcement in securities market (December 31, 2025 | 18:53)

Mobile Version

Mobile Version