Asia Pacific’s office rents mount, vacancy rates edge down

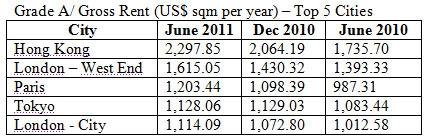

Covering 173 office markets in the world, the report finds Grade A office rents in Hong Kong to be the most expensive worldwide, followed by London – West End. Paris replaced Tokyo as the third most expensive Class A office rent in the globe, while London city remained in the 5th spot.

Covering 173 office markets in the world, the report finds Grade A office rents in Hong Kong to be the most expensive worldwide, followed by London – West End. Paris replaced Tokyo as the third most expensive Class A office rent in the globe, while London city remained in the 5th spot.

The Asia Pacific office vacancy rate tumbled 121 basis points (bps) to 11.42 per cent, while the regional office rent edged up 2.9 per cent in the first half of 2011. Hong Kong’s Class A office rent at $2,297.85 per sqm per year was the highest in the region as well as the world, while Tokyo ($1,128.06 per sqm per year) and Singapore ($935.48.00 per sqm per year) ranked the second and third most expensive, respectively, in Asia Pacific.

“Although Asia registered rising rent and lowering vacancy in the third quarter of 2011, demand for office spaces in the region showed signs of weakness amidst increasing concerns of the European sovereign debt crisis and uncertain growth prospect in the United States,” said Simon Lo, executive director of research and advisory, Asia at Colliers International.

“Individual multi-national corporations are expected to give a pause of their expansion plan, or even consolidate, while some local enterprises in the region still have solid occupational demand,” added Lo.

The region remains characterised by high levels of office construction. Construction in 10 cities, including Bangalore, Beijing, Chengdu, Chennai, Delhi, Guangzhou, Ho Chi Minh City, Mumbai, Shanghai and Tokyo, totaled 12.8 million sq meter at midyear. Guangzhou recorded the most office space under construction worldwide with 2.9 million sq meter office being built.

In Europe, Middle East, Africa (EMEA), seeing more mixed economic conditions, the average office vacancy rate was relatively higher at 12 per cent at mid-year. However, office rents in the region largely held steady. The Class A rent in London West End remained the highest in the region, or the second most expensive worldwide, at mid-year. Meanwhile, office space under construction in the region was down modestly from 15 million sqm at the end of 2010 to 14.78 million sqm in mid-2011.

The United States office market has yet to see recovery with many markets still recording little or no growth. Office rents continued to languish with those in downtown and suburban markets registering small decreases in the first half of 2011.

Given the sudden stall in job creation and continued high energy costs, full recovery of the United States office market is expected to surface in mid-2012 at the earliest. By comparison, Canadian markets enjoyed a relatively good half year supported by a robust first quarter and a modest job gains in the first half of 2011.

In terms of Class A gross rent, Midtown Manhattan in New York ($7,446.02 per sqm per year) was the most expensive in the region as of June 2011.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

- Dong Nai experiences shifting expectations and new industrial cycle (January 28, 2026 | 09:00)

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

Tag:

Tag:

Mobile Version

Mobile Version