Vietnam’s road to emerging market status

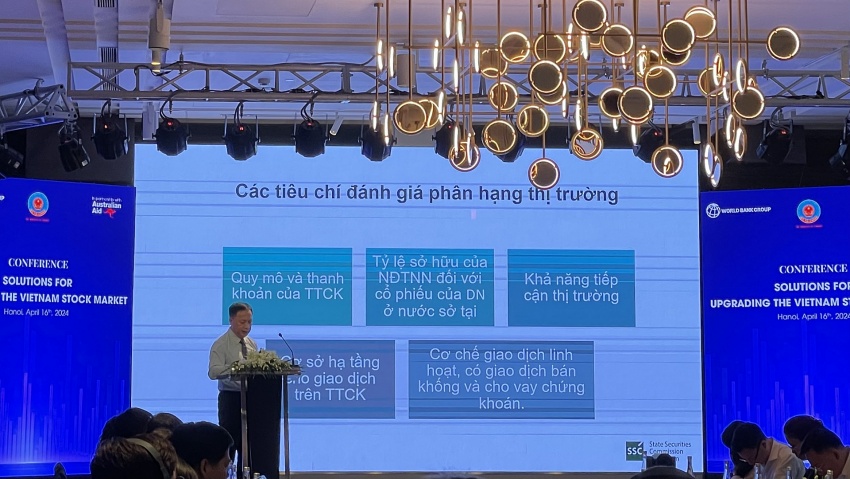

At a conference themed "Solutions for upgrading the Vietnam stock market" hosted by the MoF in collaboration with the World Bank Group on April 16, speakers clarified how Vietnam should upgrade from a frontier market to an emerging market, as assessed by international organisations, especially FTSERussell.

|

| Nguyen Nhu Quynh, director of the MoF's Institute of Financial Strategy, delivered a speech at the conference |

The conference focused on discussing four content groups includes analysing the opportunities of upgrading for the development of the Vietnamese stock market in particular, and the economy in general; analysing the conditions and criteria for upgrading to an emerging market that the Vietnamese stock market needs to achieve according to FTSE Russell's evaluation; experiences from some stock markets when upgrading, identifying challenges and risks for Vietnam when upgrading the stock market to an emerging market; proposing solutions to promote the upgrading of the Vietnamese stock market in the near future.

Nguyen Nhu Quynh, director of the MoF's Institute of Financial Strategy, stated at the conference that, "The stock market is becoming an important capital mobilisation channel for Vietnam's economy, especially for medium- and long-term capital. As of March, the VN-Index had reached 1,284 points, up 13.6 per cent compared to the end of 2023, ranking second only to Japan's Nikkei 225 Index, which increased by 20.6 per cent. The market capitalisation of stocks reached $283.33 trillion, up 13.9 per cent, equivalent to 66.2 per cent of Vietnam's estimated GDP in 2023.”

Elevating Vietnam's stock market from frontier to emerging status will be a crucial milestone for the new phase of market development, contributing to increasing scale, enhancing the efficiency of capital mobilisation and utilisation, and fostering the economic growth of the country.

|

| Vu Chi Dung, head of the State Securities Commission's International Cooperation Department, spoke at the conference |

Upgrading the market is a priority for the government, with the prime minister closely overseeing and setting specific goals to strive for by 2025.

"To ensure the sustainable development of a stock market, it must truly be healthy, transparent, and ensure fairness for all investors. As the direct supervisor for the stock market, the State Securities Commission (SSC) has, is, and will continue to make efforts to propose appropriate solutions to meet the criteria of ratings organisations towards the goal of upgrading Vietnam's stock market from frontier to emerging, ensuring continuous, transparent, stable, and fair market operation," said Vu Chi Dung, head of the SSC's International Cooperation Department, at the conference.

However, experts discussed at the conference that when Vietnam's stock market is upgraded, the biggest challenge will be to ensure that the market continues to develop sustainably, maintaining its rating and avoiding a downgrade. This can happen when stock markets no longer meet the requirements to maintain their current status or cannot meet the changing criteria issued by ratings agencies.

Based on the discussion, the conference raised more open issues that need attention from managers, policymakers, and researchers to contribute to improving policies related to upgrading the Vietnamese stock market.

| Vietnam looks for catalyst to upgrade market status In a bid to elevate Vietnam to an emerging market status, the State Securities Commission is set to engage with global rating agencies in Hong Kong next month, seeking to boost foreign investment and diversify financial instruments. |

| Vietnam closer to emerging market status Vietnam’s decade-long quest to transition from a frontier to an emerging securities market underscores the pressing need for technological, regulatory, and risk management reforms to foster a robust and investor-centric ecosystem. |

| Vietnam in waiting list for market upgrade to secondary emerging Vietnam remains in the watch list for a possible reclassification from frontier to secondary emerging market status, according to FTSE Russel’s Country Classification review in March. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version