Vietnam looks for catalyst to upgrade market status

|

| Emerging market status would create a more diversified investor base, Photo: Le Toan |

The commission (SSC) is set for fresh talks with global rating agencies, according to chairwoman Vu Thi Chan Phuong. “The dialogue will provide an important stage for the SSC to champion its market development initiatives,” Phuong shared last week.

The proposed upgrade could act as a catalyst for foreign investment into Vietnam, given the International Monetary Fund’s assessment that market classifications and indices shape roughly 70 per cent of international investment decisions. An upgrade could induce a net foreign capital inflow of nearly $300 million annually into the Vietnamese stock market, as suggested by a World Bank report.

Phuong added, “An elevation to an emerging market status would benefit Vietnam in many ways. Not only would it lead to a stronger valuation ability for stocks, but it would also hasten the state divestment process and create a more diversified investor base, thereby reducing our current over-reliance on individual investors.”

However, the path to upgrade is not without its challenges. The existing pre-transaction margin requirement necessitates the collaboration of the State Bank of Vietnam.

“Currently, Vietnam requires ample cash and stock collateral prior to transactions,” Phuong said. “Rating agencies, on the other hand, do not necessitate this pre-transaction margin. We’re working on implementing a central counterparty for settlement on the underlying market, which will help lower the margin requirement.”

Dragon Capital chairman Dominic Scriven noted in June that Vietnam’s stock market is grappling with the implementation of a central counterparty (CCP) model.

“Currently, investors must have sufficient securities prior to selling or adequate funds in place before trading, which curbs their buying power. If the CCP model is introduced successfully, it could substantially improve the market’s liquidity,” he told VIR.

Moreover, there is an ongoing call for a review of foreign ownership restrictions, confining these to crucial sectors such as national security and trade protection.

On the subject of improving market transparency and quality, Phuong said, “The SSC has increased supervisory and inspection activities, reviewed financial statements, liaised with auditing firms, and evaluated tax inspection results from the Ministry of Planning and Investment.”

Asked about the sudden volatility in the stock market, Phuong admitted that individual investors, accounting for over 90 per cent of the market, still dominate. “If we take South Korea’s market as an example, 40-60 per cent are institutional investors. Aiming initially for a ratio of 40 per cent institutional to 60 per cent individual investors could help us achieve greater stability,” Phuong explained.

Nguyen Quang Thuan, chairman of provider of financial data FiinGroup, sees technical barriers to the anticipated elevation of Vietnam’s stock market as surmountable, given robust oversight from regulatory bodies and the government. He equated Vietnam’s current market situation to a heavyweight boxer in a lighter division, with the potential for a substantial capital influx upon a status upgrade.

“If Vietnam competes in the emerging category, a meagre 1 per cent allocation from a $6.8 trillion market would equate to $68 billion flowing into our market. We’ve seen such capital movements in Pakistan, Saudi Arabia, and Kuwait when their statuses were upgraded,” Thuan noted.

However, he cautioned that the potential influx of capital could lead to disruption in the foreign exchange market. Also, he noted, organisations like MSCI would require a freely convertible currency to consider an upgrade.

“Upgrading doesn’t just serve foreign investors, it’s also essential for our 5.2 million domestic stock investors and the market’s considerable capital needs,” Thuan added.

Particularly, market watchdogs also expect the forthcoming activation of the KRX system - a new technical infrastructure for Vietnam’s stock market backed by the Korean Exchange - predicted to infuse the market with a wider array of financial instruments. This development is not only poised to raise Vietnam’s status from a frontier to an emerging market, but also expected to enhance foreign investment inflows significantly, with a particular emphasis on fostering algorithmic trading.

| The customer is what matters for advisory services In an interview with VIR’s Lam Phong, chairman of the Vietnam Financial Consultants Association (VFCA), Le Minh Nghia, sheds light on the significant demand for personal financial investment, accumulation, and protection among the Vietnamese population, giving rise to a burgeoning industry of personal financial advisory services. |

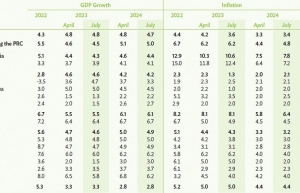

| Outlooks lowered as weaker trade hampers 2023 growth Slow recovery in domestic production and continued global challenges are expected to leave Vietnam behind its economic growth target this year, with international organisations lowering their forecasts. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version