Vietnam’s e-commerce market to exceed $17 billion in 2023

|

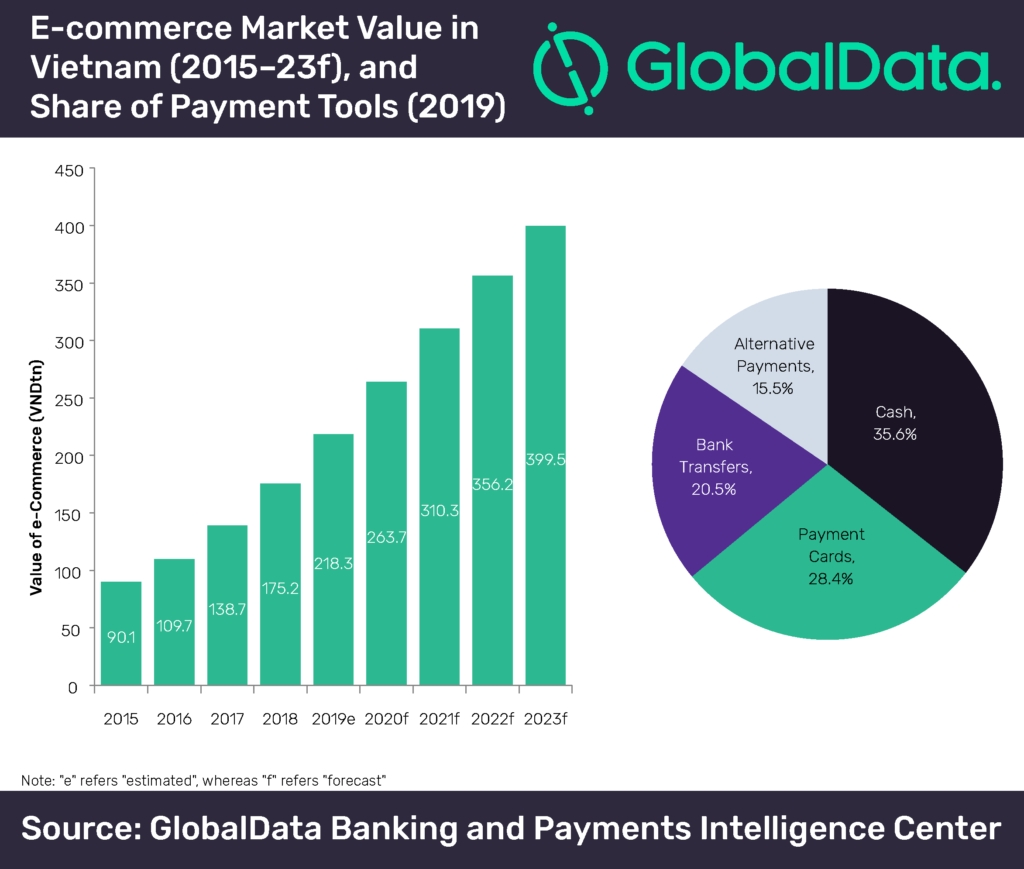

GlobalData’s latest report, "Vietnam Cards & Payments: Opportunities and Risks to 2023", states that the country’s e-commerce market has doubled during the past five years, with total online spending increasing from VND90.1 trillion ($3.9 billion) in 2015 to VND218.3 trillion ($9.5 billion) in 2019.

Nikhil Reddy, Banking and Payments analyst at GlobalData, said, “While the traditional payment instruments such as cash, cards, and bank transfers are widely used for e-commerce purchases, consumer preference for alternative payments is on the rise. There is a growing demand for faster and more convenient payment means, especially among tech-savvy millennials.”

According to GlobalData’s 2019 Banking and Payments Survey, cash is still the most preferred payment mode for e-commerce purchases in Vietnam, accounting for 35.6 per cent in 2019. Alternative payment solutions are gradually gaining ground and accounted for 15.5 per cent. MoMo is the most preferred alternative payment solution in Vietnam, followed by PayPal.

Strong growth has prompted global companies to invest in Vietnamese e-commerce companies. In 2018, e-commerce company Tiki received $5.3 million and $44 million funding from VNG Corporation and Chinese investor JD.com, respectively. In the same year, another company Sendo secured $51 million from SBI Group (a Japan-based financial services company) and other investors. Furthermore, Chinese e-commerce giant Alibaba invested an additional $2 billion in Lazada, one of the leading e-commerce companies in the country.

Reddy concludes that, “Improving payments infrastructure, coupled with rising consumer confidence in online shopping and the availability of convenient payment solutions are expected to further drive e-commerce growth in Vietnam.”

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- PM sets five key tasks to accelerate sci-tech development (February 26, 2026 | 08:00)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Citi report finds global trade transformed by tariffs and AI (February 25, 2026 | 10:49)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

Tag:

Tag:

Mobile Version

Mobile Version