US braces for debt deal vote amid default jitters

|

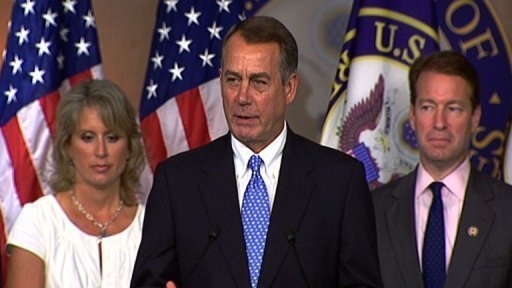

| Speaker of the House John Boehner said on Thursday his party has presented a bill to raise the debt ceiling that is as "large a step" as Republicans can take that "is doable and signable into becoming law." |

As Republicans sought to whip their new unruly conservative Tea Party lawmakers into line, a vote in the House of Representatives was postponed in an indication that the proposed bill might not yet have won enough party support.

But Republican sources insisted the vote on a two-step plan forged by House Speaker John Boehner to raise the nation's $14.3 trillion debt limit would take place later Thursday.

With only five days to go until an August 2 deadline when the Treasury says it will run out of funds, IMF chief Christine Lagarde piled on the pressure for a deal saying the dollar's status could be in doubt if the impasse continues.

Stock markets also remained nervous that the fragile economic recovery nurtured since the 2008 global financial crisis could be at risk.

Lagarde warned if the crisis continued: "It would probably entail a decline of the dollar relative to other currencies, and probably doubts in the mind of those people who reserve currencies as to whether the dollar is effectively the ultimate and prime currency of reserve."

Democrats have slammed Boehner's plan which would raise the debt ceiling for just a few months, saying it would only plunge the world's economic superpower back into crisis at the start of the 2012 presidential election year.

A majority of senators has warned they will block the bill if it reaches Senate, and the White House has said President Barack Obama would veto it if it reaches his desk.

Boehner admitted his plan was "not perfect," but he said there were no "gimmicks or smoke screens."

"For the sake of jobs and for the sake of our country, I am asking the representatives in the House in a bipartisan way and asking my colleagues in the Senate, let's pass this bill and end this crisis."

Republican House Majority Leader Eric Cantor also appealed to Democrats, saying Senate Majority Leader Harry Reid had several choices.

"One is to suffer the economic consequences of default, which I hope, which all of us hope, he doesn't choose," Cantor said.

But Reid vowed that the Boehner proposal, which would shave $915 billion off the national deficit over 10 years in return for hiking the debt ceiling by some $900 billion, would fail in the Democratic-controlled Senate.

"No Democrat will vote for a short-term Band-Aid that would put our economy at risk and put the nation back in this untenable situation a few short months from now," he said.

White House spokesman Jay Carney, however, said the administration remained "optimistic" US lawmakers would clinch a compromise deal and avoid an unprecedented default which could roil global markets.

European stocks markets ended mixed, weighed down by the debt strains in the United States, after Asian bourses had slumped earlier in the day.

In the fifth straight day of losses, the Dow Jones Industrial Average slumped 62.44 points (0.51 per cent) to close at 12,240.11.

The broader S&P 500 fell 4.22 points (0.32 per cent) to 1,300.67, while the tech-heavy Nasdaq Composite eked out a slight gain, rising 1.46 points (0.05 per cent) to 2,766.25.

White House officials admitted Wednesday for the first time they are working on a back-up plan to keep the country running if in the worst case scenario the United States is forced into default.

Washington hit its debt ceiling on May 16 but has used spending and accounting adjustments, as well as higher-than-expected tax receipts, to continue operating normally.

The heads of Wall Street's top banks, meanwhile, urged Obama and Congress to reach a deal, warning of "very grave" dangers if there is no accord.

The chief executives of Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, Wells Fargo and other top financial firms wrote in a joint letter that they hoped for a deal this week.

"The consequences of inaction -- for our economy, the already struggling job market, the financial circumstances of American businesses and families, and for America's global economic leadership -- would be very grave."

Democrats have rallied behind a rival plan crafted by Reid which would cut spending by $2.2 trillion over 10 years, and raise the debt ceiling until after the November 2012 elections.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- France supports Vietnam’s growing role in international arena: French Ambassador (January 25, 2026 | 10:11)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- Russian President congratulates Vietnamese Party leader during phone talks (January 25, 2026 | 09:58)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

- Int'l media provides large coverage of 14th National Party Congress's first working day (January 20, 2026 | 09:09)

- Vietnamese firms win top honours at ASEAN Digital Awards (January 16, 2026 | 16:45)

Mobile Version

Mobile Version