Vietnam’s debt structure meeting limit targets

The National Assembly Standing Committee has just concluded consideration of a government a report on Vietnam’s public debt situation.

|

| Vietnam’s debt structure meeting limit targets, illustration photo/ Source: freepik.com |

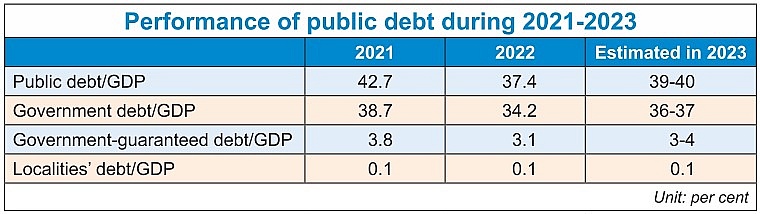

“In 2021-2023, all public debt safety indicators have stayed within the limit allowed (see box),” the report said.

The nation’s foreign debt in 2021-2023 was lower than the permissible limit set by the NA, not exceeding half of GDP. It has seen a slight reduction compared to the plan, at an estimated 38 per cent of GDP as of late 2023, largely thanks to a decrease in foreign loans of businesses and credit institutions under the form of self-borrowing and self-payment.

The nation’s foreign debt refers to total foreign debts of the government and government-guaranteed foreign debt, and foreign debts of businesses and credit institutions under self-borrowing and self-payment.

According to the Ministry of Finance (MoF), in the context of global tightened financial conditions and a rise in lending rates, businesses in Vietnam virtually sought no new loans in the past few years, and instead focused on debt repayment. The public sector’s foreign debt – including government debt and government-guaranteed debt – continued reducing from 14.7 per cent of GDP in 2021 to an estimated 10.8 per cent of GDP in 2023.

Meanwhile, foreign debts of enterprises and credit institutions under the form of self-borrowing and self-payment climbed from 23.4 per cent of GDP in 2021 to 26.2 per cent of GDP in 2023.

“Though enterprises obtained few new loans in 2022, they still continued increasing loans in 2023 to add more capital to their business and production activities in hope of recovery and implementation of new large-scale projects,” the MoF said.

|

For example, many businesses have registered for large foreign loans at the State Bank of Vietnam, such as Formosa Ha Tinh Steel Corporation ($500 million), Jinko Solar Vietnam ($450 million), Masan Group ($308 million), and Vietcombank ($300 million).

When it comes to the structure of the nation’s foreign debt, debts of enterprises and credit institutions accounted for 61.4 per cent in 2021, which is estimated to have risen to 70 per cent in 2023.

The ratio of the nation’s foreign debt repayment in the country’s total goods and service export turnover is ensured at a level lower than 25 per cent allowed by the NA.

At the sixth session of the 15th NA in Hanoi last October and November, Prime Minister Pham Minh Chinh said, “The state budget overspending has been controlled in 2023, and all indicators related to public debt is also maintained at a level lower than the limit and the warning level of the government.”

In 2023, total state budget revenue and expenditure reached $72.48 billion and $73 billion, respectively, meaning a deficit of $520 million. Total public debt was equivalent to 39-40 per cent of GDP, while the government debt was tantamount to 36-37 per cent of GDP; the nation’s foreign debt hit 37-38 per cent of GDP; and the government’s direct debt repayment reached 20-21 per cent of total state revenue.

For 2024, PM Chinh stated, “New solutions will be used to increase revenue and save expenses, and also to closely control budget deficit, public debt, government debt, the nation’s foreign debt, and the government’s direct debt repayment within the NA’s permissible limits.”

The government has decided on a 5 per cent rise in state budget revenue as compared to the realised figure in 2023 to increase capital for development investment.

“We will also ask the NA to allow us to continue implementing policies on exempting and reducing taxes and fees, while timely enacting appropriate and effective policies related to the global minimum tax,” PM Chinh said.

Over a month ago, the government submitted to the National Assembly Standing Committee a plan for borrowing and paying public debt for 2024, based on expectations that the economy will grow 6-6.5 per cent in 2024, and the state budget revenue of about $69.62 billion with a state budget deficit of as much as 3.6 per cent of GDP.

Under the plan, the government’s total loans will be $28.52 billion, including $15.73 billion for borrowing to offset the central budget deficit, $12.1 billion for borrowing to pay the principal debt of the state budget, and $680.3 million for on-lending.

“These loans will come from many sources, including issuance of government bonds, official development assistance (ODA), foreign concessional loans, and other legal financial sources,” said Minister of Finance Ho Duc Phoc.

When it comes to the government’s debt payment obligations for 2024, based on the government’s existing debt portfolio, it is estimated that the government’s direct debt payment is $16.7 billion and the payment of on-lending projects is $2.45 billion. By late 2024, the government’s direct debt payment will be ensured at a cap of 25 per cent of the state budget.

When it comes to the loan and payment plan of localities, their total borrowing for the whole of 2024 will be about $1.3 billion, largely coming from ODA, government concessional loans, and other domestic sources. Localities’ total debt payment will be about $173.8 million, and total debts by late 2024 will be as much as $4 billion.

With the estimated borrowing and payment of government debt, government-guaranteed debt, debt of authorities, and self-borrowed and self-paid foreign debt of enterprises and credit institutions, if there is positive GDP growth that meets targets, by the end of 2024, Vietnam’s total public debt will be about 39-40 per cent of GDP, while the government debt will be about 37-38 per cent of GDP, and the nation’s foreign debt will 38-39 per cent.

The government’s direct debt payment obligation compared to the estate budget revenue will stand at about 24-25 per cent, guaranteed to stay “within the cap and threshold allowed by the NA,” according to the MoF.

| Implementation of public debt borrowing and repayment targets The total government loan is about $55.57 billion, reaching 42.9 per cent of the plan, of which the central budget loan is about $53.97 billion or 44.1 per cent of the plan. The government’s direct debt repayment obligation is around $38.25 billion, hitting 53.3 per cent of the plan. Capital from government loans to refinance sat at $1.63 billion, ensuring the limit does not exceed $9.37 billion. The average issuance term of government bonds was 13.92 years in 2021, and 12.67 years in 2022. In 2023, it is expected to be 12.6 years, ensuring the target of 9-11 years. The growth rate of government-guaranteed debt in a year is not to exceed the growth rate of nominal GDP of the previous year. Such debt decreased 12.9 per cent in 2021 and 7 per cent in 2022, which is estimated to go down to 6.1 per cent. The total loan of localities’ budgets is about $1.64 billion, reaching 26.3 per cent of the approved plan. Localities’ debt repayment obligation is $611.8 million, hitting 41.1 per cent of the approved plan. Source: Ministry of Finance |

| Bank bad debts forecast to remain under great pressure in 2024 Though the asset quality of banks in Vietnam will be temporarily under control until the end of 2023, experts said more attention should be paid to the issue in 2024 as bad debts are rising. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

Mobile Version

Mobile Version