Techcombank partners with Personetics to revolutionise financial management with AI

|

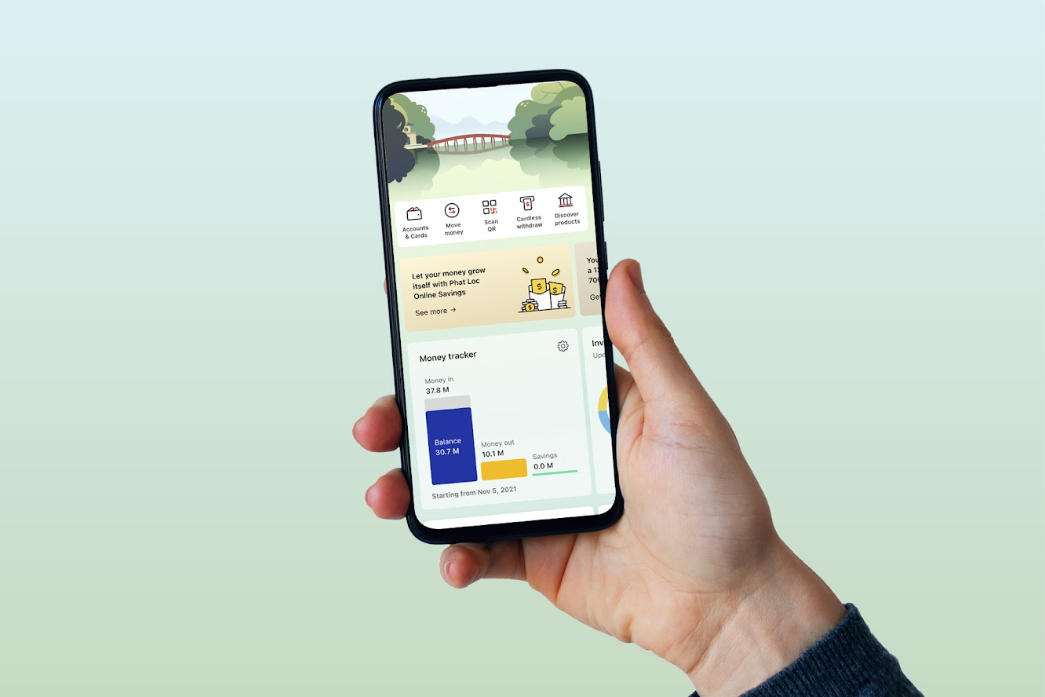

By analysing individual customers' financial transaction history and behaviour, Techcombank’s updated system provides personalised advice on saving strategies, recommends suitable financial products, and offers guidance for asset growth.

Additionally, users receive alerts regarding excessive spending and unexpected payments, enabling them to improve their financial health and achieve their goals.

The partnership has yielded impressive results, with a three-week trial involving 10,000 participants experiencing significant positive changes. Notably, customers' savings balances increased by 9 per cent, demonstrating the effectiveness of the AI-driven financial management approach.

Moreover, the average frequency of customer logins to the application skyrocketed from 14.2 times during the trial phase to 77.3 times during the deployment phase. Additionally, there was a remarkable 43.7 per cent surge in instalment transactions, accompanied by a substantial 32 per cent increase in total instalment value.

Pranav Seth, head of the Digital Transformation Office at Techcombank, underscored the critical role of Techcombank's personalised financial management tools, which are built on in-depth analysis of customer spending behaviour. This approach allows for the delivery of tailored solutions at the right time, catering to each user's specific needs.

It exemplifies the distinct advantage of digital banking over traditional financial management by providing swift, optimised, and personalised experiences based on the wealth of information and user behaviour.

With a customer-centric strategy at its core, Techcombank believes that collaborations with industry leaders like Personetics and Adobe will bring unique financial solutions that enhance the experience for millions of Vietnamese customers.

Seth added, "Our primary objective is to empower customers with unprecedented convenience and control, ranging from identifying new investment and savings opportunities to managing personal expenditure."

David Sosna, CEO and co-founder of Personetics, also shares his optimism for driving positive business transformation for Techcombank and its targeted customer segments.

The Israel-backed firm Personetics, serving nearly 130 million customers worldwide, specialises in providing personalised solutions and enhancing customer interactions through the collection and analysis of financial data.

The company collaborates with over 100 financial institutions and digital banks across 32 markets in North America, Europe, and Asia, including renowned entities such as U.S. Bank, Metro Bank, and UOB.

| Techcombank enters 2023 with strategic plan Against the formidable challenging confronting the banking system, Techcombank has embarked upon distinct strategies to effectively address and advance amid obstacles in the real estate and corporate bond market. |

| Techcombank confident about 2025 targets despite headwinds Despite several temporary headwinds, Techcombank is staying consistent in the third year of its five-year transformation journey, with medium-term objectives and targets remaining unchanged. |

| FPT Smart Cloud sets its sights on Indonesia: unleashing AI innovation to transform financial market Armed with a rich portfolio of AI-driven solutions and backed by an illustrious track record, FPT Smart Cloud aims to empower businesses, optimise operations, and foster sustainable growth across various sectors, particularly the banking, finance and insurance industries in Indonesia – the largest economy in the Southeast Asia. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Mobile Version

Mobile Version