Standard Chartered adjusts Vietnam's 2023 GDP growth forecast to 5 per cent

|

As Vietnam navigates through a period of economic adjustment, insights from Standard Chartered Bank present a mixed but cautiously optimistic scenario.

The bank's latest macroeconomic report, which was released on October 24, has downgraded Vietnam's 2023 GDP growth by 0.4 per cent from the earlier estimate of 5.4 per cent.

This adjustment reflects the lower-than-expected performance so far this year and a more subdued global outlook. To align with these revised figures, a robust 7 per cent growth rate in the fourth quarter of this year is hoped for, though achieving this remains a significant challenge.

Despite this, Standard Chartered maintains a strong GDP growth forecast for 2024, pegged at 6.7 per cent. This projection is split into 6.2 per cent growth over the first half of the year, escalating to 6.9 per cent in the latter half.

Recent macro indicators reveal some positive signs. Trade data, while not yet heralding a definitive manufacturing rebound, suggests a cautious improvement. The domestic market is also showing more robust recovery signals, particularly in terms of retail sales.

Furthermore, sectors such as construction have demonstrated impressive growth over the year-to-date, with manufacturing also beginning to pick up pace. The external outlook seems encouraging as well, with forecasts indicating the current account surplus could rise to 3.5 per cent of GDP in 2024, up from 2 per cent this year.

However, there has been an upward adjustment in the inflation outlook for 2023, now revised to 3.4 per cent on-year from the previously projected 2.8 per cent.

Fourth-quarter inflation is expected to spike at 4.3 per cent. This upward trend is likely to continue into the next year, potentially driving search-for-yield behaviour and amplifying the risk of financial instability. Notable inflationary pressures are emerging from sectors such as education, housing, food, and transport.

Tim Leelahapan, economist for Thailand and Vietnam at Standard Chartered said, “The medium-term outlook remains promising given Vietnam’s economic openness and stability. To reinvigorate foreign direct investment inflows, Vietnam needs to resume rapid GDP growth and develop its infrastructure.”

In terms of monetary policy, the Standard Chartered report anticipates that the State Bank of Vietnam will refrain from further rate cuts.

It projects a 50 basis point hike in the fourth quarter of 2024 to mitigate looming price pressure, followed by a hold in 2025. The report also notes an acceleration in capital outflows in recent quarters, prompting a revision of the USD-VND forecasts to 24,500 by the end of 2023 and 23,500 by the end of 2024. Influenced partly by growing pessimism around the Chinese yuan, this shift reflects the indirect impact on the VND.

“The property market may require further liquidity support, as measures so far appear to have only reduced the short-term repayment pressure. Low interest rates, new project approvals, and a pick-up in buyer sentiment could help the market,” added Leelahaphan.

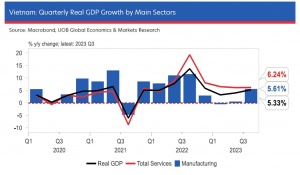

| UOB adjusts 2023 growth forecast for Vietnam UOB (United Overseas Bank) has adjusted its full-year growth forecast for Vietnam to 5 per cent from 5.2 per cent previously, with the assumption of further acceleration of real GDP growth in Q4 at 7 per cent on-year. |

| Standard Chartered brings its globally renowned marathon to Vietnam The iconic Standard Chartered Marathon is set to come to in Vietnam as the company announces its title sponsorship for the Hanoi Marathon Heritage Race. |

| 2023 FDI inflows in Vietnam forecast to surpass 2022 Foreign direct investment (FDI) inflows in 2023 will continue to be stable and overtake 2022, according to KB Securities Vietnam JSC (KBSV). |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version