UOB adjusts 2023 growth forecast for Vietnam

|

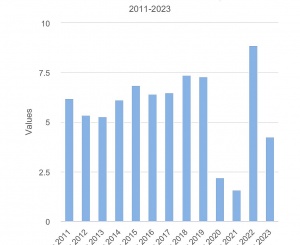

In the first nine months of 2023, Vietnam’s economy expanded by 4.24 per cent on-year, which is an improvement compared to 3.72 per cent in the first half of 2023, but only at half of the pace of 8.85 per cent on-year in the same period in 2022.

This means that the official growth target of 6.5 per cent is increasingly unreachable, according to UOB. To hit the official target, Vietnam’s Q4 growth rate will need to be at least 12 per cent, which is unlikely in the current environment without sharp improvements in the underlying demand.

Despite a firmer growth in Q3, the drag from the first half of the year remains significant. As such, UOB has adjusted Vietnam’s full-year growth forecast to 5 per cent (from 5.2 per cent previously), with the assumption of further acceleration of real GDP growth in Q4 at 7 per cent on-year (prior forecast of 7.6 per cent). This would still require that activities and orders pick up quickly in the coming months.

Traditionally, Q4 is the best-performing quarter in any given year in Vietnam, though the base effect will play a disproportionately large role in 2023 due to the exceptionally strong year in 2022. With that in mind, UOB needed to trim further the forecasts with most of the year already passed and maintain the 2024 projection at 6 per cent.

Growth pace and external demand

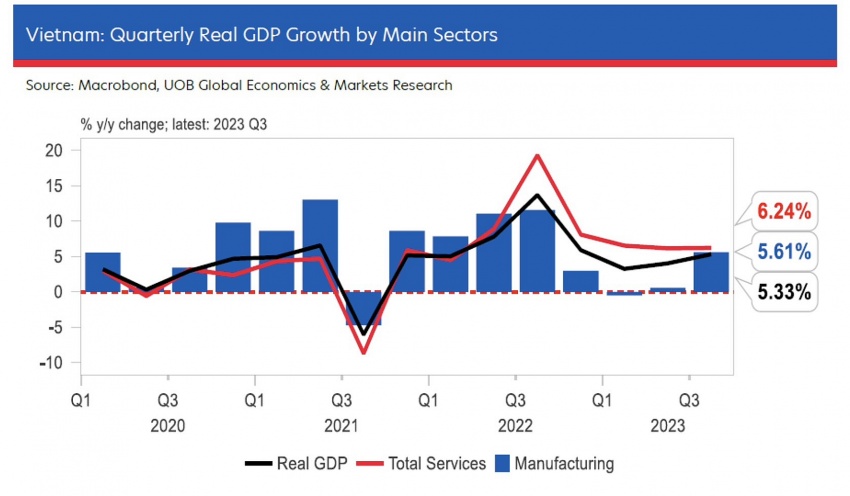

Data released by the General Statistics Office last week showed Vietnam’s real GDP growth pace extended further in Q3 to 5.33 per cent on-year, from 4.14 per cent on-year in Q2. This was underpinned by improvements in trade performances and manufacturing sector output, as well as domestic activities. The outcome came close to UOB's expectation (5.6 per cent) and above a Bloomberg poll of 5 per cent.

Underlying data have shown some improvement in Q3 compared to Q2, although the performance was far below that of the same period last year. By sectors, manufacturing output regained its footing with a 5.6 per cent on-year gain in Q3 after struggling near the zero mark in the prior two quarters, while services sector output (43 per cent share of GDP) rose by 6.2 per cent on-year, about the same as in Q2.

|

Some encouraging signs that activities may have turned around as performances improved on a monthly basis. Exports expanded in September after six consecutive months of declines, with a reading of 4.6 per cent on-year. Imports also showed a similar trend, gaining 2.6 per cent on-year last month after 10 straight months of declines.

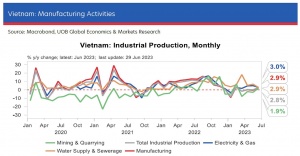

In response, industrial output rose by 5.1 per cent on-year in September, its best performance since November 2022, as the manufacturing sector recorded its fourth consecutive month.

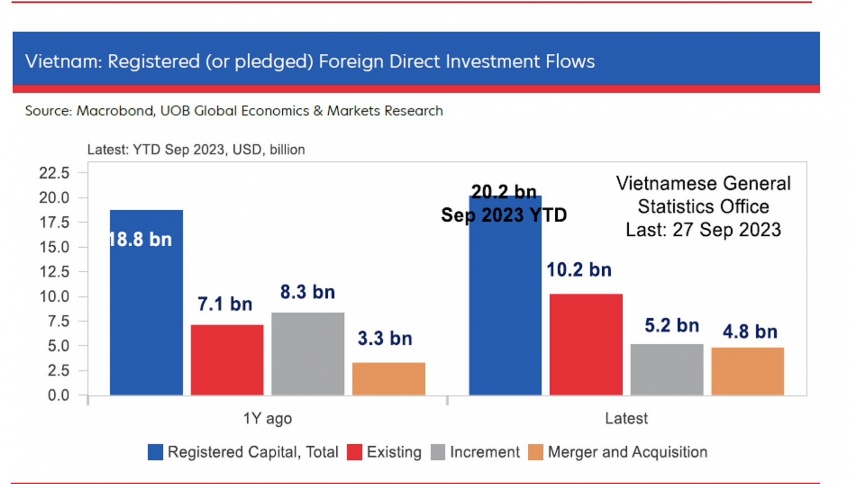

Despite a backdrop of weak growth prospects and poor exports performances much of the year, foreign enterprises continued to commit to the country in the current wave of de-globalisation, de-risking, and supply chain shifts. Vietnam’s disbursed foreign direct investment rose for the fourth straight month, with a 2.2 per cent on-year of increase to $15.9 billion, compared to the 1.3 per cent on-year increase in the first eight months.

If the run rate continues at the same pace, full-year inflows of foreign funding are likely to match the value of $19.7 billion in 2021, which is a considerable achievement considering the current circumstances that are dominated by uncertainty, inflation pressures, and weakened confidence, UOB forecasted.

In the domestic arena, consumer spending seemed to have regained its momentum, with overall retail trade expanding 9.4 per cent on-year in September after hovering below the 7 per cent in the prior three months and for its best month since April.

Retail sales gained 7.4 per cent on-year in September, also the biggest gain since April, while accommodation and services trade output surged 34.7 per cent in September after moving around the 5-10 per cent range in the prior four months, suggesting that tourism activities are picking up speed.

|

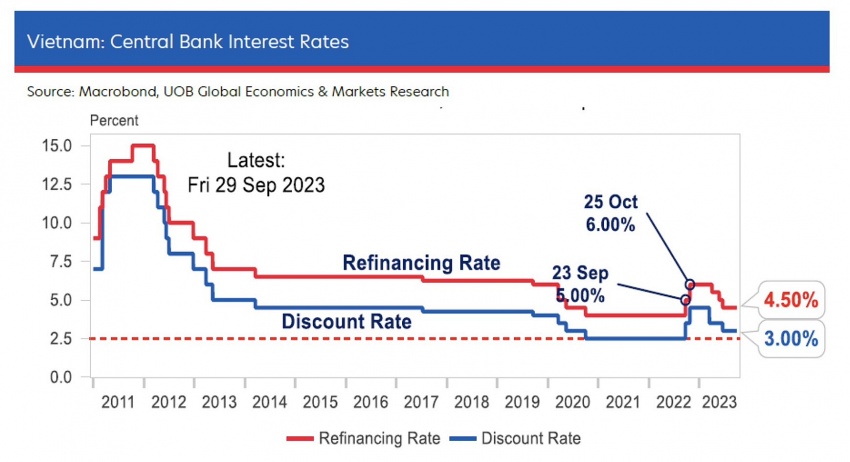

Room for lowering further

Considering the subpar economic performance, the State Bank of Vietnam (SBV) has responded swiftly by cutting its refinancing rate by a cumulative 150 based points by June 2023, to 4.5 per cent. While UOB still sees prospects for another 100bps rate cut (to 3.5 per cent), the timing has been shifted out to Q4 instead, with greater uncertainty as the central bank balances between growth and inflation risks.

Inflation rates have turned higher in recent months and the risks are that upward pressures on consumer prices could intensify ahead given the recent increases in food and energy prices as a result of output cuts by key oil producers, and the ongoing conflict between Russia and Ukraine.

UOB keeps the forecasts of Vietnam’s CPI inflation at 3.9 per cent for 2023, the latest reading of 3.7 per cent on-year for September is well above this year’s low of 2 per cent (June 2023) and edging closer to the official target of 4.5 per cent.

As such, UOB's call for a further SBV rate cut in Q4 remains shrouded with uncertainty.

| Headwinds weakening Vietnam’s economic recovery Vietnam’s GDP growth was only 3.32 per cent in the first quarter compared to the same quarter of the previous year. Growth accelerated in the second quarter but only to 4.14 per cent – very far from the rapid pace of 7-8 per cent annually before 2020. |

| Vietnam's Q3 GDP poised for growth, Standard Chartered reports In the latest global research dispatch on September 22, Standard Chartered projected a 5.1 per cent on-year ascension in Vietnam’s Q3 GDP, a leap from the 4.1 per cent growth witnessed in Q2. |

| Soft momentum likely for Q3: UOB United Overseas Bank (UOB) maintains the full-year growth forecasts of 5.2 per cent for 2023 and 6 per cent for 2024, pencilling a projected 5.6 per cent on-year growth in Q3 this year and 7.6 per cent for Q4. |

| GDP growth rose in first nine months of 2023 The Ministry of Planning and Investment's General Statistics Office held a press conference on September 29 to cover the economic situation from the first nine months of the year. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- ABB Robotics hosts SOMA Value Provider Conference in Vietnam (February 19, 2026 | 08:00)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Digital security fundamental for better and faster decision-making (February 13, 2026 | 10:50)

- Aircraft makers urge out-the-box thinking (February 13, 2026 | 10:39)

Mobile Version

Mobile Version