Social distancing orders take toll on economic prospects

|

Global data analysts FocusEconomics last week stated that the latest COVID-19 wave has been seriously hurting the Vietnamese economy, especially tourism and manufacturing industries, thus forcing the analysts to revise down the country’s GDP growth forecasts.

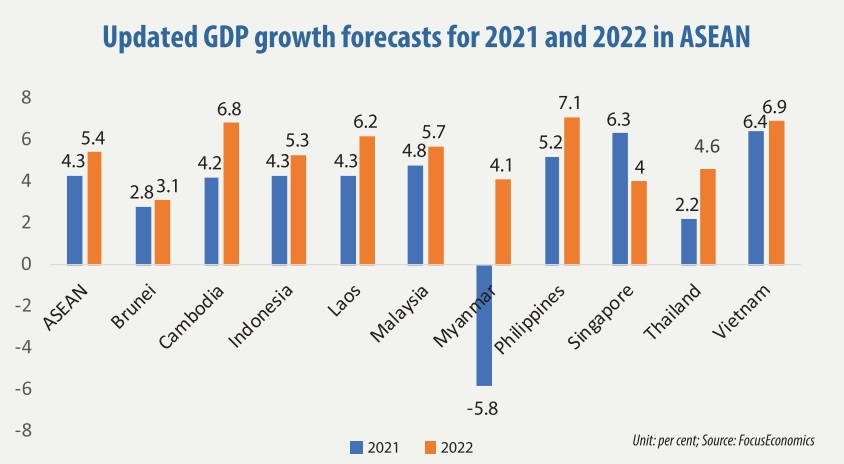

“Vietnam’s GDP is projected to grow at the fastest pace in the region this year, with a rebound in domestic activity driven by strong manufacturing and improving foreign demand boosting exports. However, the impact of the recent surge in daily COVID-19 cases on the already-subdued tourism sector remains a key downside risk to the outlook. Our panellists expect GDP to expand 6.4 per cent in 2021, down 0.5 percentage points from last month’s forecast, and 6.9 per cent in 2022,” the analysts told VIR.

However, 6.4 per cent remains higher than the average growth forecast of ASEAN as a whole and all regional nations separately. Vietnam is also projected to take the lead in economic growth in the region in 2022 (see chart), according to FocusEconomics. “We remain positive on Vietnam as far as its regional standing goes. Amid a broader resurgence of the pandemic in Asia, Vietnam’s growth prospects still look better in a relative sense,” commented Khoon Goh from ANZ.

“After averting contraction in 2020, its expected pace of recovery in 2021 implies that Vietnam’s economy will be one of the first to narrow, or even close, its negative output gap in the region. In addition, the medium-term prospects are solid, amid expectations of rising exports and foreign direct investment,” Goh said.

More than two weeks ago, the Asian Development Bank (ADB) also lowered Vietnam’s economic growth forecast in 2021 from 6.7 per cent in April to 5.8 per cent in its updated report on Asian development outlook for 2021. However, 5.8 per cent remains higher than the average growth forecast of the entire Southeast Asian region (4 per cent), including Indonesia (4.1 per cent), Malaysia (5.5 per cent), the Philippines (4.5 per cent), Singapore (6.3 per cent), and Thailand (2 per cent).

In 2022, Vietnam’s economic growth is predicted by the ADB to ascend to 7 per cent, the highest rate in the region, whose average growth rate is forecast to be 5.2 per cent, with Indonesia (5 per cent), Malaysia (5.7 per cent), the Philippines (5.5 per cent), Singapore (4.1 per cent), and Thailand (4.9 per cent).

Standard Chartered also remains upbeat over Vietnam’s prospects this year, with a prediction for 2021 at 6.5 per cent, slightly lowered from the previous forecast of 6.7 per cent. The bank maintains its 7.3 per cent growth projection for 2022, continuing to expect a post-pandemic acceleration.

“We believe Vietnam is moving towards its goal of becoming a regional supply-chain hub, a modern industrial economy and a high-income country,” said Tim Leelahaphan, economist for Thailand and Vietnam at Standard Chartered.

GDP growth in Vietnam accelerated from 1.81 per cent in the first half of 2020 to 5.64 per cent in the corresponding period of this year as global recovery increased exports.

Bogged down in difficulties

The General Statistics Office (GSO) reported that the current infection wave has taken a heavy toll on the Vietnamese economy, especially industrial production and tourism. “The new variant has become complex and had negative impacts on industrial production in July and the first seven months of the year,” said the GSO’s general director Nguyen Thi Huong.

Specifically, the economy’s index for industrial production (IIP) in July expanded 1.8 per cent on-month and 2.2 per cent on-year – also the lowest increase over the past seven months. The seven-month IIP climbed 7.9 per cent on-year, far higher than that of only 2.6 per cent on-year in the same period last year, but still lower than that of 9.4 per cent in the first seven months of 2019.

In the first seven months of this year, manufacturing and processing – which create 80 per cent of industrial growth – ascended 9.9 per cent on-year; while production and distribution of electricity increased 8.2 per cent, and mineral exploitation fell 6.3 per cent on-year – causing a 1 per cent reduction in industrial production.

In a specific case, state-owned Vietnam National Coal and Mineral Industries Group reported that in the first half of this year, its total revenue was about $2.8 billion, down 2 per cent on-year. In which, the revenue from coal was $1.6 billion, down 9 per cent, while production and sale of electricity hit $304.3 million – down 5 per cent; and consumption of coal hit 22.53 million tonnes, down 5 per cent on-year.

Huong added COVID-19 has dented all activities in trading, transport, and tourism as southern localities have been deploying social distancing. Total revenues from retail and consumption services hit $14.75 billion in July, down 8.3 per cent on-month and 19.8 per cent on-year. The figure was $121.3 billion in the first seven months of 2021, up 0.7 per cent on-year.

Hong Sun, vice chairman of the Korea Chamber of Business in Vietnam, told VIR that over 9,300 South Korean businesses in Vietnam using more than one million employees have been badly affected by COVID-19, and there has been untold losses caused by the fourth pandemic wave. “The life of the workers has been badly affected as so many enterprises have suffered disruptions in supply chains and halted operations,” Sun said. “We think the situation may be worse if COVID-19 continues without any boost in vaccination.”

Minister of Planning and Investment Nguyen Chi Dung commented that Vietnam currently has around 870,000 operational businesses, of which about 97 per cent are small- and medium-sized enterprises (SMEs), with very low competitiveness and capacity.

“Meanwhile, their supply chains are being disrupted and their orders and output have also been slashed,” Dung said. “Also, their production costs are rising due to price hikes in input materials and logistics services. Notably, they now have to pay more for preventing COVID-19.”

According to the minister, many enterprises are now facing risks of insolvency and halted operations. In 2020, the rate of businesses with profits was only 33.86 per cent.

In the first seven months of 2021, the pandemic forced about 79,700 enterprises, both local and foreign ones, to halt and complete procedures for dissolution, up 25.5 per cent on-year. On average, nearly 11,400 enterprises left the market every month.

“Enterprises’ activities are expected to continue with difficulties. The trend of businesses that withdraw from the market will likely stay at a relatively high level,” said Minister Dung.

Currently, the whole southern region – including Ho Chi Minh City and some industrial hubs like Dong Nai and Binh Duong – are in social distancing, with thousands of enterprises affected, while some industrial hubs in the north like Bac Giang, Bac Ninh, and Thai Nguyen have yet to recover from COVID-19 which recently forced them to close many industrial zones (IZs), home to hundreds of thousands of workers. This situation is expected to continue affecting Vietnam’s economic growth this year.

The IIP in May, June, and July of Bac Giang declined 26.7, 49.8, and 15.3 per cent on-year, while that of Bac Ninh increased 23.9 per cent on-year in May, dropped 8.6 per cent in June, and increased 1.1 per cent on-year in July, according to the Ministry of Industry and Trade.

Tough job ahead

As of late last week, Vietnam had vaccinated nearly eight million of its 98 million people. Minister Dung said, “The most important job for us in the latter half of 2021 is controlling and pushing back COVID-19, especially in large cities and localities with IZs. This is the first and foremost duty, which is a prerequisite for boosting economic growth and ensuring social security. To this end, we must accelerate vaccine inoculations.”

The ADB supposed that vaccination delays and an extended social distancing in the country’s largest growth area may restrict mobility and limit economic activity in 2021. Mobility restrictions drove the composite Purchasing Managers’ Index down to 44.1 in June 2021, the lowest reading since May 2020.

Prime Minister Pham Minh Chinh noted that it will be a hard job to materialise the target of an economic growth of 6-6.5 per cent this year, but the targets will not be changed now. “We must be well aware that challenges will be far bigger. Efforts are to be made to weather all storms to reach the targets,” he stressed.

According to the World Bank, close attention should be paid to the evolution of industrial production and retail sales as both could be further affected by the current outbreak. Exports may also suffer from the slowdown of activities in some industrial parks.

“If the current outbreak is not contained quickly, the government may wish to adopt a more accommodative fiscal stance to support affected people and businesses, and also to stimulate domestic demand,” said a World Bank bulletin released recently.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Mobile Version

Mobile Version