Samsung expects second-quarter profit to plunge more than 95 percent

|

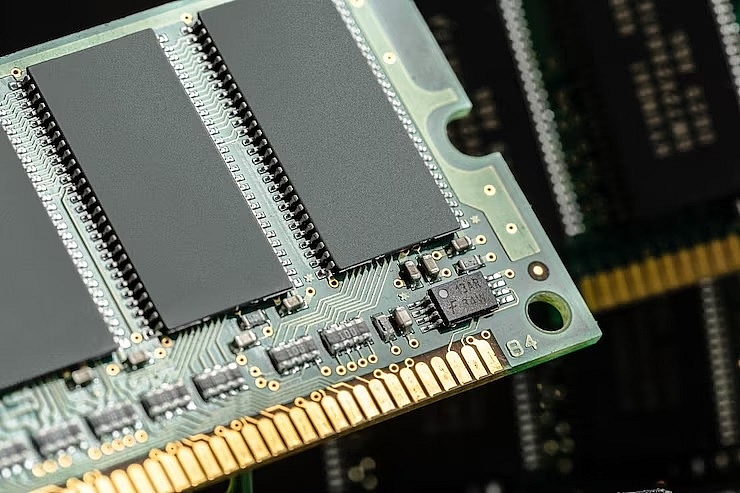

| Samsung expects second-quarter profit to plunge more than 95 percent, illustration photo/ Source: freepik.com |

The firm is the flagship subsidiary of South Korean giant Samsung Group, by far the largest of the family-controlled conglomerates that dominate business in Asia's fourth-largest economy.

The tech giant said in a regulatory filing that April-June operating profits were expected to drop 95.7 percent to 600 billion won ($458 million).

It would be their lowest profit since the first quarter of 2009's 590 billion won, a Samsung spokesman told AFP.

Sales are expected to drop 22.3 percent to 60 trillion won, the company added.

South Korean chipmakers, led by Samsung, have experienced record profits in recent years as prices have skyrocketed, but the global economic slowdown has harmed memory sales.

Prices of DRAM chips, which are often used in PCs and smartphones, continued to decline in the quarter -- falling around 13 to 18 percent, according to Taipei-based market researcher TrendForce.

"The demand for memory is bottoming out with slower-than-expected demand coupled with the inventory in the market, which is still being cleared out since January," Neil Shah, an analyst at Counterpoint research, told AFP.

"This is a full U-turn from last year when the memory division contributed to more than a third of the profit," he added.

The announcement comes as securing supplies of advanced chips has become a crucial issue internationally, with the United States and China locked in a fierce battle for control of the market.

China's trade ministry on Monday said exports of two rare metals vital for making semiconductors -- of which Beijing is a major producer -- would require a licence from August 1 in the name of "security and national interests".

But "curbs by China on Samsung's rivals such as Micron... could drive some tailwinds for Samsung," analyst Shah said.

"We estimate the demand and supply balance at the end of this year and next year should be back to pre-pandemic levels, though not the significant post-pandemic uptick the industry witnessed in 2021 and 2022," he added.

And the company's "high cash buffer remains an important support for its credit quality given the cyclicality and large capex needs of its businesses," Gloria Tsuen, vice president and senior credit officer at Moody’s Investors Service told AFP.

Samsung is expected to release its final earnings report at the end of this month.

| Samsung Vietnam: Where dreams come true Following 15 years of successfully achieving remarkable feats in Vietnam, Samsung has now set its sights on fostering a prosperous economy, fulfilling the aspirations of the Vietnamese populace, and cultivating a deep and enduring appreciation for the Samsung brand within the region. |

| Samsung meets with EVNNPT to ensure stable power supply Choi Joo Ho, general director of Samsung Display Vietnam, and the representatives of some of its vendors are working with National Power Transmission Company (EVNNPT) to discuss the power supply situation coming up to their peak production season. |

| South Korean giants to pour billions of dollars into Vietnam More than 100 MoUs were signed by South Korean and Vietnamese businesses at the Vietnam-South Korea Business Forum on June 23. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

Tag:

Tag:

Mobile Version

Mobile Version