Reporting still to fully reach global norms

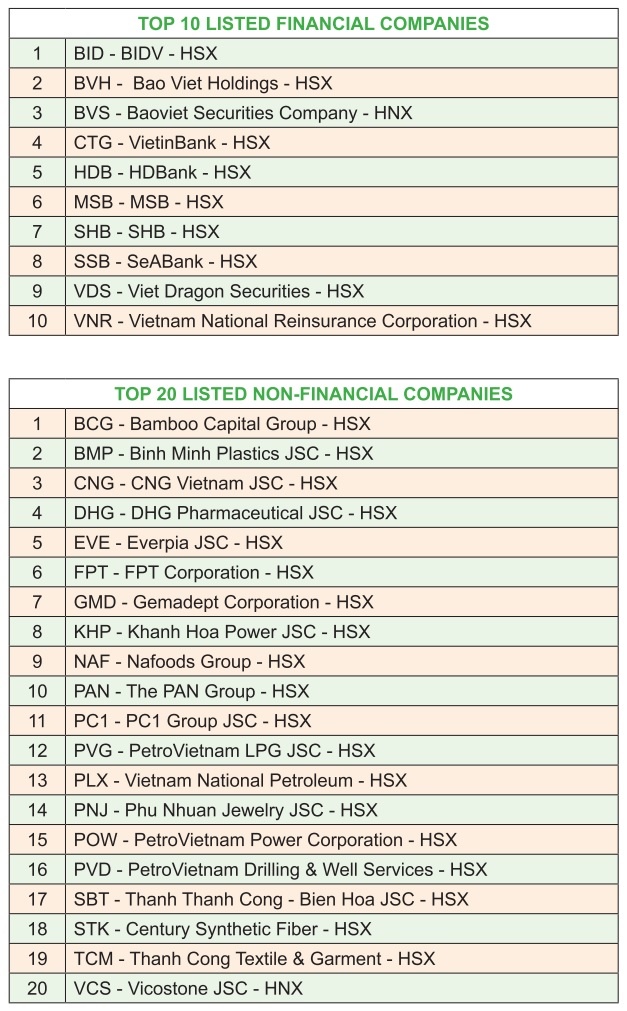

At the Vietnam Listed Companies Awards (VLCA) 2024, held in the Central Highlands city of Dalat last week, progress in English-language reporting was noted, but significant gaps remain. Among 96 participating companies, only 36 produced annual reports in English, accounting for 37.5 per cent – a slight improvement in percentage terms, but a drop in absolute numbers compared to figures from last year.

Meanwhile, corporate environmental impact disclosures are gaining traction, with this year marking the second time such criteria were mandatory in evaluations.

Although the total number of reports addressing greenhouse gas reduction declined due to fewer participants, the percentage of disclosures grew, reflecting a gradual shift towards prioritising environmental, social, and governance transparency.

“More companies recognise the importance of addressing environmental and social issues in their annual reports, aiming to communicate these priorities to shareholders and investors,” the VLCA reported.

However, the VLCA also noted that many firms still meet only basic governance requirements and fail to adopt best practices.

“Company reports often lack depth in discussing market positioning and environmental metrics,” the VLCA said, adding that sustainability goals, social responsibility initiatives, and emissions data remain underreported. “Growth in English-language reporting also remains slow, highlighting the gap between Vietnamese and international transparency standards,” it added.

|

Foreign investors face additional challenges due to differing accounting standards. Vietnamese companies follow the Vietnam Accounting Standards (VAS), while international investors rely on the International Financial Reporting Standards (IFRS), leading to valuation inconsistencies.

The VAS allows asset revaluation only in limited circumstances, unlike the IFRS, which permits fair value adjustments, offering a more accurate view of asset values.

“For example, under the IFRS, employee stock ownership plans are recognised as expenses over time, directly impacting profits,” an industry expert said.

Vietnam plans mandatory IFRS adoption after 2025, with companies such as PVTrans and PVT Logistics viewing this shift as essential for improving financial transparency. Similarly, aquaculture firms like Nam Viet and Minh Phu hold land with market values far exceeding book values, which cannot be adjusted under the VAS.

Beyond reporting and accounting, Vietnam’s market infrastructure also lags behind international standards. The lack of a central counterparty (CCP) system, standard in 80 per cent of global markets, is a key challenge. Currently, Vietnam operates on a T+2 settlement cycle, but without CCP, settlement processes lack the security and efficiency seen in developed markets.

To address these issues, Circular No.68/2024/TT-BTC, issued in September, introduced amendments to regulations on securities transactions, clearing, settlement, and disclosure.

The circular allows securities firms to act temporarily as clearing agents for foreign investors without requiring upfront margin deposits, in a move welcomed by FTSE Russell analysts. If fully implemented, analysts believe the CCP could facilitate Vietnam’s upgrade to emerging market status.

Ta Thanh Binh, CEO of the Vietnam Securities Depository and Clearing Corporation (VSDC), emphasised that structural changes are critical for achieving an upgrade.

“While we have introduced technical solutions, we must ensure trading and settlement operate as they do in developed markets,” Binh said, noting that the VSDC has proposed a subsidiary dedicated to CCP implementation under the amended Securities Law.

Young Lee, head of Asia Equities at Morgan Stanley, projected that an upgrade to emerging market status could pull in up to $800 million from passive investors tracking FTSE indices, $2 billion from other passive funds, and an additional $4-6 billion from active investors.

“This structure allows foreign investors to engage in T+2 trades without prefunding, removing a major barrier to market access and supporting future trading growth,” Lee said.

|

| Annual reports this year showcased improved design and presentation, with most reports effectively covering general information and board assessments of company performance. However, sections on corporate governance, annual performance, and executive evaluations often lacked in-depth analysis, as indicated by the evaluation chart. While some companies enhanced corporate disclosure, only 36 out of 96 participants provided English versions, a slight increase in proportion from 2023 but with two fewer reports. For the second year, the evaluation criteria included mandatory disclosures on environmental impact. Although fewer companies addressed emission reduction this year due to lower participation, a larger percentage incorporated environmental and social topics in their reports, reflecting an increased investment in communicating these issues to investors. Notable progress was also made in corporate governance. This year, the weighting for best practices increased to 40 per cent, with the compliance score reduced to 60 per cent, encouraging companies to adopt international governance standards. While companies generally met compliance requirements, many only achieved minimum standards, without fully adopting best practices. Shareholder rights, environmental disclosure, and sustainable development are areas where further transparency is needed. Many companies have yet to facilitate electronic voting for shareholders and often lack English-translated materials for annual general meetings. In the sustainable development category, companies demonstrated marked improvement, with the number of standalone sustainability reports rising from 18 in 2022 to 33 in 2024. International standards like GRI, CDP, and SASB are gaining traction, and more firms are now setting greenhouse gas targets, with two companies - Vinamilk and Century Synthetic Fiber Corporation - aligning their goals with the Science-Based Targets initiative. Nonetheless, some companies struggle to maintain past quality, and many still rely on outdated standards. Gaps remain in data collection processes and third-party assurance, which would enhance report reliability, particularly for emissions data.Source: 2024 evaluation report from the VLCA Council |

| Do Van Tam, deputy CEO Hanoi Stock Exchange (HNX)

This year, the HNX increased the weighting for best practice governance criteria from 30 to 40 per cent, yet average scores rose slightly, reflecting companies’ efforts to improve governance. However, the assessments revealed areas for improvement, particularly in the quality of disclosures and overall governance practices. One key recommendation is for listed companies to expand English-language disclosures, which remain limited but are crucial for foreign investor transparency. Decree No.68/2024/TT-BTC, issued in September, amends regulations on securities transactions, clearing and settlement, securities company activities, and market disclosures, now requiring companies to provide disclosures in English to meet new standards. In terms of governance, the HNX advises listed companies to prioritise transparent reporting on board members, supervisory committees, and management teams, particularly regarding ownership structures, compensation, and shareholdings, to prevent conflicts of interest. Companies are also urged to hold timely and inclusive annual general meetings, ideally in a hybrid format, allowing all shareholders to participate and vote electronically. Independent directors are another critical focus. Findings from the VLCA 2024 show that some companies still lack the required proportion of independent directors, and, in some cases, these roles are not fully effective. The HNX encourages companies to establish dedicated governance committees and invest in governance training for their leadership. Dr. Nguyen Thu Hien, director, Technical Advisory Board Vietnam Institute of Directors

A survey on environmental, social, and governance (ESG) practices in Vietnam from our institute and PwC reveals that while 80 per cent of companies have made or are planning ESG commitments, only 23 per cent feel confident in their leadership’s capabilities in this area. This gap highlights the need for proactive and informed leadership to bridge the divide between commitment and effective action. Boards and executives must stay updated on sustainable development trends and continually reassess strategies to ensure alignment with ESG goals. To move from commitment to action, companies should establish a sustainability steering committee that includes board members, the CEO, and relevant department heads. This team can conduct initial assessments, identifying key ESG risks and opportunities that will shape strategic planning. Comprehensive training is also essential, cascading from the board to senior management, ensuring ESG becomes ingrained in decision-making. Integrating this into the corporate strategy is critical, with boards providing oversight and tapping into green financing to support ESG investments. However, strict criteria attached to green capital pose challenges, as many Vietnamese companies struggle with the required sustainability disclosures. Effective strategy execution requires robust monitoring, ideally through an internal control framework, ensuring accountability across all action points. Over the long term, companies should aim to develop integrated ESG information systems, facilitating data-driven reporting that appeals to green financiers and stakeholders alike. Nguyen Son, chairman Vietnam Securities Depository and Clearing Corporation

The VLCA 2024 highlighted the increasing commitment of Vietnamese companies to transparency and high standards of corporate governance. This year’s selection process was especially rigorous, involving independent evaluations and thorough discussions to align on scoring The awards reflected significant progress, with many companies now investing more seriously in both content and presentation. Reports are becoming visually engaging, featuring creative slogans and clear messaging that strengthen brand identity. Financial data is presented in a systematic, transparent manner, and some firms are also beginning to align with international corporate governance practices. However, companies are advised to go beyond aesthetics by strengthening risk analysis and including projections to give investors a clearer view of future risks and opportunities. Legal compliance in information disclosure and governance remains a core focus. Corporate governance criteria for the awards are rooted in Vietnamese law as well as ASEAN and global principles, covering shareholder rights, transparency, board accountability, and sustainability. While progress is evident, many companies still fall short of best practices in areas such as shareholder rights, transparency, and board oversight. Sustainability reporting has also improved, with higher quality and consistency this year. Companies with dedicated sustainability reports or strong environmental and social scores were closely reviewed in the final round. Marking its 17th year, the VLCA honoured companies for their commitment to transparency, good governance, and sustainable growth, reflecting the evolving standards of Vietnam’s securities market. Nguyen Ngoc Xuan Quynh, corporate governance researcher Ho Chi Minh City University of Technology

Investors and the public today access company information almost instantly through digital channels such as corporate websites, social media, and financial platforms, rather than waiting for an annual report. While this shift seems to undercut the timeliness of annual reports, these documents retain a unique and indispensable role. In many jurisdictions, annual reports are still legally mandated for listed firms, enforcing periodic, structured disclosure. But beyond regulatory compliance, an annual report can serve as a powerful strategic tool, documenting a company’s progress over time, establishing benchmarks for comparison, and offering a roadmap for the future. A professionally designed report doesn’t just convey data - it communicates brand values, captures public interest, and strengthens corporate identity. To align with digitalisation and sustainability trends, ASEAN companies are modernising their reports. Electronic reports with rich visual elements and multimedia features are becoming common, while integrated reporting - combining financial and non-financial information - gains traction, global guidelines encourage emerging markets like Vietnam to elevate their reporting standards, incorporating various key elements to attract global investors. Yet, a gap remains. Many smaller firms still view annual reports as a basic compliance task, while well-resourced companies see them as a branding tool. To truly add value, however, an annual report must reflect the organisation’s authenticity and commitment. When produced with executive focus and care, it becomes a transparent bridge to the company’s goals and accomplishments, enhancing credibility with stakeholders. |

|

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version