Opportunities reshaped by disciplined capital aspects

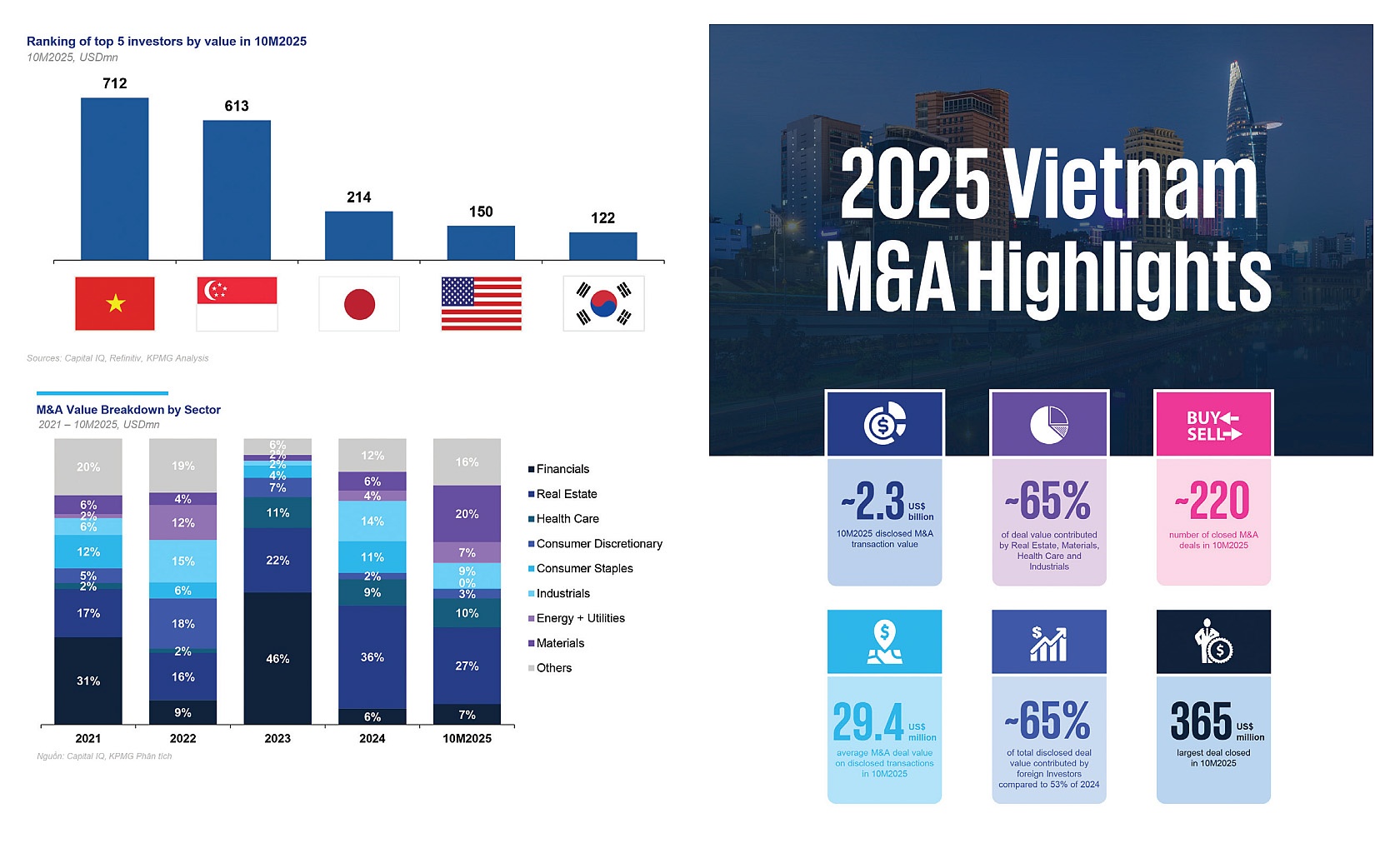

Total disclosed deal value reached $2.3 billion in the first 10 months of 2025, while deal volume eased to 218 transactions, extending the gradual decline since 2021. This reflects more cautious underwriting, stricter due diligence and disciplined valuations, particularly in sectors facing margin pressure or slower near-term demand.

Market value this year was driven by several sizeable deals, including the $365 million acquisition of Eastern Real Estate by Birch, Hyosung’s $277 million restructuring, AEON’s $162 million buyout of Post and Telecommunication Finance Co., Ltd., and Ares Management’s $50 million acquisition of Medlatec Group.

|

Together, these transactions represent close to $1 billion of disclosed value. Notably, these top megadeals were led by foreign and regional investors, underscoring continued cross-border appetite for high quality, asset-backed and strategically essential platforms.

Following the unusually high $50.7 million average deal size in 2024, the figure moderated to $29.4 million in January-October this year, reflecting a return to more typical deal size distribution and a larger share of mid-market activity.

Deal activity became more evenly distributed across major sectors, with real estate supported by improving liquidity, healthcare buoyed by structural under capacity, and materials and industrials benefiting from ongoing supply chain realignment. Consumer sectors remained muted amid competitive pressures, tariff-related uncertainty earlier in the year, and tighter tax enforcement.

This year up to November, Vietnamese investors continued to play a pivotal role in the market, contributing more than 30 per cent of total disclosed deal value. However, the gap with foreign investors has narrowed meaningfully, as Singapore accounted for roughly 27 per cent, followed by Japan (9 per cent), the US (7 per cent), and South Korea (5 per cent).

This trend highlights that while domestic capital remains the anchor of Vietnam’s merger and acquisition (M&A) landscape, regional investors have become increasingly active in selective, larger ticket transactions.

Singaporean and US investors gravitated towards real estate, healthcare and other cash-generative platforms, reflecting a preference for scalable, asset-backed businesses with strong fundamentals. Japanese and South Korean investors, meanwhile, focused more on industrial, manufacturing and materials-linked assets, aligned with their longstanding supply chain presence in Vietnam. Across groups, sector selection has become more disciplined, with capital concentrating in sectors offering transparency, resilience and visible paths to scale.

Deal activity shows a notable shift in sector contribution, with real estate (27 per cent), materials (20 per cent), and healthcare (10 per cent) emerging as the top three drivers of total deal value. Together, these sectors account for more than half of all transactions, underscoring investor preference for asset-backed businesses, essential upstream industries and high-growth service platforms.

The rise of materials reflects a year of large-scale packaging, chemicals, and manufacturing-input transactions, driven by portfolio realignment and regional supply chain consolidation.

Healthcare also gained prominence as investors focused on private hospitals, diagnostics and tech-enabled healthcare services, while real estate maintains a sizeable share despite ongoing structural challenges, as liquidity improves and restructuring accelerates.

Compared to last year, consumer sectors contributed more modestly, signalling a more selective investor appetite, softer discretionary spending earlier in the year and tighter tax enforcement on food and beverages and retail operators.

Reforms related to the Land Law, investment procedures, and corporate bond market are anticipated to unlock additional real estate transactions and accelerate project restructuring.

Within healthcare, investor interest is expected to remain strong, particularly in hospitals and diagnostics with rising middle-class demand and improved scalability across nationwide networks.

Vietnam’s commitments under direct power purchase agreements (DPPAs) and renewable energy targets will continue to support dealmaking in energy and utilities, despite the sector’s moderate contribution in recent years. Momentum in the materials sector will likely continue as global supply chain shifts draw more manufacturing capacity into Vietnam.

Even amid subdued consumer sector M&As in 2025, underlying demand fundamentals remain intact, and investor interest in healthcare, retail platforms, and tech-enabled services may re-emerge as macro stability improves.

Vietnam’s M&A activity through 2025 shows a market steadily regaining balance after two volatile years, with dealmaking shaped by rising selectivity, clearer regulatory signals and the return of larger, higher conviction transactions. While overall volume continues to moderate, the aforementioned disclosed value figure demonstrates that capital is flowing into assets with resilient demand profiles and strategic relevance.

Looking ahead, the outlook for 2026 is underpinned by disciplined optimism. The enforcement of revised land regulations, ongoing DPPA implementation, and continued emphasis on infrastructure, energy transition and manufacturing upgrades are expected to unlock new deal pipelines. At the same time, healthcare, education, logistics and other mission-critical services are poised to attract sustained attention as investors focus on cash-generative, needs-driven sectors.

|

*Dinh The Anh and Nguyen Thu Trang Deal Advisory, KPMG Vietnam

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Tax & Legal Institute 2025 drives Vietnam’s tax reform momentum (November 06, 2025 | 17:18)

- Drive for innovation and digital growth proving a big catalyst for investment (November 04, 2025 | 15:27)

- KPMG Vietnam and ACCA partner to support development of IFC (November 04, 2025 | 11:32)

- KPMG Vietnam appoints new head of Deal Advisory (October 10, 2025 | 15:01)

- Tariff modeller guides exporters through trade shifts (August 11, 2025 | 10:00)

- KPMG launches tariff modeller in Vietnam to navigate US tariff risks (July 29, 2025 | 12:11)

- Removing hidden barriers to unlock ASEAN trade (June 29, 2025 | 11:31)

- New report charts path for Vietnam’s clinical trial growth (May 21, 2025 | 08:58)

- TTC Agris strengthens market position with investment in Bien Hoa Consumer JSC (May 19, 2025 | 10:14)

- World Bank to help SBV build shared database for banking industry (April 09, 2025 | 08:55)

Mobile Version

Mobile Version