Over half of foreign-invested companies reported losses in 2019

|

| 2019 has been hard on foreign-invested companies |

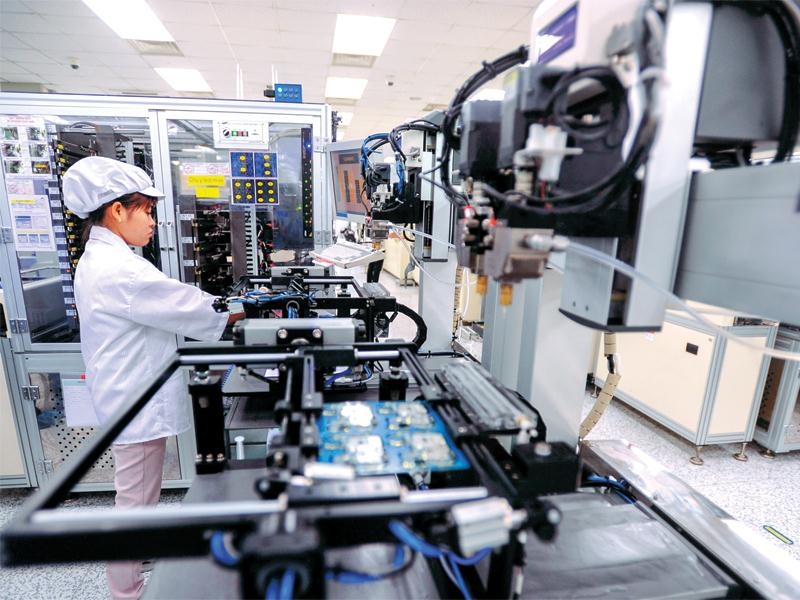

The data is collected based on 2019 financial statements of 22,603 foreign-invested firms in Vietnam. Specifically, around 12,455 companies reported losses in 2019 although their revenue increased by 13 per cent to VND847 trillion($36.83 billion).

About 3,545 companies lost capital in 2019, accounting for nearly 16 per cent. Among them, 2,160 businesses reported revenue growth.

Some of the industries recording losses for two consecutive years are mainly the production of iron, steel, and other metals, oil and gas, petroleum and petrochemical products. In contrast, FDI enterprises have good profit margins mainly operating in the fields of automobile manufacturing and assembling, automobile distribution and maintenance, food processing, alcohol, beer, beverage, business support services, medicine, education and training, science and technology.

Based on the ranking by country and territory, the FDI enterprises from Europe (Denmark, the Netherlands, France, and Luxembourg) have the highest total profitability. Countries such as Korea, Japan, Singapore, Taiwan, and the British Virgin Islands have the largest registered capital in Vietnam. However, FDI companies from these countries only posted reasonable profitability in Vietnam.

Companies from Hong Kong and China recorded low profitability despite being among Vietnam’s top 10 major investor. Some countries such as Australia, Brunei, Turkey, and Indonesia even make before and after-tax losses in spite of being among the top 10 major investors.

According to the General Department of Taxation in 2019, the FDI sector generated domestic tax revenue of VND210.2 trillion ($9.14 billion – excluding crude oil), up 13 per cent compared to 2018. The FDI sector made quicker budget contribution in 2019 compared to two years ago.

However, the Ministry of Finance assessed that FDI enterprises have yet to maximise the efficiency of assets and investment capital. Their budget contribution was not commensurate with the incentives they have enjoyed. Besides, there is still the phenonmenon of transfer pricing and tax evasion among a number of foreign-invested enterprises. These enterprises have been reporting losses for years but they are still expanding production and business, which ultimately caused loss and damage to the state budget.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

- 14th National Party Congress’s opening: Great aspirations, steady steps (January 20, 2026 | 09:50)

- Opening remarks of 14th National Party Congress (January 20, 2026 | 09:44)

Mobile Version

Mobile Version