New legal upgrades can aid pharma tech transfer

|

| Ta Manh Hung, deputy director Drug Administration of Vietnam Ministry of Health |

Vietnam’s pharmaceutical industry has made notable achievements in recent times. The total value of the market has increased from $3.4 billion in 2015 to $7.46 billion in 2022, with an annual growth rate of about 12-15 per cent. There are currently over 24,000 drugs with valid marketing authorisation, with over 800 active ingredients. The country is now home to well over 200 factories meeting GMP-WHO standards, of which 17 factories meet GMP-EU standards.

The industry has also produced 15 types of vaccines, meeting all expanded vaccination needs and 10 per cent of service vaccination needs.

However, there are still many limitations in technology transfer in the pharma industry. Specifically, the proportion of domestically produced drugs meets about 70 per cent in quantity, but only accounts for about 46 per cent of consumption value. Raw materials for drug production are still mainly imported.

Moreover, the industry is still focused on producing generic drugs, yet focusing on high-tech or innovative drugs.

Technology transferred products are still mostly generic drugs or conventional biologicals, not including breakthrough products or advanced technologies such as mRNA, recombinant technology, or high-tech dosage forms.

There are also many other barriers. The industry still faces a lack of investment capital, unsynchronised infrastructure, and limited high-quality people in research and production. Administrative and legal procedures are still complicated. The investment environment is also not attractive enough and preferential policies are not strong enough to attract foreign enterprises.

The supporting ecosystem for the pharmaceutical industry is still underdeveloped, causing difficulties in localising production materials and largely depending on imported raw materials for production.

Nevertheless, the industry targets to develop Vietnam into a hub for production and technology transfer of original brand name drugs in the ASEAN region. In particular, the specific target is to meet 80 per cent of domestic drug demand by 2030, and add special incentives for projects on research, production of innovative drugs, high-tech drugs, vaccines and biological products.

The amended Law on Pharmacy 2024 now adds some improvements. It provides priority mechanisms to shorten the time and procedures for granting marketing authorisations for special drugs such as new drugs, original brand name drugs, rare drugs, vaccines, and high-tech drugs.

The new law also regulates the use of funds such as the national technology innovation fund, the national science and technology development fund, and the high-tech venture capital fund to support activities related to research and development, clinical trials, and drug commercialisation in specific cases.

The cases include clinical trials, technology transfer, production and commercialisation of ingredients, new drugs, vaccines, biological products, high-tech drugs, the first domestically produced generic drugs, traditional drugs in modern dosage forms, herbal medicines, and others.

Regarding investment and development policies, there are commitments to combining state budget investment with socialised resources to develop the industry of producing vaccines, biological products, medicinal herbs and traditional medicines.

The amended law also includes procurement incentives, investment incentives and human resources training. Accordingly, the government is responsible for allocating land and funding to support pharmaceutical research and production activities. It will also develop legal documents to ensure effective implementation of policies on resources.

The pharmaceutical development strategy sets ambitious targets for domestic drug production to meet domestic demand and increase export value. By 2030, Vietnam aims to produce about 80 per cent of the necessary drugs and increase the market value to 70 per cent. This vision extends to vaccines, with a target of meeting all the demand for the national expanded immunisation programme on and 30 per cent for private vaccination.

It also aims to become the regional hub for high-value pharmaceuticals. By 2030, the goal is to attract technology transfer and outsourcing production for at least 100 innovative drugs, vaccines, and similar biologicals, including products not currently available in Vietnam.

The strategy also emphasises the importance of complying with GMP. By 2030, Vietnam aims to have 20 per cent of its pharmaceutical manufacturing facilities complying with EU-GMP or PIC/S-GMP standards, demonstrating its commitment to producing high-quality medicines.

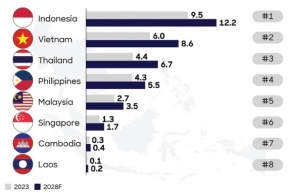

| Pharma to experience robust growth Vietnam healthcare market size is estimated to reach $23.7 billion and grow at an average rate of 7.5 per cent annually from 2023 to 2028. Healthcare expenditure per capita is also projected to increase from $237 to $328 in that time. |

| Innovation and biotechnology lead Vietnam’s healthcare development Unlocking the power of health innovation and biotechnology will help Vietnam keep pace with global trends in healthcare research and development, providing a golden opportunity for healthcare and pharmaceutical startups to rise and thrive. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

Tag:

Tag:

Mobile Version

Mobile Version