New approach into logistics

|

According to Tran Thanh Liem, Chairman of the Binh Duong People’s Committee, foreign investors, especially those in new investment fields like hi-tech and environmentally- friendly manufacturing, are flocking to this southern province.

These include BW Industrial Development JSC (BW), a for-rent industrial and logistics real estate platform providing factories and warehouses for rent. BW is a joint venture between Becamex IDC Corporation and Warburg Pincus from the United States, and has just received two new projects with the total investment of $105.8 million in Thoi Hoa Industrial Park in southern province of Long An. With this latest allocation, BW is nearer to its development plan to add a further 170 hectares of projects in 2019, after the 230ha added in 2018.

Binh Duong is also home to another giant industrial zone developer, Vietnam-Singapore Industrial Park (VSIP), which is a joint venture between Singaporean Sembcorp and Becamex IDC. To date, the six VSIPs have attracted more than 800 investors who registered the total investment capital of more than $11.3 billion across the country.

Huynh Quang Hai, vice president of VSIP, said that the company has been co-operating with many partners in investment consultancy, and has attracted investment from many multinational corporations (MNCs).

“International consultants are the connection to bring MNCs and leading global brands to Vietnam,” Hai said. “We at VSIP have been strictly obeying our commitment to choose investors who fit the government’s orientations on investment attraction. Apart from our current investors, there are many others from Asia, the US, and European countries looking to set up operations at VSIP in the near future.”

C.K. Tong, CEO of BW, commented that this is the best time for industrial zones to attract more investment from tenants. His company will focus on ensuring the sustainable development of its network and becoming one of the leading investors in industrial property for leasing in Vietnam.

Binh Duong is among many localities nationwide that are attracting many foreign investors in the infrastructure, real estate, and logistics sectors.

As employment and land costs rise in China, and expect to see more ‘Made in Vietnam’ or ‘Made in Indonesia’ labels on goods, Chinese manufacturers are looking to outsource to Southeast Asian neighbours, where average wages might be half of those expected by Chinese workers. This outsourcing is driving the demand for industrial real estate, both for manufacturing facilities and for logistics space to support exports and infrastructure.

According to John Campbell, senior consultant of industrial services at real estate consultancy Savills Vietnam, Vietnam’s regional competitiveness is driven by low labour costs, affordable land, favourable corporate income tax rates, a dynamic workforce, and a geographical location near source and destination markets.

“Low labour costs continue to attract foreign companies from China, especially those in labour-intensive industries. Due to the US-China trade war, foreign and mainland Chinese companies are racing to secure manufacturing capacity in Southeast Asia. As one of the fastest growing industrial markets in the region, Vietnam is well-positioned to accommodate the influx of foreign investors. For example, Apple manufacturers have recently shown interest in moving operations to Vietnam to avoid the $200 billion of tariffs on Chinese goods,” said Campbell.

Modern consumption trends

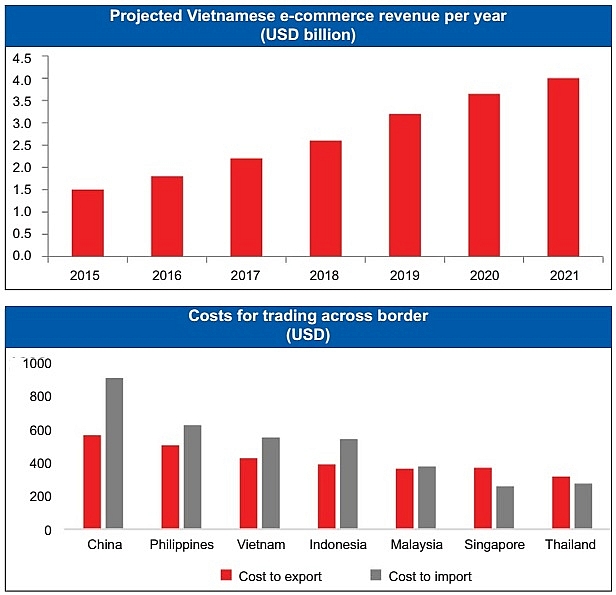

“If there was ever a time that logistics was ‘in’, that time is now. The reliance and need for logistics space is at an all-time high, driven by advancements in the e-commerce sector,” said Stephen Wyatt, country head of real estate consultancy JLL Vietnam.

With considerable growth in smartphone penetration in major cities, the e-commerce market will grow significantly via the smartphone channel, resulting in more pressure on the logistics industry.

According to advisory group KPMG’s international survey titled “The Truth about Online Consumers”, Vietnamese consumers are leaning towards online shopping where they can easily compare prices, find online sales, or get better deals from online retailing platforms such as Amazon, Lazada, and Tiki.

Many e-commerce firms are picking up the pace to keep up with the demand. The e-commerce market has witnessed some significant events such as the successful collaboration between Alipay and National Payment Corporation of Vietnam (NAPAS) whilst the local e-commerce platform Tiki received $44 million funding from JD.com – Alibaba’s competitor.

“Compared to regional peers, the Vietnamese logistics market is still in its infancy, featuring low-specification premises located in remote locations. Significant investment is needed to implement technology as well as construct infrastructure, factories, and warehouses to deal with the obstacles ranging from traffic congestions to failed deliveries, as well as the higher costs in rural areas. Driven mainly by growth in the e-commerce and manufacturing sectors, the Vietnamese logistics market will move to the next level, evolving in the same way we have witnessed in other markets,” Wyatt said.

Airbnb of logistics rising

Wyatt commented that apart from traditional industrial properties such as warehouses, the new trend of “Airbnb of logistics” has also been gathering momentum.

“Over the past few years, co-working operators have been increasing their presence in the market. Therefore, it is only a matter of time before we see a flexible approach to leasing warehouse space,” said Wyatt.

Especially, according to him, the strong demand from the e-commerce sector requires smaller and more flexible warehouse facilities for the fastest “last mile” delivery.

“We believe the flexible approach to warehousing could be very successful in the Vietnamese market, and this is something that JLL will be monitoring closely in the future. A flexible warehouse space solution could be the answer to a number of existing problems in the industrial sector. Industrial space in the country has high occupancy rates and rents, if a flexible approach enters the market, I’m sure there will be strong demand from many businesses,” he said.

Meanwhile, the e-commerce boom in recent years has led to a greater demand for hi-tech production plants.

“The connection between factories will be optimised, blurring out the physical boundaries and thus shaping the future of production with small-scope factories with well-connected information system,” Wyatt said.

He also noted that the biggest challenge Vietnam will face over the next few years is the result of the inevitable disruption and changes brought about by technology and automation. “How radical these changes will be will depend on how quickly automation is adopted. Automation does not mean today’s buildings will simply become obsolete, but occupiers, developers, and investors need to be ready for change,” he added.

The logistics industry is now the hottest area for real estate investments in the Asia-Pacific region, according to the latest annual real estate report from the US’ Urban Land Institute in co-ordination with advisory group PwC.

Challenge for logistics

While Vietnam’s overall spending on infrastructure is relatively high compared to neighbouring countries, there is still a long way to go. Many infrastructure projects face delays due to land compensation, funding, and limited success in public-private partnership.

According to the Doing Business 2018 report by the World Bank Group, it currently takes Vietnam 105 hours to export products and 132 hours to import auto parts. This is significantly longer than the only 62 hours for export and 54 hours for import in Singapore. Although the withdrawal of the US from the Trans-Pacific Partnership Agreement in 2017 eliminated significant trade opportunities, the country’s growth is nonetheless projected to remain robust from strong exports.

According to JLL Vietnam, the cross-border trading costs, consisting of documentary compliance and border compliance costs, in Vietnam is less competitive than most of its regional peers.

Documentary compliance contributes more than 30 per cent of the total costs, while this is only 10-15 per cent in developed nations like Singapore. The remarkable variance in the cost structure suggests that more improvement is required in the documentary compliance area.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Mobile Version

Mobile Version