Negotiations over payment agreement for LNG power stuck in deadlock

|

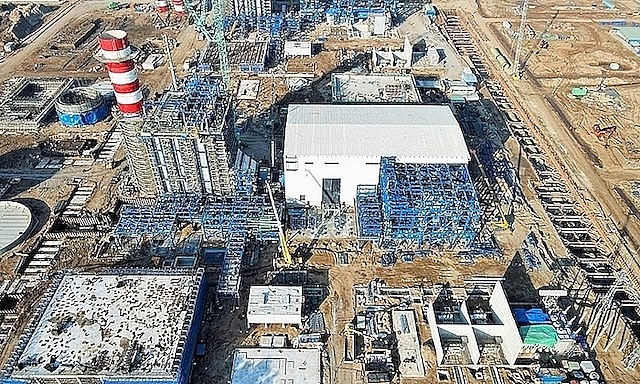

EVN has been in negotiations with PV Power — the investor of the Nhon Trach 3 and 4 LNG power plants, and Siemens – the investor of the Hiep Phuoc power plant, but they have yet to reach a compromise on the purchase ratio of power.

The investors want EVN to buy between 72 per cent and 90 per cent of the power capacity of these plants, but EVN is refusing to budge past 65 per cent to avoid creating pressure on selling prices.

The investors are also asking for the power purchase ratio to remain constant for the duration of the PPA following a proposal made by creditors to ensure they have stable cash flow to repay their loans. In addition, LNG suppliers are asking for a high fuel purchase ratio to ensure stability in quantity and price. This stability would help them to develop international maritime transport, especially given that Vietnam is a small market for international LNG suppliers.

However, according to EVN, the proposals made by investors are unfeasible because of the risk of power price hikes.

The cost of importing LNG to Vietnam is high, currently between $12-14 per million BTU. As a result, selling prices using imported LNG are from VND2,400-2,800 per kWh, which is much higher than power produced by coal-fired plants.

Approving a high purchase price for the contract's duration would cause financial risks for EVN if the demand for LNG power drops.

In addition, a higher price for LNG power would be unfair on power plants that use other fuels and have no long-term power purchase commitments with EVN.

According to Vietnam's Power Development Plan VIII, power produced using domestic gas and imported LNG will reach 37,000MW by 2030, or 25 per cent of the country's total production. Of this, 24,000MW will come from imported LNG-to-power, or 15 per cent.

EVN explained that with high electricity generation costs, large fluctuations, and long-term output commitments, EVN's purchasing costs will be affected, strongly impacting the retail selling price.

Hence, EVN has proposed a power purchase commitment of 65 per cent.

| Liquefied natural gas among strongest solutions in transitioning from coal With up to a 50 per cent lower carbon footprint than coal, liquefied natural gas (LNG) can be adjusted to increase greener electricity when available. |

| Thai Binh unveils $2 billion LNG power plant project in Japanese deal Thai Binh province announced a $2 billion LNG thermal power plant project, in collaboration with Tokyo Gas Co., Kyuden Corporation, and Truong Thanh Group, marking a major stride in Vietnamese-Japanese economic cooperation. |

| Tokyo Gas makes progress on $2 billion LNG power project in Thai Binh province On January 24, Tokyo Gas Co., Ltd. announced the establishment of Thai Binh LNG Power JSC for the development of a liquefied natural gas (LNG) to power project in Thai Binh province in collaboration with Truong Thanh Vietnam Group and Japan's Kyuden International Corporation. |

| Thai Binh to host $2 billion LNG project The Thai Binh liquefied natural gas (LNG) project is located in Thai Binh Economic Zone, and will have a designed capacity of 1500MW. The investment consortium behind the project is responsible for nearly $2 billion in funding and consists of Tokyo Gas, Kyuden, and Truong Thanh Vietnam Group. |

| SK E&S and T&T Group research LNG project in Quang Tri A consortium of investors, including South Korea's SK E&S and Vietnam's T&T Group, have made a proposal to research the development of a liquefied natural gas (LNG) project in the central province of Quang Tri. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Mobile Version

Mobile Version