Moody’s changes outlook on Vietnam banking system to stable

The stable outlook is based on Moody’s assessment of six drivers: operating environment (stable); asset risk (improving); capital (stable); funding and liquidity (stable); profitability and efficiency (improving); and government support (stable).

|

| Vietnam's strong growth will support bank operations, according to Moody’s. Photo: Dung Minh |

Moody’s says that strong economic growth in Vietnam will support the banks' operating environment.

The ratings firm expects Vietnam’s real GDP growth to remain one of the strongest in the ASEAN, at 6.7 per cent in 2018 and 6.5 per cent in 2019, driven by improved economic competitiveness, exports, and domestic consumption. Domestic credit growth will moderate to about 16 per cent in 2018 from 20 per cent in 2017, as the Vietnamese government seeks to control inflation in the country to less than 4 per cent.

“Economic growth in Vietnam will remain robust, and the banks’ asset quality will improve, helping to strengthen their profitability,” says Eugene Tarzimanov, Moody’s vice president and senior credit officer.

Regarding asset quality, Moody’s says that Vietnamese banks will show improved asset quality over the next 12-18 months because strong economic growth will translate into improvements in borrower repayment capabilities and enable banks to accelerate the write-offs of legacy problem assets.

“But asset risks are still evident after years of rapid credit growth, and negative spill-overs from the escalating trade tensions between the US and China will see Vietnam vulnerable to slower trade growth,” says Rebaca Tan, analyst at Moody’s.

However, rapid credit growth in recent years can result in a deterioration of asset quality as new loans mature, although this situation is unlikely to occur during Moody’s outlook period of the next 12-18 months.

The banks’ capitalisation will prove broadly stable. A moderation in asset growth will ease pressure on the banks' capitalisation, while internal capital generation will continue to improve, along with profitability at most rated banks.

Funding will stay stable as loan growth slows. In particular, Moody’s points out that the banks’ deposit growth has been strong, reducing their reliance on market-sensitive funding sources, such as interbank borrowings. As loan growth moderates to the pace of deposit expansion, the banks' loan-to-deposit ratios will remain largely stable.

As for profitability, the banks will show better profitability because interest margins will continue to improve as banks boost loans in the higher-yielding retail and small and medium-sized enterprise segments. At the same time, credit costs will decline, as more banks resolve their legacy problem assets.

With government support, Moody’s says that the Vietnamese government will continue to support the country’s banks when needed, mainly in the form of liquidity assistance and forbearance from the central bank.

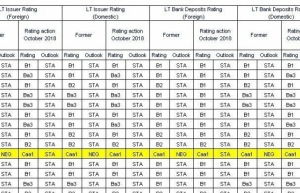

Moody’s rates 16 banks in Vietnam, which together accounted for 61 per cent of total banking system assets at the end of 2017.

Three of the 16 banks – BIDV (B1 stable, b2), Vietcombank (B1 stable, ba3), and Vietinbank (B1 stable, b1) – are controlled by the government, while the other 13 are privately owned joint-stock commercial banks.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version