Investors seek seaport access improvements

At the launch of the 2023 Whitebook from the European Chamber of Commerce in Vietnam (EuroCham) earlier in February, development of seaport access was among the top discussions.

|

| Investors seek seaport access improvements |

Hans Kersten, vice chairman of EuroCham’s Transportations and Logistics Sector Committee, said they highly appreciate the Ministry of Industry and Trade’s plans for improvement of Vietnam’s logistics performance index, which has addressed most of the current concerns in the sector.

“However, we want to focus more on the two critical areas of infrastructure access to the main ports and the development of quality distribution and logistics centres,” Weber said.

“Connectivity between Lach Huyen International Gateway Port in the northern port city of Haiphong and beyond should be improved further with focus on inland waterway development, railroads, and highways to the surrounding provinces. The access channel to Go Gia in Cai Mep should also be upgraded to allow larger vessels.”

The sector committee represents dozens of companies interested in Vietnamese seaports and logistics, such as Bollore Logistics, Maersk, Logwin Air, DHL, FM Logistic, and Dextra Transport, among others.

France’s CMA-CGM has meanwhile sent a document to the Vietnamese government, proposing the implementation of maritime and logistics infrastructure. In particular, the company expects support at all levels for the Gemalink phase 2 expansion at Cai Mep-Thi Vai, plans for Lach Huyen International Gateway Seaport, and inland depot projects in southern regions of Vietnam.

CMA-CGM has funded port infrastructure in Vietnam since 1994, under joint ventures with Sowatco of Vietnam and Mitsui&Co of Japan.

Similarly, FM Logistic is expanding here. Last year it set up a 20,000 sq.m urban distribution centre in the southern province of Binh Duong as part of a new strategy for this decade. The French supply chain operator aims to double its revenue to €3 billion ($3.18 billion) by 2030 by focusing on omnichannel supply chain services, urban logistics, automation, and sustainability.

Like EuroCham’s businesses, other investors are facing challenges in their seaport investment plans. For instance, My Thuy International Port Joint Venture Company, the investor of the an international seaport costing around $619 million in central Quang Tri province, has suffered from delays since it officially kicked off two years ago because of problems in development of connections to and from Quang Tri Industrial Park. The investor has also not been handed over some land for project implementation.

At a meeting on February 21 with Quang Tri People’s Committee, a representative of the company said, “We are completing design documents to submit for approval. However, the current problems include investment resources, annual operating, and maintenance costs.”

My Thuy is one of many seaports in Vietnam facing problems related to access infrastructure. According to the Vietnam Maritime Administration (VMA), Vietnam now has 45 seaports, several inland container depots, and major logistics centres. However, the country still lacks infrastructure connecting such complexes.

Economist Nguyen Duc Kien said the number of true seaports is very few. “We have more berths than ports. Cai Mep-Thi Vai seaport in southern Ba Ria-Vung Tau province has no connecting railroad. And in Haiphong, Lach Huyen International Gateway Seaport has been developed but also lacks a connecting railroad.”

Seaports play an increasing role in a country’s economic development. According to the VMA, more than 90 per cent of Vietnam’s imports and exports are transported by sea. In 2022, Vietnam recorded around $732 billion in total imports and exports – the first time Vietnam surpassed the target of $700 billion. Because of growing trade, other foreign players have engaged in building and exploiting seaports in Vietnam, including PSA from Singapore, APMT from Denmark, Hutchison Port Holding of Hong Kong, Mitsui O.S.K from Japan, and Wanhai Lines from Taiwan.

Mediterranean Shipping Company, the world’s largest container shipping company, is also interested in cooperating with Vietnam International Maritime Corporation in developing the $6 billion Can Gio Transshipment Port in Ho Chi Minh City. A pre-feasibility study of the venture is being carried out and is expected to be submitted to the Ministry of Planning and Investment in the next month or two. The investors expect to kick off the project next year and complete it in 2027.

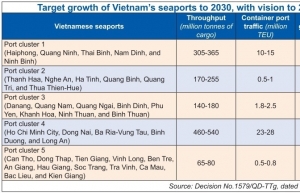

More opportunities are there for potential investors. Vietnam is estimated to need funding of around $13 billion in seaport infrastructure by 2030 to improve the handling of container goods from the current 24 million TEU a year to 30-40 million.

| Quang Ngai invests in seaport infrastructure The Department of Agriculture and Rural Development of the central coastal province of Quang Ngai has proposed the provincial People’s Committee and central agencies pay more attention to investment in infrastructure at local fishing ports. |

| Seaport ventures to rake in new funds The Ministry of Transport this month submitted a report requesting approval to implement the master plan for Vietnam’s seaport system for the 2021-2030 period. |

| Seaport and logistics advances get European flavour Vietnam is seeking European experiences and support in developing seaport and logistics infrastructure projects, with opportunities available for investors who are showing increased interest in the Southeast Asian market. |

| Red River Delta to develop more transport infrastructure projects By 2045, the Red River Delta region targets developing a synchronised and modern transport infrastructure system through investments in roads, rivers, railways, and aviation. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

- Haiphong welcomes long-term Euro investment (February 16, 2026 | 11:31)

- VIFC in Ho Chi Minh City officially launches (February 12, 2026 | 09:00)

- Norfund invests $4 million in Vietnam plastics recycling (February 11, 2026 | 11:51)

- Marico buys 75 per cent of Vietnam skincare startup Skinetiq (February 10, 2026 | 14:44)

- SCIC general director meets with Oman Investment Authority (February 10, 2026 | 14:14)

- G42 and Vietnamese consortium to build national AI infrastructure (February 09, 2026 | 17:32)

Tag:

Tag:

Mobile Version

Mobile Version