Investment opportunities booming despite increased volatility

|

In addition to the nearly 100 guests who joined the event live, the event enticed thousands of online viewers on VIR's fan page, website, and YouTube platforms.

In his opening remarks, Le Trong Minh, editor-in-chief at VIR said, “Many investors around the world are eager to explore the new investment opportunities that are presented by the changing economic environment. However, as it becomes more complex, it is increasingly difficult to find opportunities. The old methods of investment and business are no longer effective in the current context.”

Experts forecast that 2023 will be a difficult year for the global economy, negatively affecting investment channels. However, history has proven that there are always opportunities in any situation.

| Hanh Nguyen , Country Business Development Manager, Exness Vietnam

There are opportunities everywhere, especially in the financial sector. In the context of constantly moving markets and changing geopolitical economic situations, we can still see opportunities. Investors need to determine their risk appetite in the field of financial transactions, and each person needs to build their own risk management strategy. This needs to determine the risk tolerance level, approximating how much money to invest and in which investment segment. In the 4.0 era where most techniques and technologies are developing quickly, sources of knowledge are diverse. Each individual investor needs to spend time strengthening their skills to figure out the level of risk in the portfolio before looking for opportunities. The market is forecasted to remain gloomy over the short term. The Fed shows no sign of stopping interest rate hikes, at least in the first half of the year. But by the end of 2023, it is likely to ease monetary policies. I believe the economy will be looking brighter by the end of 2023 and in good shape by early 2024. | |

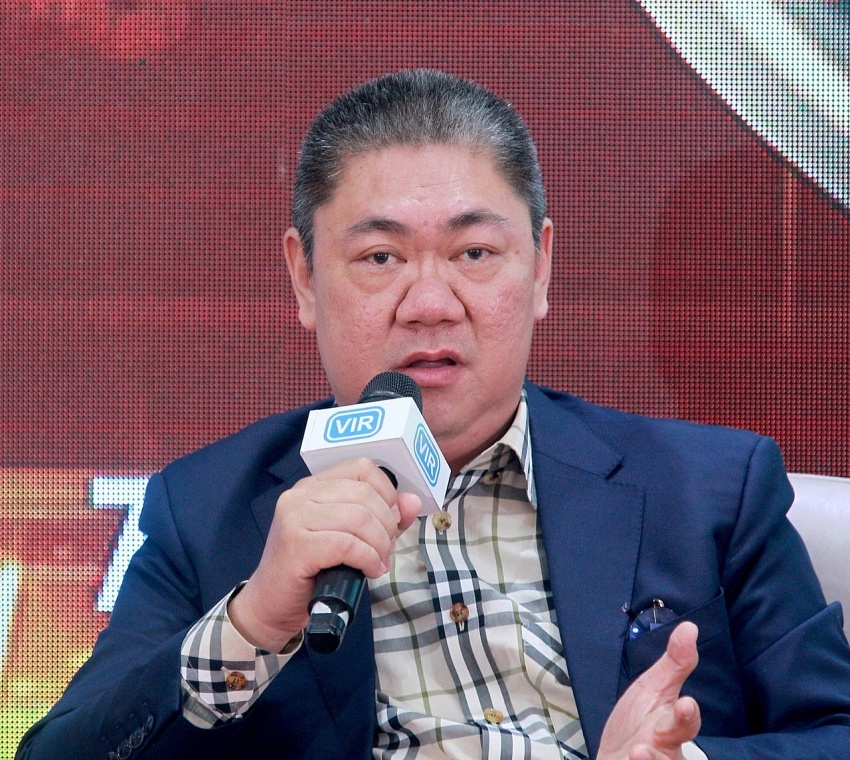

| Nguyen Tri Hieu, economist

All the problems from 2022 will linger this year, including liquidity problems in the stock and real estate markets, so we must prepare to enter 2023 ready to cope with new crises. I think the stock market will be strongly influenced by both internal and external factors. I expect the Fed will stop raising interest rates around mid-2023 once inflation in the US is under control. It is very unlikely that the benchmark VNIndex will return to the 1,500 point range, as it is expected to fluctuate around the current level until about the middle of the year. I believe that Vietnam’s stock market will rally, gain points, and further evolve in the second half of the year. | |

| Pham Duy Khuong, managing director, ASL Law Firm

In 2022, many legal issues were tightened, especially those that seemed to be unsolvable relating to bonds, stocks, real estate, blockchain, and digital assets. The State Bank is also expected to tighten the transfer of money abroad in the near future, meaning we must choose the right investment methods. During the consultation process, I see many foreign investors pouring money into areas where there is no clear legal corridor, such as blockchain or electronic exchanges. Many Vietnamese investors ignore legal factors and only focus on profits. Therefore, when making investment decisions, it is necessary to determine the legal status of the subjects and their business licences. | |

| Hoang Nguyet Minh, senior director of Commercial Leasing, Savills Hanoi

Over the last six months, the real estate market has created a negative feeling across the whole investment economy, including businesses and individuals. Residential real estate is currently the most affected segment in the market. However, other product lines such as offices for lease are still renting well and the retail segment has started to recover. Hotels have bounced back, and so has industrial real estate. Factories, warehouses, and logistical systems continue to expand, and foreign capital considers Vietnam has having huge potential. International investors are willing to inject money, even from non-loan sources. | |

| Thai Viet Dung, director, Exness Vietnam

It is possible to grab smart investment opportunities in the new, volatile environment if one's knowledge of risk management is sufficiently high. 2023 is expected to be a tumultuous year for investors as the conflict between Ukraine and Russia grows, inflation remains high, and economic contraction continues as expected. This is predicted to lead to tighter monetary policies and mass lay-offs in large global technology companies. | |

| Vu Huu Dien, director of portfolio management, Dragon Capital

2023 will be a profitable year for investors who understand market research and have sufficient confidence. The stock market is now something that everyone fears because it has lost too much value. Interest rate hikes in 2022 had a significant impact on business results for the majority of publicly traded firms, particularly those using virtual currencies. However, I believe that positive corporate outcomes will eventually return. | |

| Nguyen Minh Tuan, Founder at TOPI

Going forward in 2023, amid a lot of existing general risks, individual investors should look at two factors in the economy -- GDP growth and inflation -- to determine where the cycle of the economy is. Experts say that the best asset group in the world is currently is cash. In Vietnam, the interest rate hike cycle may have peaked, and macroeconomic factors are showing signs of changing in a positive direction quickly in the last two months. As for the particular risk, when it is coming, the individual investor should strengthen the protection layer (real estate), the income generation layer (deposits), and cash-flow properties. The growing class (stocks), and growing real estate should drop as a storm is coming. The less penny stocks, condotel real estate, and crypto assets they own, the better. Investing is a process of controlling risks. The higher the risk is, the more that is expected to earn, for example with risks in legal issues, counterparties, and operations. If these risks are well managed, new profit will come true, not merely the expectation. All asset classes move inversely with interest rates, when interest rates are high, assets generate low returns. So we should monitor and evaluate when the interest rate peaks to make the right investment decision, based on investor's taste and investment goals, then distributing the asset class proportion. | |

| Le Duc Khanh, Director of investment capability development, VPS

This year, with the current macroeconomic situation, and liquidity facing difficulties in the past quarters, the economic cycle may pull the stock market up after falling to the bottom, accumulating, adjusting, and creating small tiny waves. But it is difficult to see a peak period like 2020-2021. Amid massive difficulties, there are still some businesses with good growth, revenue and profit, which may also be the destination of big M&A deals this year, and the prices of some stocks may increase. The market will be differentiated, and a number of industries will benefit, such as retail, construction, banking, and maybe even pharmaceuticals and electricity. Derivatives are also a good investment channel that many people do not know and understand properly. The derivatives market is growing too slowly, and it can be deployed strongly on the exchange, deploying futures contracts. Despite the current challenges, I still see some opportunities. Good investors will have good risk management capacity, while better allocation experience will create high efficiency in many investment channels. |

|

|

|

|

|

|

|

| Investment opportunities in HCM City introduced to Singaporean firms A programme to promote investment and trade connectivity between Vietnamese enterprises and Singaporean partners was held by the Investment & Trade Promotion Centre of Ho Chi Minh City ((ITPC), in the southern hub on August 23. |

| Investment opportunities arise in Thua Thien-Hue Vietnam’s central province of Thua Thien-Hue is taking action to pick up a possible new wave of investment. Nguyen Dai Vui, director of the provincial Department of Planning and Investment, talked to VIR’s Bich Thuy about future funding orientations and how to attract more economic interest in the province. |

| 36 Danish groups seek investment opportunities in Vietnam A delegation of 36 Danish investors will visit Vietnam to look for partners and investment opportunities in renewable energy, especially offshore power early next month. |

| Hunting for real estate investment opportunities after Tet Although the market faced a standstill at the end of 2022, wealthy investors are still hunting for potential business opportunities after the Lunar New Year holiday. |

| Foreign investment funds plan to pour money into Vietnamese stocks Many billion-dollar investment funds have the intention to pour money into the Vietnamese stock market, an event held by VIR has heard. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Vietnam startup funding enters a period of capital reset (January 30, 2026 | 11:06)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- PM inspects APEC 2027 project progress in An Giang province (January 29, 2026 | 09:00)

- Vietnam among the world’s top 15 trading nations (January 28, 2026 | 17:12)

- Vietnam accelerates preparations for arbitration centre linked to new financial hub (January 28, 2026 | 17:09)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

- Digital economy takes centre stage in Vietnam’s new growth model (January 28, 2026 | 11:43)

- EU Council president to visit Vietnam amid partnership upgrade (January 28, 2026 | 11:00)

Mobile Version

Mobile Version