Hong Kong to facilitate listings for Vietnamese companies

What makes Vietnam appealing to international investors, and what sectors is the Hong Kong delegation interested in, particularly in cities like Ho Chi Minh City?

Vietnam is highly attractive to investors due to its robust economic growth and dynamic market. This is my first trip here, and I'm thoroughly impressed by the young, vibrant population and rapid development in business and innovation. Vietnam aims to become a high-income economy by 2045 and achieve net-zero carbon emissions by 2050, driving significant economic activities and reforms. The GDP growth target for 2024 is 5.5-6.5 per cent, which is impressive.

|

| Bonnie Y Chan, CEO of Hong Kong Exchanges and Clearing Limited (HKEX) |

Hong Kong's investment ecosystem is inclusive, attracting local and global investors, including those from mainland China. These investors are drawn to Vietnam's rapid economic expansion and potential for substantial returns.

During our visit, we've explored a diverse range of sectors, from traditional manufacturing to innovative fields like electric vehicles and advanced technologies. Vietnam's broad and varied investment opportunities are very appealing as they offer multiple avenues for investment.

Vietnam is also a strategic location for Chinese companies looking to diversify their manufacturing operations as part of the "China plus one" strategy. Over the last few days, I've observed that Vietnam is a popular choice for this approach. The combined interest from Mainland Chinese, Hong Kong, and global investors is expected to significantly drive Vietnam's economic progress in the coming years.

Last year, there were rumours that some Vietnamese companies were seeking to list on HKEX. Can you provide us with any updates on this development?

While I can't name specific companies, I can share that at HKEX, one of our key strategies is to expand our international footprint. We aim to attract more companies from around the world, especially from the ASEAN region, to list in Hong Kong. Going public in Hong Kong is highly attractive because it provides access not only to capital in Hong Kong but also to global investors.

One significant advantage we offer is the Stock Connect Programme, which allows Mainland Chinese investors to invest in Hong Kong-listed international companies. This is particularly appealing because the Chinese investor base is substantial, and they are keen to diversify their investments beyond Mainland China assets. Therefore, being able to invest in international companies through Hong Kong is very attractive to them.

We have increased our resources dedicated to sales and marketing, particularly in Southeast Asia. Our team in the Singapore office is actively marketing to companies in the region, including Vietnam. While I can't share specifics on where discussions stand, I can say we've laid a strong foundation that we hope will lead to actual listings in the future.

How many Southeast Asian companies are currently listed on HKEX, and how have they performed post-IPO?

As of now, we have around 100 Southeast Asian companies listed on HKEX. These companies come from various countries within the region, and their post-IPO performance varies based on their sectors, listing timings, and valuations. However, the continued interest and number of listings indicate that Southeast Asian companies recognise Hong Kong as an excellent venue for listing.

Recently, we've made it easier for regional companies to list in Hong Kong by recognising more local stock exchanges as Recognised Stock Exchanges (RSE). For instance, we've recently added the Indonesia Stock Exchange as an RSE. This means companies listed on the Indonesia Stock Exchange can come to Hong Kong for a secondary listing more conveniently. We've also added the Saudi Exchange and two exchanges from the UAE, including the Abu Dhabi Securities Exchange and the Dubai Financial Market, to this list. We will continue to expand collaboration within the ASEAN region with the aim of adding more local exchanges, making it even easier for regional companies to list in Hong Kong.

How can Hong Kong help Vietnam build an international financial centre?

I'll focus on the stock market, as that's my area of expertise. After our luncheon, we had a meeting with Hong Kong’s Chief Executive John Lee and the chairman of Ho Chi Minh City People's Committee Phan Van Mai.

I'm aware that Vietnam has two public stock exchanges, which are highly favoured by domestic investors and issuers. While their main focus is on stocks, these exchanges also offer other products like bonds and ETFs.

In comparison, HKEX has a longer history and now boasts 2,600 listed companies with a total market capitalisation of around $4 trillion. Stocks account for about 40 per cent of our business, while derivatives contribute approximately 30 per cent of our revenue. We also offer ETFs, structured products, and commodities, and are exploring many new areas.

What I shared with chairman Mai is that we are very happy to exchange our experiences. We've been operating our stock market for a long time and have developed a diverse portfolio of products. I believe that our experience could be valuable to the two Vietnamese stock exchanges in Hanoi and Ho Chi Minh City.

You might wonder why we would share our knowledge if we are competitors. While we do compete for investors, we believe that if all regional exchanges collaborate, we can attract more global investors' attention to Asia, Southeast Asia, and the broader region. Increased interest in Asia will lead to more investment inflows, benefiting everyone. Inter-regional capital flows can enhance overall market growth.

We have signed MoUs with many regional exchanges, promoting talent and knowledge exchange. Although we didn't sign any MoUs during this visit, we will continue the dialogue and hope to forge closer ties with the stock exchanges in Hanoi and Ho Chi Minh City in the future.

As the first female CEO of HKEX, how has your experience been, and do you have any advice for women in STEM and finance?

Yes, I am the first female CEO of HKEX, but I focus more on being the first internally promoted CEO within HKEX, which highlights our commitment to nurturing in-house talent. This is something I am particularly proud of.

Hong Kong has made significant strides in gender equality, especially in the financial services sector. We have over 60 female CEOs, including the Hong Kong CEOs of HSBC and Standard Chartered Bank, as well as the CEO of the Securities and Futures Commission. This illustrates the supportive environment that Hong Kong has cultivated for women to advance in their careers.

During my tenure, I have taken concrete steps to advance gender diversity. Two years ago, we introduced a landmark listing rule mandating that all listed companies in Hong Kong maintain diverse boards. Companies with single-gender boards will be in violation of this rule. With a compliance deadline set for the end of 2024, over 2,600 listed companies must ensure their boards are gender-diverse by then.

The results have been promising. When we initiated this rule, around 800 companies had all-male boards. Today, that number has significantly dropped, and we are now 85 per cent compliant. We still have 15 per cent of companies that must add at least one woman to their boards by the end of this year. These initiatives are part of our broader strategy to enhance diversity and encourage more women to take on senior roles in Hong Kong's corporate world.

I have come to know that Vietnam is actively promoting gender inclusion for listed companies, with a notably high proportion of women in the workforce. It is commendable that both Vietnamese companies and the government are committed to supporting gender diversity, inclusion, and sustainable development. I believe there is a great opportunity for us to actively exchange our experiences and learn from each other's efforts in this crucial area.

I’ve learned that Hong Kong is pioneering in launching digital assets. Given that Vietnam has a high crypto adoption rate, do you see any future for Vietnamese or Southeast Asian-focused ETFs for crypto?

Digital assets as an asset class are gaining popularity globally. At HKEX, we aim to provide a regulated environment for investors to engage in this asset class. Since 2022, we have been offering digital asset-related products, starting with cryptocurrency futures and related ETFs. This year, we took another step by introducing spot virtual asset ETFs, including three Bitcoin spot ETFs and three Ethereum spot ETFs. While they are not heavily traded, they provide investors with an additional asset class.

Regarding your question about involving participants from Vietnam, the answer is definitely yes. Vietnamese investors could participate in these ETFs, and there is potential for Vietnamese entities to become issuers, provided that they meet the licensing requirements. Given the high interest in digital assets in Vietnam, this opens up better opportunities for collaboration between our markets.

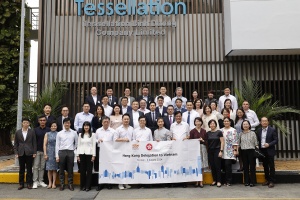

| Hong Kong delegation signs 30 MoUs with Vietnamese government agencies and businesses A delegation led by Hong Kong Special Administrative Region (HKSAR) Chief Executive John Lee has concluded a working trip to Vietnam, having signed 30 MoUs. |

| Standard Chartered to explore Hong Kong-Vietnam business opportunities Standard Chartered Bank (Hong Kong) announced on August 5 that it has signed MoUs with Kingboard Holdings, Computime Group, and Stavian Group to explore business opportunities between Hong Kong and Vietnam. |

| Hong Kong's expertise to help develop Ho Chi Minh City During his visit to Vietnam from July 31–August 2, Hong Kong chief executive John Lee expressed his willingness to share the special administrative region's experience of building a global a financial centre with Ho Chi Minh City. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- FDI disbursement in first two months highest in five years (March 07, 2026 | 09:00)

- EU standing ready to boost trade, investing (March 06, 2026 | 15:21)

- Fresh pathways laid out for industrial ties with Germany (March 06, 2026 | 15:18)

- South Korean company to build synthetic graphite anode material plant in Thai Nguyen (March 05, 2026 | 16:41)

- YADEA launches $100-million smart manufacturing plant in Bac Ninh (March 03, 2026 | 11:55)

- Law on Investment takes effect (March 02, 2026 | 16:21)

- VinFast invests nearly $500 million in its EV plant in Ha Tinh (March 02, 2026 | 16:19)

- Ho Chi Minh City attracts nearly $980 million in FDI in early 2026 (March 02, 2026 | 10:57)

- Japan’s Fujiya strengthens production base in Vietnam (February 28, 2026 | 09:00)

- Haiphong gains new growth impetus from strategic planning and integrated infrastructure (February 27, 2026 | 16:40)

Tag:

Tag:

Mobile Version

Mobile Version