Grounds for new hope to unfreeze FDI process

|

South Korean-run Everpia JSC, which boasts the famous bedding brand Everon, is feeling the impact of the virus pandemic due to postponements in raw material supply holding up its operations in Vietnam.

Lee Jae Eun, 56-year-old CEO of Everpia JSC, seems to have more grey hairs, thinking about solutions for the situation. “Compared to travel and hospitality, COVID-19 has had a more limited impact on our business. However, the outbreak has certainly delayed our raw material procurement schedule from suppliers abroad,” he told VIR.

“We have managed to mitigate the procurement issue early on thanks to our management team’s efforts and the support of our trusted suppliers. We continue to develop preventive measures to possible risks in the future, including seeking alternative material sources, and assessing possible scenarios in regards to financial stress on the company.”

Everpia now operates three factories in Vietnam. Its distribution system in the country has expanded continuously from 154 agents in 2008 to around 400 now. While the South Korean investor has expanded its business in Vietnam in the last year by opening a new business of curtains and blinds to meet the local demand for high-quality and affordable products, the company is being forced to postpone the next investment steps, focusing instead on developing preventive measures to possible risks in the future.

Overcast picture

South Korea is not the only foreign investor affected by this economic slowdown, be it in Vietnam or further afield. Many others from Japan, Singapore, the United States, and Europe, which are Vietnam’s biggest foreign investors, are in the same situation, thus inevitably changing Vietnam’s foreign direct investment (FDI) picture into a negative one.

“Restrictions on immigration will cause significant impacts on FDI in Vietnam. Foreign investors will have to delay their business in the country, causing more risks regarding their plans of investment, expansion, and launching new products,” said Kim Jae Hong, chairman of the Korea Chamber of Commerce and Industry.

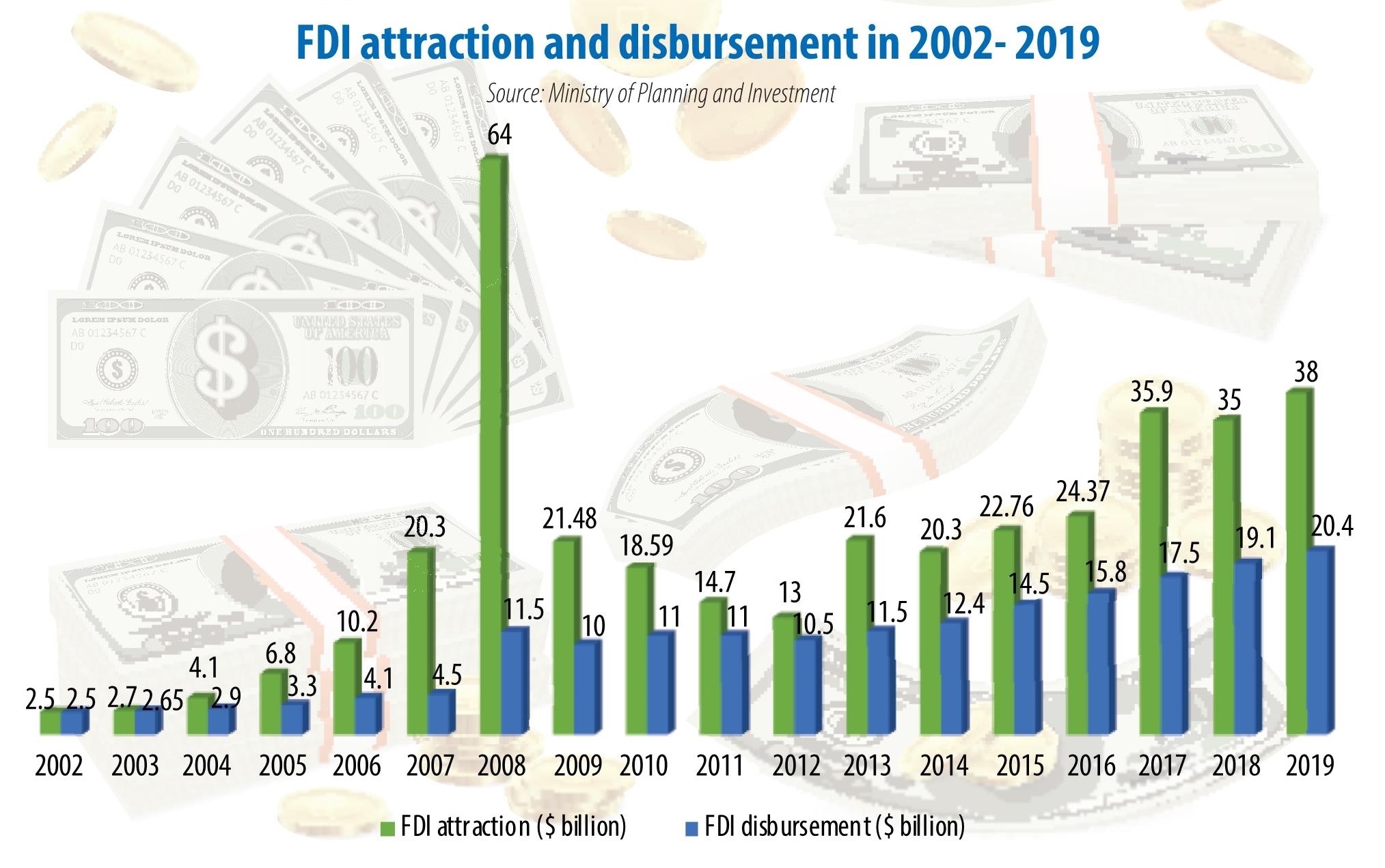

According to statistics from the Ministry of Planning and Investment (MPI), in the first three months of 2020 Vietnam lured in $8.55 billion in registered FDI, equaling 79 per cent compared to the same period last year. The decline comes from the impact of the coronavirus.

Except for the Singaporean-invested $4 billion liquefied natural gas-fired power plant licensed in January, newly-pledged FDI from other projects hit only over $1.5 billion. FDI for capital expansion also fell 18 per cent.

This is considered among the lowest falls since the SARS pandemic, which also pulled down Vietnam’s FDI attraction at the time. In the same period of 2019, the country saw a record in FDI pledged in the first quarter in the last three years, with total FDI reaching $10.8 billion, up 86.2 per cent on-year.

The MPI in a recent report sent to the government blamed the fall to a halt of trips, investment conferences, and forums by potential foreign investors to seek business opportunities during the period. “Newcomers hesitate to make investment decisions, while existing ones postpone any capital increase for their projects,” it said.

Specifically, FDI in processing and manufacturing significantly decreased in the first quarter of 2020. Unlike the last months of 2019, when when the sector often made up about over 70 per cent of Vietnam’s total registered FDI, since the beginning of this year, the ratio fell to about 31.5 per cent to around $2.7 billion, compared to 77.7 per cent and $8.4 billion in the same period last year.

A survey of IHS Markit and Nikkei released in early March also outlined the decline. Accordingly, the Vietnam Manufacturing Purchasing Managers’ Index (PMI) fell below the 50.0 no-change mark in February, signalling a deterioration in business conditions, marking it the first decline for over four years. The survey blamed the fall on shortages of necessary inputs and scarcity of new orders.

In February, about 10 per cent of businesses had to scale down their production. The situation deteriorated in the first two weeks of March, when the rate increased to 15 per cent, according to the latest statistics from the Ministry of Labour, Invalids and Social Affairs. As a result, thousands of workers found themselves unemployed, with the majority coming from foreign-invested enterprises (FIEs).

Even giant manufacturers like Samsung, Honda, Toyota, and Ford are now suffering. Last week, Ford Vietnam announced a temporary halt of its factory in the northern province of Hai Duong for several weeks, with the reopening time depending on the outbreak situation.

The situation is getting worse because of the serious developments of the outbreak. Many FIEs in the most attractive sectors such as processing and manufacturing, real estate, retail, services, and tourism are temporarily closing their doors or downsizing operations.

Realty and sci-tech are the other sufferers, with little new investment being made during the period. As a result, FDI in property is three times lower while the figure in sci-tech is nearly halved against the corresponding period in 2019, reaching $263.9 million and $229 million, respectively.

On the service front, lodging and food services witnessed foreign investment dropping over two times on-year, while that in other services fell twofold, blamed on the suspension and lockdown of tourism and entertainment services nationwide to battle the virus outbreak.

The Ministry of Transport estimates total initial losses of over VND30 trillion ($1.3 billion) among domestic air carriers from flight cancellations and postponements. At the government’s March media briefing, Minister and Chairman of the Government Office Mai Tien Dung said that the country faced a two-digit drop in the number of tourist arrivals, leading to a $7 billion loss for the tourism industry.

Although services is an emerging sector among foreign investors – especially those from South Korea, Japan, and Singapore – no international investors have made any new investments at this time.

In 2003, Vietnam faced a hard plunge in FDI when the country was hit by the SARS pandemic. This time COVID-19 has been making even more serious global impacts, and FDI is not an exception.

Future hopes

Vietnam and other countries around the world are taking strong and concrete measures to fight the global health crisis. Many nations in Asia, the EU, and the Americas have created blockades, closed border gates, or enforced curfews. This will exert more serious negative impacts on FDI attraction in the long term unless the virus is brought under control in the short term.

Nicolas Audier, chairman of the European Chamber of Commerce in Vietnam, which has over 1,000 members in the country, said, “The international travel bans introduced in Vietnam, Europe, and elsewhere are, we hope, a short-term measure and that the virus can be brought under control as soon as possible. While it could have an impact on foreign companies and investment here, all of us doing business in Vietnam need to put the health and wellbeing of the public first.”

While facing another possible slowdown in FDI attraction, investment shifts among international giants to Vietnam might rekindle hope for the Southeast Asian nation, proving it a safe destination amid the health crisis. Recently, Samsung Electronics has said that it would temporarily move some smartphone production to Vietnam from South Korea after another of its South Korean staff tested positive for COVID-19, forcing it to close a factory.

In another development, Fast Retailing, which operates multiple fashion brands including UNIQLO, GU, and Theory and is the world’s third-largest manufacturer and retailer of private-label apparel, is going to open more stores in Vietnam despite the pandemic, with a new UNIQLO store in Ho Chi Minh City this summer.

In an effort to support businesses in times of difficulty, the Vietnamese government in early March issued Directive No.11/CT-TTg on urgent tasks and solutions to help enterprises affected by the pandemic. The government is planning to issue incentives in the form of tax breaks as well as delayed tax payments and land-use fees. Thus far, the State Bank of Vietnam has already cut interest rates from February.

Warrick Cleine, chairman of KPMG Vietnam, said that business leaders have an obligation to learn how to do business with a new set of rules. “The worst thing we can do is stop business and delay business decisions. Business should keep moving forward, and the government should continue to support that,” he noted.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Ho Chi Minh City attracts nearly $980 million in FDI in early 2026 (March 02, 2026 | 10:57)

- Japan’s Fujiya strengthens production base in Vietnam (February 28, 2026 | 09:00)

- Haiphong gains new growth impetus from strategic planning and integrated infrastructure (February 27, 2026 | 16:40)

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

Tag:

Tag:

Mobile Version

Mobile Version