Generali Vietnam implements e-KYC, stepping up Transparent Insurance strategy

This is a testament to the company’s ongoing efforts with a series of drastic improvements in processes and technology to heighten service quality and promote the implementation of its Transparent Insurance strategy.

Electronic Know Your Customer (e-KYC) is an essential foundation for digital transformation.

The application of e-KYC is an inevitable development trend in the digital era, especially given that ensuring transaction safety and customer information security is a top priority.

|

| The implementation of e-KYC is a new step for Generali Vietnam along with its considerable efforts to adopt its Transparency Insurance strategy |

In line with this trend, Generali Vietnam is a pioneer in bolstering the implementation of e-KYC in the life insurance sector to enhance security, transparency, and customer experience.

The mandatory implementation of e-KYC, effective from August 1, is a new step for Generali Vietnam after a period of preparation, upgrade, and process improvement. It is being run in parallel with significant efforts to adopt its Transparent Insurance strategy – a focus area for development in 2023.

The implementation of e-KYC applies to two processes, the onboarding of new customers at the policy application submission stage and the search for policy information, and conducting online transactions on the customer portal MyGenerali in the GenVita application for existing customers.

|

| Generali Vietnam has successfully built an advanced digital system, serving the paperless service needs of its customers, partners, staff, and agents |

Specifically, Generali Vietnam requires all onboarding customers to submit e-KYC data before submitting their application forms.

Existing customers need to do e-KYC after logging in or signing up with GenVita.

When the e-KYC result is successful, customers can access documents and make transactions on the MyGenerali customer portal, such as viewing new policy e-acknowledgements, looking-up policy information, claiming insurance benefits, making premium payments, adjusting policy information, changing the premium payment mode, and requesting a withdrawal, among others.

| The mandatory e-KYC will fully protect the interests of customers in terms of personal information security, insurance contracts, and transaction safety. |

Customers also have the autonomy to carry out procedures with electronic devices and an internet connection.

The e-KYC feature has a user-friendly interface, a simple process, high accuracy, and is integrated into the GenVita application, a digital ecosystem under the one-stop destination for all insurance and healthcare demands model from Generali Vietnam.

All of these efforts are aimed at implementing Generali Vietnam's Transparent Insurance strategy, which has been implemented since the beginning of this year, with a specific orientation to ensure the provision of complete and accurate information promptly and in compliance with the law.

To facilitate this goal, the company has constantly led a series of activities to review information and processes relating to products, services, training, and managing distribution, aiming to improve effectiveness, professionalism, and transparency for customers.

With strong investments in technology over the last several years, Generali Vietnam has successfully built an advanced digital ecosystem, serving the paperless service needs of its customers, partners, staff, and agents.

|

| Generali Vietnam has recently led a series of activities to review information and processes, striving to improve effectiveness, professionalism, and transparency for customers |

Along with making the most of its technological strength, Generali has also been focusing on other factors to improve the customer experience, such as removing the requirement for original claims documents, replacing paper contracts with electronic ones, paying attention to using easy-to-understand language in all correspondence with customers, and more.

Generali has also built an in-house specialist team to handle claims instead of using a third party as is usual practice, helping to ensure the quality of its claims service.

The company pays special attention to the inspection of its consulting quality before and after policy issuance to promptly correct any signs of violations.

During a recent visit and working session by international senior leaders in early July 2023, Generali Vietnam received high praise from Generali Group for being an innovative and effective business unit that has taken the initiative in terms of digital transformation and customer experience enhancement.

Vinay Dhareshwar, acting CEO of Generali Vietnam said, “Amidst the challenges from the global economic recession and fluctuations in Vietnam's financial markets, Generali Vietnam has steadfastly pursued its sustainable development strategy. It has identified the year's focus of increasing honesty and transparency through enhancing operational processes and controls relating to products, services, and training, all while managing distribution to protect the interests of customers.”

“With the launch of our latest e-KYC process, we are taking one more step in our endeavour to be fully transparent to our customers while offering convenience and complete safety of data. I believe that with the strong trust and support from our group and a cohesive and passionate team, we will get closer to our goal of becoming the most innovative, transparent, and trusted insurance brand in Vietnam,” he noted.

Many banks and financial institutions have recently stepped up the implementation of e-KYC to simplify their procedures, reduce risks, and optimise operational processes.

As a form of customer identity verification through facial recognition solutions and optical character recognition technology, e-KYC helps verify customers as real service users, preventing fraudulent activities.

| Vietnam an attractive life insurance market The life insurance market remains attractive despite slowing down of late, according to the Insurance Association of Vietnam. |

| CEO of Generali International visits Vietnam Jaime Anchustegui, CEO of Generali International, made a visit to Vietnam on February 27 as the group continues to pledge its long-term commitment to the market with its fast-growing, successful local business – Generali Vietnam Life Insurance Co., Ltd. |

| Vietnam in need of national digital data strategy The 2023 Vietnam-Asia DX Summit is taking in Hanoi between May 24 and 25 to discuss driving economic growth through digital data and smart connectivity. |

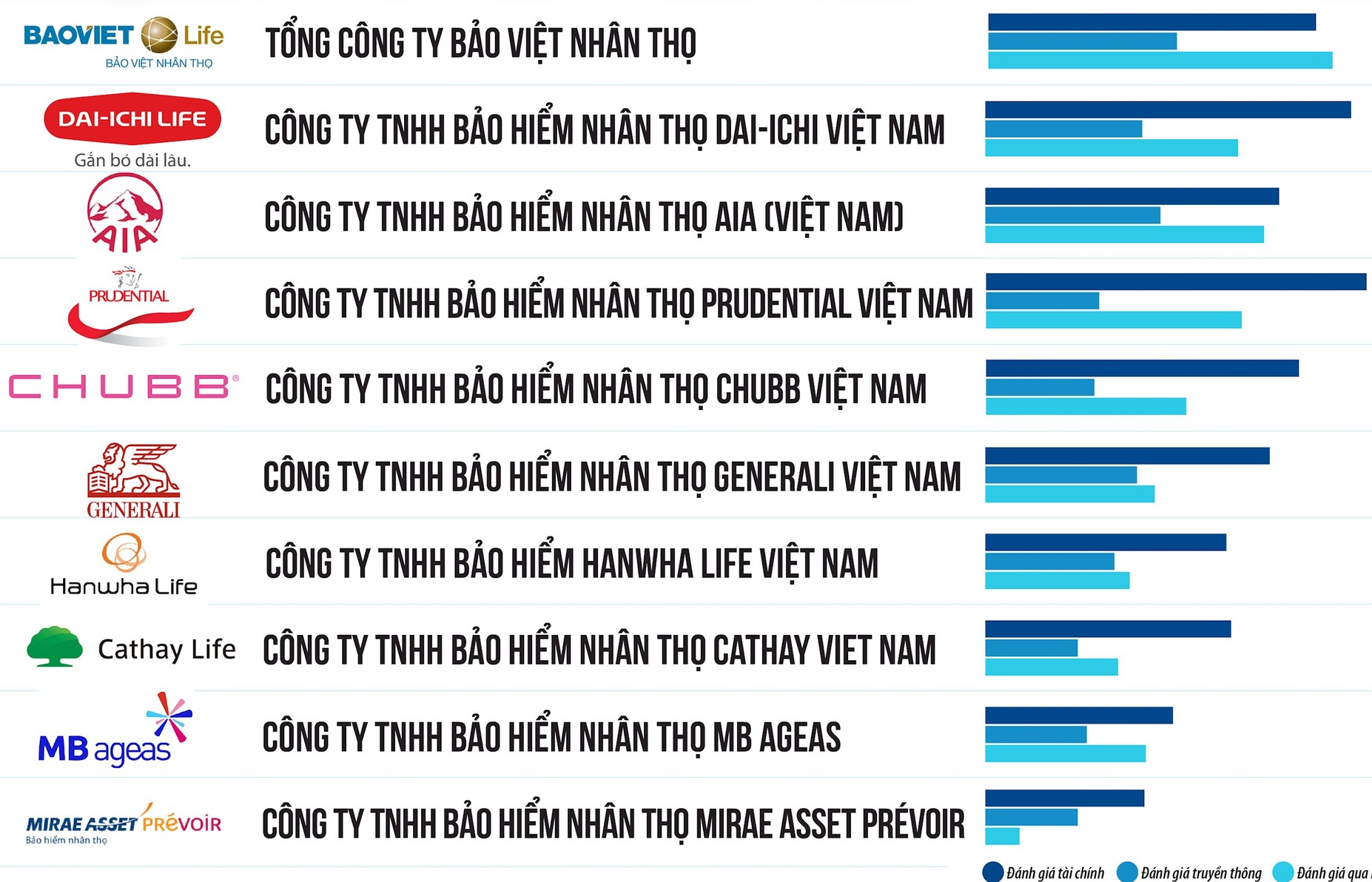

| Vietnam Report reveals Top 10 insurance companies in Vietnam in 2023 Vietnam Report has just released its highly anticipated list of the 10 most reputable insurance companies in Vietnam for 2023. The list encompasses two categories, life insurance and non-life insurance. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- QBE Vietnam: 20-year journey of building trust and enabling resilience (November 20, 2025 | 14:25)

- Hanwha Life hosts training course in South Korea for Vietnamese fintech talents (November 20, 2025 | 09:51)

- Insurers accelerate post-typhoon recovery (October 28, 2025 | 15:31)

- Shinhan Life Vietnam builds growth on people strategy (October 07, 2025 | 09:45)

- Insurance sector initiates rapid response after Typhoon Bualoi devastation (October 03, 2025 | 18:25)

- Non-life insurers face mounting pressure after typhoon hits motor sector (October 02, 2025 | 18:59)

- Prudential Vietnam delivers responsible investment package (September 25, 2025 | 10:37)

- Insurers struggle to keep pace with EV rapid adoption (August 29, 2025 | 17:12)

- Non-life insurance market in sees bright spots in H1 despite rising challenges (August 28, 2025 | 16:21)

- Life insurance rebounds with renewed growth and trust (August 06, 2025 | 18:04)

Tag:

Tag:

Mobile Version

Mobile Version