Generali confirms its extremely solid capital position

|

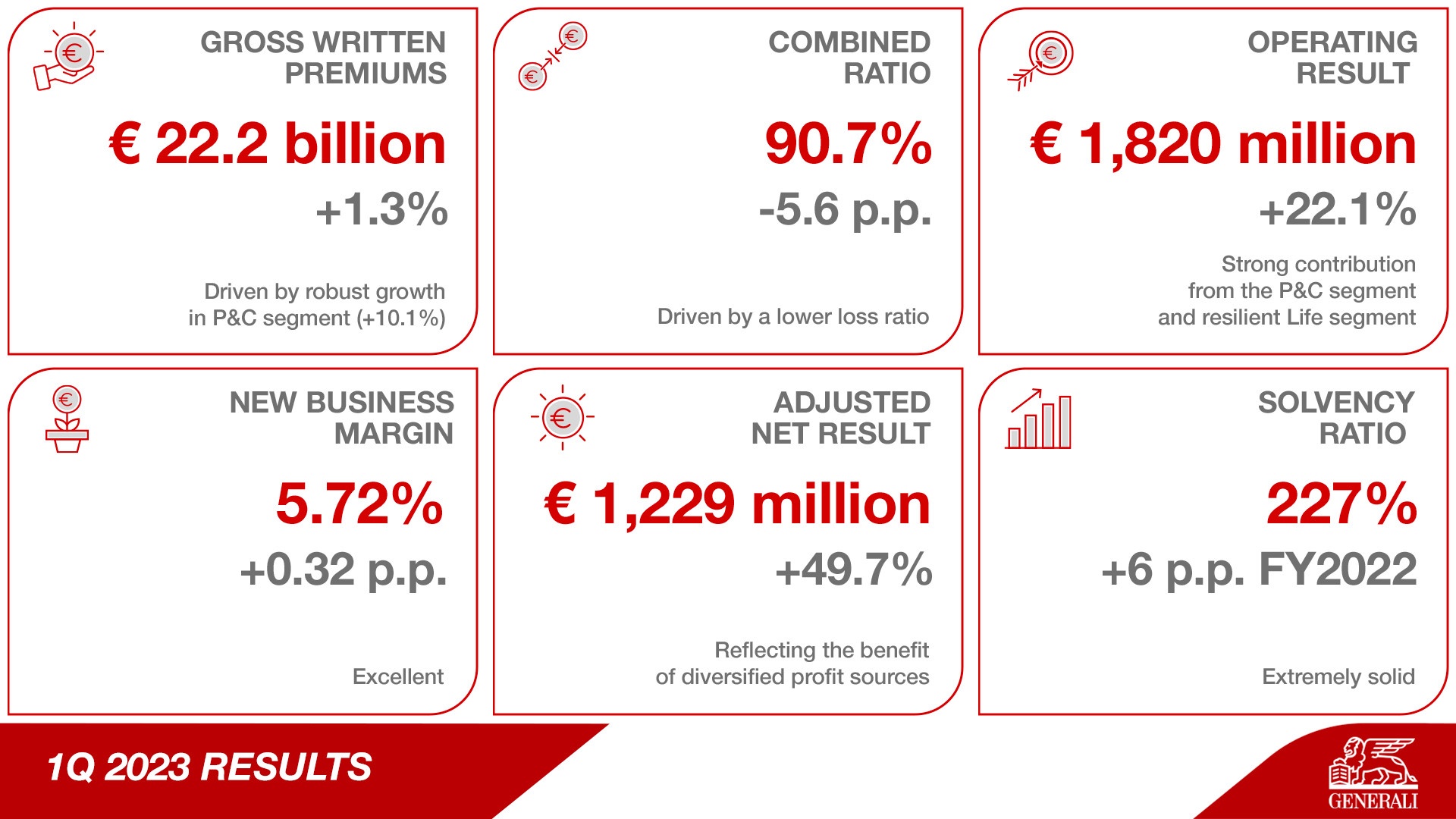

In the first quarter, Generali’s gross written premiums increased to $23.76 billion – up 1.3 per cent – driven by robust growth in the property and casualty (P&C) segment – up 10.1 per cent. Life net inflows were entirely focused on unit-linking and protection, consistent with the group’s strategy.

Meanwhile, its operating result rose to $1.9 billion, a rise of 22.1 per cent, mainly thanks to the strong contribution from the P&C segment, while the Life segment was resilient. The combined ratio improved to 90.7 per cent, down 5.6 per cent on-year. The excellent new business margin stood at 5.72 per cent, up 0.32 per cent against Q1 last year.

Generali's adjusted net result grew substantially to $1.27 million, an increase of 49.7 per cent, reflecting the benefit of diversified profit sources. The extremely solid solvency ratio stood at 227 per cent, compared with 221 per cent in the financial year 2022.

|

Generali Group CFO Cristiano Borean said, “The strong profit growth delivered in the first quarter confirms that we remain fully on-track to meet the targets of our Lifetime Partner 24: Driving Growth strategy. The performance of the P&C segment reflects our focus on technical excellence, while in the Life segment we continue to rebalance our business mix towards our more profitable lines, even amidst the challenging environment. The group also confirms its extremely solid solvency position, driven by strong organic capital generation."

"This quarter is also the first time that we are reporting under the new accounting standards. This allows us to significantly improve the visibility and predictability of profit sources and provides a more accurate representation of the value embedded in our Life business. I would like to thank all my colleagues in the group that have contributed to the International Financial Reporting Standards 17 and 9 project,” he added.

|

Generali Vietnam has contributed to the group’s performance with strong growth after 12 years of operation and outstanding achievements in products and services, digital transformation, customer experience, people strategy, and community support.

The company has quickly developed a strong network, a preeminent product suite, and excellent customer service with a leading relational net promoter score in the Vietnamese market over the past 11 consecutive quarters since 2020.

Generali is one of the largest global insurance and asset management providers. Established in 1831, it is present in 50 countries around the world, with a total premium income of $87.2 billion in 2022.

| Generali Group touts best-ever operating results in 2022 Generali achieved its best operating results in 2022 with continued growth in premiums and net results, putting it in an extremely solid capital position. |

| Generali named insurer with best customer experience in Vietnam Italian-backed insurer Generali Vietnam has reaffirmed its position as the market leader in customer experience, after being named “Insurer with the best customer experience in Vietnam” at the 22nd Golden Dragon Awards at the 2023 Vietnam Connect Forum on March 17. |

| Generali – 192 years of global protection, 12 years of companionship with Vietnam On April 24, Italian-backed life insurer Generali Vietnam celebrated its 12-year anniversary with excellent business performance and a nationwide network of more than 100 GenCasa agency offices and branches, serving nearly 500,000 clients across the country. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Shinhan Life Vietnam builds growth on people strategy (October 07, 2025 | 09:45)

- Insurance sector initiates rapid response after Typhoon Bualoi devastation (October 03, 2025 | 18:25)

- Non-life insurers face mounting pressure after typhoon hits motor sector (October 02, 2025 | 18:59)

- Prudential Vietnam delivers responsible investment package (September 25, 2025 | 10:37)

- Insurers struggle to keep pace with EV rapid adoption (August 29, 2025 | 17:12)

- Non-life insurance market in sees bright spots in H1 despite rising challenges (August 28, 2025 | 16:21)

- Life insurance rebounds with renewed growth and trust (August 06, 2025 | 18:04)

- Global Care launches Vietnam’s first insurance KOL platform (July 25, 2025 | 09:42)

- Liberty Insurance leaves mark at 2025 Insurance Asia Awards with dual wins (July 14, 2025 | 07:27)

- New CEO takes helm at Prudential Vietnam (July 07, 2025 | 17:51)

Tag:

Tag:

Mobile Version

Mobile Version