Experience required in solar sector

|

China is the largest panel supplier in the world, with many large and small manufacturers in the country. Most of the top 10 manufacturers have already set up factories in Vietnam, such as Trina Solar and JA Solar. Companies such as these are now scrambling to find new customers, both domestic and internationally, in a shored reversal of fortunes for an industry flooded with orders only a few years ago.

At the recent Solar Power Expo Vietnam in Hanoi, Ku Jun Heong, Trina Solar director of sales and marketing in Asia Pacific and the Middle East, said that Vietnam has always been an important market for the company.

“With a deep understanding of the market, we built a production facility in the country, and achieved production capacity of 800MW annually. It shows our confidence in the solar potential of Vietnam,” Heong said.

According to the annual report of JinkoSolar Holding Co., Ltd., as of December 31, 2018 it had more than 900 customers for solar modules from China and 1,200 from other countries, including the United States, Mexico, Australia, Japan, and Vietnam. Revenue from the Vietnamese market last year reached $148.52 million.

Last August, JinkoSolar signed a 240MW solar module supply agreement with Powerchina Huadong Engineering Corporation Ltd. for the second phase of the 420MW Dau Tieng solar plant, which is expected to become the largest solar power project in Southeast Asia upon completion.

“We believe that the domestic market demand for solar power and solar power products in the near term will continue to substantially depend on the availability of government incentives because the cost of solar energy currently exceeds, and will continue to exceed, the cost of conventional fossil fuel energy and certain non-solar renewable energy, particularly in light of the low level of oil prices in recent years,” read a 2017 JinkoSolar report.

Those are among many suppliers that are benefiting from a booming Vietnam solar arena thanks to the feed-in tariff (FiT). Besides that, the boom is riding on chances for engineering, procurement, and construction (EPC), as well as banking.

The Institute for Energy Economics and Financial Analysis (IEEFA) stated in its report released in September on Vietnam’s renewable energy market that Chinese players appear to be watching the market closely.

Chinese companies and banks have played an important role in the market, but not as developers, the report said. Chinese-led projects seem more than happy to have them play a crucial, indirect role as providers of new-generation, low-cost equipment with generous funding from Chinese banks. For example, the report noted, Thailand’s B Grimm used a Chinese EPC and Chinese suppliers to construct solar farms in Vietnam. B Grimm paid just 10 per cent of what it owed its Chinese partners up front and is only required to begin repaying the rest over a year after construction begins. Subsequently, this financial flexibility has given B Grimm room for manoeuvre in Vietnam’s solar market.

Chinese groups have reportedly gained a solid foothold by offering similar terms to other developers, leveraging the funding capacity of the major Chinese banks, according to the report.

However, Mai Van Trung, business development director of locally-invested SolarBK, told VIR previously that inexperienced players join in the solar market by competing with low quality products with unknown origins. This could bring about many consequences for the market in the long term. Trung suggested that solar panels should have third-party guarantees such as MunichRE, SwissRE, or PowerGuard, which would prevent EPC contractors from mixing B-grade solar modules.

EPC is the most critical part enabling the successful deployment of solar rooftop systems. The contractor typically provides everything from site survey and operation to maintenance services during the lifespan of a project, typically over 25 years, according to Trung.

Lessons are being made in a wider sense from India, which has been adding thousands of megawatts of solar power capacity, but this boom manifested into poor quality that will affect investor returns as EPC and developers failed to focus on maintaining systems post-construction, and only cared about costs.

Vietnam’s medium-term plans for its renewable energy sector are now taking shape after two busy years of project development. According to the IEEFA report, the need to bring large amounts of new capacity online quickly – coupled with the desire for clean and secure power – has been the driving force spearheading renewables into the country.

With 4.46GW of solar power now coming online as the solar FiT programme hits its deadline, attention is shifting to plans for new grid investment and the next phase of the FiT programme which focuses on the burgeoning wind sector, the IEEFA stated.

Vietnam’s renewables programme is gaining momentum at a strategic time. Vietnam has already electrified 99 per cent of its population. Now the demand for electricity is poised to increase. The revised National Power Development Master Plan VII currently forecasts commercial growth to grow at about 10.3 per cent annually until next year.

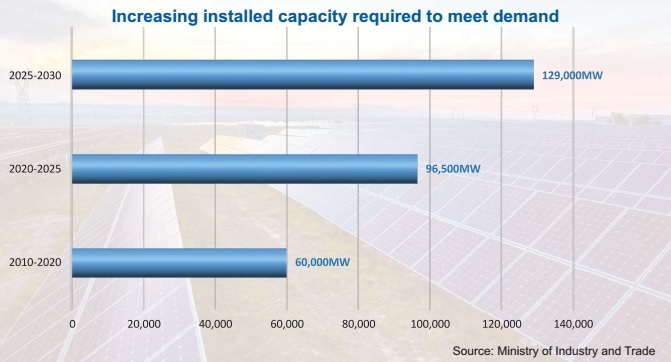

It is then expected to decrease somewhat, but still produce robust growth until 2030. The plan calls for capacity additions of between 6,000-7,000MW per year to meet the country’s increased demand.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Green finance and circular economy as drivers of growth (February 18, 2026 | 20:35)

- EVN awards EPC contract for Quang Trach II LNG project (February 10, 2026 | 09:00)

- Canada backs Vietnam’s green transition with AGILE project (February 09, 2026 | 17:41)

- Momentum is real in the race to net-zero emissions (February 02, 2026 | 08:55)

- $100 million initiative launched to protect forests and boost rural incomes (January 30, 2026 | 15:18)

- Trung Nam-Sideros River consortium wins bid for LNG venture (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Envision Energy, REE Group partner on 128MW wind projects (January 30, 2026 | 10:58)

- Vingroup consults on carbon credits for electric vehicle charging network (January 28, 2026 | 11:04)

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version