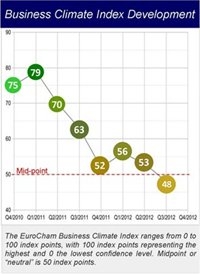

EuroCham Business Climate Index falls to record low

The survey, conducted in July 2012, shows the index dropped 5 points further to 48, indicating a declining confidence in Vietnam as an investment destination, according to EuroCham Chairman Preben Hjortlund.

The survey, conducted in July 2012, shows the index dropped 5 points further to 48, indicating a declining confidence in Vietnam as an investment destination, according to EuroCham Chairman Preben Hjortlund.

“For the first time since we started this survey in the third quarter of 2010, the index has dropped below the mid-point of 50 pointing towards an overall negative business sentiment,” says the chairman in a written announcement.

EuroCham members that participated in the survey expressed an increasing concern about their current business situation and outlook as well as the overall macroeconomic outlook in Vietnam. Some 38% of the surveyed businesses are active in the services industry, about 30% in manufacturing and the rest in trading or other activities.

The percentage of respondents assessing their current business situation as 'good' has fallen from 34% in the previous quarter to 29% now, and down from 43% one year ago.

Only one percent of respondents described their current situation as 'excellent'. The neutral assessment of the current situation remained constant at around 30%.

Meanwhile, the number of businesses viewing their current business situation 'very poor' has increased by ten points, with 39% of respondents having a negative view of their current situation.

EuroCham says that they can see a negative trend in companies’ business outlook, when only 31% stated a 'good' or 'excellent' outlook, down from 38% last quarter and a significant drop from the 42% of respondents that had a positive business outlook in the second quarter of 2011.

The shift has been towards a negative outlook with 31% assessing their business outlook as 'not good' or 'very poor'. One year ago, only 20% of respondents had such a negative outlook.

“Despite some progress on inflation there is a torrent or new and ongoing issues that are eroding confidence in the business environment in Vietnam: macroeconomic troubles, lack of adequate infrastructure and administrative burdens,” said EuroCham Executive Director Paul Jewell.

Worry about orders, lower investment

When asked about their expected number of orders and revenue in the medium-term, the answers were mixed.

Some 45% of companies expect revenue to increase, down from 58% in the last quarter, while 20% of respondents expected revenue to remain the same in the medium term. Worryingly, 35% expect their orders to decline, representing a 12-points increase from last quarter and significantly more than the 9% who were worried about a decline in orders/revenue one year ago.

Relating to investment, when asked about their investment plans for 2012, only 32% of respondents were looking to increase their investment in the country, falling from 36% in the last survey and plunging from the 52% that were planning to do so one year ago.

A staggering 33% of businesses in this survey are planning to reduce their investments with 20% of them stating that they will 'significantly reduce' their investments in Vietnam this year. Meanwhile, in EuroCham’s survey one year ago, only 4% of respondents anticipated a significant reduction of their investment in Vietnam.

Relating to recruitment plans, 32% of respondents expected to hire more staff in the medium-term. Meanwhile, 41% expected to maintain the same level.

However, 26% are planning to reduce their staff in Vietnam. Only 19% of businesses were planning to do so last quarter and just 9% had plans to reduce their headcount this time last year.

While overall concerns about inflation remain high with 49% of companies expecting inflation to have a significant impact on their business, this figure is slightly lower than 52% last quarter.

However, when asked about the macroeconomic outlook for Vietnam over the next six months, 60% of respondents think that they will see a further deterioration of an already difficult economic situation against 30%, who think that the situation will stabilize and gradually improve.

This shows that the measures taken to stabilize the economy do not ease the concern of the business community about the macroeconomic outlook.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version