Economy buckles up for bumpy year

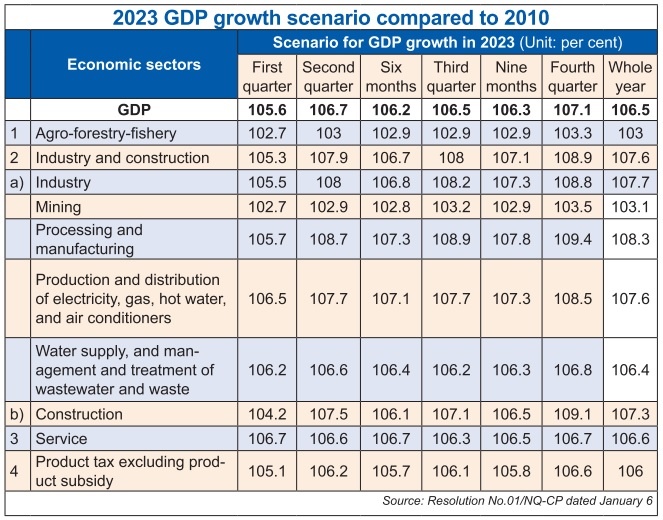

The government has released a projection that due to a slowdown in production induced by the traditional Lunar New Year break, the country’s GDP will likely grow 5.6 per cent in Q1 before bouncing back to 6.7 per cent in Q2 (see box) – in which the respective growth rates will be 2.7 and 3 per cent for the agro-forestry-fishery sector, 5.3 and 7.9 for the construction sector, and 5.5 and 8 per cent for the industrial sector.

The government has set a target of 6.5 per cent in economic growth this year.

The General Statistics Office (GSO) last week reported that in January when the Lunar New Year holiday took place with about 10 days off from working, the economy’s index of industrial production went down remarkably, at an estimated rate of 14.6 per cent on-month and 8 per cent on-year.

More specifically, the manufacturing and processing sector, which creates more than 80 per cent of industrial growth, in January declined 9.1 per cent on-year and induced a reduction of 7 percentage points in total industrial production; the mining sector dropped 4.9 per cent; and electricity production and distribution fell by 3.4.

“Many enterprises had in December 2022 boosted production for increased demands for consumption during the festive break, so in January, the number and the scale of orders reduced, affecting the month’s industrial production,” said GSO general director Nguyen Thi Huong.

According to the Ministry of Planning and Investment’s Department of Business Registration Management, in January there were 10,800 newly established enterprises registered at about $4.3 billion and employing nearly 68,600 workers – down 16.6 per cent in the number of enterprises, 48.5 per cent in registered capital, and 11 per cent in the number of employees as compared to those in the same period last year.

| Nguyen Chi Dung - Minister of Planning and Investment

With unpredictable issues in the global economy, along with domestic troubles, it is too difficult for the business sector to access capital for maintaining production and business. It is also tough to maintain medium- and long-term capital mobilisation channels for investment expansion and business recovery, such as in corporate bonds, stocks, and bank credit. Early withdrawal of investors and repurchase of issued corporate bonds caused many difficulties in terms of cash flow for businesses, as well as a drop in confidence. Businesses that have already issued bonds are struggling because the total volume of corporate bonds due for repayment in 2022-2024 is gigantic, especially for real estate firms. Meanwhile, cash flow into the market is decreasing for several reasons. Credit institutions are tightening lending, securities investment, and margin lending interest rate is increasing; and large enterprises are liquidating their stock portfolios to balance cash flow for corporate bond redemption in the context of inaccessibility to bank credit. Also, investors are anxious after negative impacts from macro risks and serious violations in the capital market. The liquidity of banks is under a lot of pressure and high lending interest rates hinder enterprises to access credit. Even if the State Bank of Vietnam (SBV) opens more credit room, commercial banks do not have enough capital to lend more because they must ensure the capital adequacy ratio, while commercial banks have to increase deposit rates to mobilise capital, pushing the interest rate up to 13-15 per cent. Therefore, the Ministry of Planning and Investment (MPI) in collaboration with the Ministry of Finance, the SBV, and relevant agencies have submitted to the government some solutions to support and develop businesses by 2025. First is promoting the implementation of the 2 per cent interest rate support policy under the economic recovery programme. We will provide enough credit capital for the economy, focusing on production and manufacturing in prioritised areas and growth drivers; strictly control credit in potentially risky areas; and direct commercial banks to meet capital needs of traders importing petrol, oil, and coal, contributing to ensuring energy security. There will be timely handling of short-term difficulties related to corporate bonds and promoting healthy, efficient, and sustainable development of the market in the medium and long term. It is also a must to strengthen enterprises’ financial management capacity and access to capital, especially small- and medium-sized enterprises. Besides this, in the socioeconomic report submitted to the government every month, the MPI usually points out burdens surrounding businesses, and raises solutions. This year will continue to be a challenging time for them, especially in the domestic private sector. In order to remove difficulties in capital for enterprises and the economy, the MPI will continue to propose to the government to assign relevant ministries and agencies to implement some strategies. First is to drastically and effectively implement the Programme on Socioeconomic Recovery and Development. The MPI also proposed the government speed up the implementation of policies, review, and adjust resources from policies that are difficult to implement or not fully implemented, and transfer to the remaining policies, such as the 2 per cent interest rate support policy, and the rent support policy. Next is to sustainably develop the stock market and corporate bond market to become an important and safe capital mobilisation channel of enterprises; bettering mechanisms and policies on corporate bonds; and proposing solutions to continue the policy of exemption, reduction, and extension of taxes, fees, and land use fees to reduce cash flow pressure and support businesses. We should also continue to develop and diversify new capital mobilisation channels for enterprises, develop new types of financial intermediaries, and consider allowing pilot deployment related to capital attraction channels for businesses. Additionally, the MPI has proposed the government solve inadequacies that hinder business development, and unlock the potential of the private sector. Ministries and agencies can take action in terms of reforming administrative procedures, deploying e-government, and linking procedures among ministries and agencies to save time and costs. We will try more to update and deliver information on fluctuations and trends of major import and export markets. Petroleum will be ensured and supplied to the domestic market, and we will administer gas prices in accordance with the actual situation. Trade promotion activities will also be innovated, while markets will be developed and digitalised via IT applications and digital transformation to enhance performance. |

Global analysts FocusEconomics told VIR that under its own calculations, after expanding sharply in on-year terms in Q3, the Vietnamese economy slowed in Q4 as weaker momentum in services, industrial activity and construction more than offset acceleration in the agriculture, forestry and fisheries sector. Higher interest rates, accelerating inflation and an annual contraction in exports dragged on activity.

“That said, Vietnam was likely still one of ASEAN’s top performers in the quarter. Turning to Q1 of 2023, GDP growth should be robust. While weaker demand from developed markets will be weighing on exports, higher tourist arrivals, the border reopening with China in January and solid domestic demand will provide,” added FocusEconomics.

|

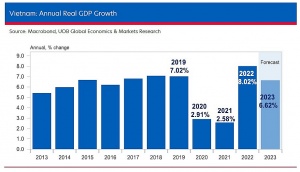

GDP growth fell to 5.9 per cent on-year in Q4 of 2022 from 13.7 per cent in Q3. Q4’s reading marked the slowest expansion since Q1, driven by a less favourable base effect. Overall, Q4’s result led to 8.02 per cent annual growth in 2022.

In Q4, significant slowdowns occurred in the services, industry and construction sectors. Services expanded 8.1 per cent, compared to 19.3 per cent in Q3; industry 3.6 per cent, compared to 11.1 per cent in Q3; and construction 6.7 per cent, compared to 17.5 per cent. That said, growth in the agriculture, forestry and fisheries sector accelerated to 3.9 per cent, compared to 3.7 per cent in the previous quarter.

“Looking ahead, quarterly on-year growth is set to remain robust in Q1 of 2023 as increased post-pandemic spending and exports remain resilient, likely boosted by increased tourism amid China’s reopening. That said, higher interest rates will likely add downward pressure to activity,” FocusEconomics said.

In their outlook, analysts at United Overseas Bank said, “The strong growth seen in 2022 showed Vietnam’s resilience and ability to pull off a recovery from the damages caused by the pandemic, due to its diversified economic sectors in manufacturing and services. However, overall growth momentum is likely to moderate further in 2023, as policy tightening from major central banks weighs on external demand.”

While FocusEconomics expects Vietnam’s GDP to expand 6 per cent in 2023 and 6.6 per cent in 2024, HSBC in December revised down the Vietnam forecast for 2023 from 6 to 5.8 per cent due to lingering risks including trade headwinds.

The Asian Development Bank with its own calculations also stated that although domestic trade continues to increase, there are indicators of weakening global demand for the country’s exports. Moving forward, growth for 2023 has therefore been adjusted down to 6.3 per cent as major trade partners weaken.

The World Bank in last October predicted that the Vietnamese economy will increase by about 6.7 per cent in 2023.

“We need to acknowledge that 2023 is going to be a much more difficult year, and we expect the economy to slow down during the next months, as the global economic outlook is gloomy and this will affect Vietnam’s economic performance,” said Andrea Coppola, lead economist at the World Bank.

| Anticipated GDP growth rate for 2022 hits 8.02 per cent This is the highest growth rate in over a decade, indicating a robust economic rebound this year. |

| Potential for 6.6 per cent GDP growth in 2023 Overall growth momentum is likely to moderate further this year, as policy tightening from major central banks weighs on external demand. With that, UOB has kept its 2023 GDP growth forecast at 6.6 per cent. |

| World Bank says Vietnam's GDP growth to moderate in 2023 Vietnam's GDP growth is projected at 6.3 per cent in 2023, according to the latest Global Economic Prospects report by the World Bank. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

Tag:

Tag:

Mobile Version

Mobile Version