Covering the many complexities of livestream taxes

What are the current obstacles to tax collection on e-commerce platforms in Vietnam?

|

| ASL Law senior partner Nguyen Thi Thuy Chung |

Currently, managing taxes related to sales on e-commerce platforms faces numerous challenges. Tax management is currently conducted under a self-declaration and self-payment mechanism according to regulations. Hence, taxpayers, especially individuals doing business through social media platforms, have not been voluntarily registering their businesses or for tax purposes.

Many individuals and online business households conduct transactions through cash payments via shippers. If payments are made through banks, they often use bank accounts that are not registered with tax authorities.

Some individuals conduct business without a fixed location to transact with customers, relying solely on phone or social media accounts like Facebook and Zalo, and primarily engage in direct delivery and cash collection. Hence, tax authorities often lack sufficient information about these individuals to invite them for work-related meetings or to determine their tax obligations.

Determining actual revenue after sessions is often challenging due to the lack of authentic documentation.

What are the differences in management, declaration, and tax filing experience for those selling on e-commerce platforms in other countries?

In Germany and France, intelligent search tools have been developed to identify those conducting online business without declaring or paying taxes.

Xpider is used to detect e-commerce websites of German entities and individuals, identifying activities not complying with tax laws, and storing information for tax inspections. Meanwhile, France utilises tools like Copernic Agent, Metacrawler, and web scraping to search and collect information from websites and tax databases for computer audits.

Vietnam has implemented a centralised tax management system nationwide. Unlike systems in France and Germany, Vietnam’s tax management system offers many functions, including tax registration integration, dossier management, tax declaration and settlement processing, domestic tax accounting, debt management, analysis reporting, assessment.

Currently, businesses selling goods and providing services in Vietnam must issue electronic invoices to buyers, except for cases where goods are transferred internally for further production processes. For individuals and household businesses, invoice issuance is mandatory only when they apply the periodic declaration method for tax calculation.

On the other hand, all individuals and businesses selling on e-commerce platforms in China must issue paper invoices, electronic invoices, or other service documentation to validate transactions.

Both Vietnam and China have regulations that mandate the use of electronic tax declaration systems via the websites of their tax departments. While both countries have implemented electronic systems, China’s is more complex and comprehensive. China requires all businesses, regardless of size, to issue invoices for every transaction, a regulation in place since 1998. In contrast, Vietnam only started implementing its electronic invoicing system in 2022 and is still in the process of finalising the technical framework.

How can tax be collected effectively, especially given that the General Department of Taxation has recently issued a directive for local tax departments to intensify the management of e-commerce taxation?

To ensure effective tax collection, ASL LAW proposes several measures. First is to require e-commerce platforms to declare taxes on behalf of individuals and organisations doing business on the platform. Individuals and organisations selling on e-commerce platforms should also issue electronic invoices to consumers for all orders.

Dissemination of information and guidance to the public on tax issues related to e-commerce should be intensified. This includes the role of invoices, taxable entities, tax rates, and registration. Additionally, tax authorities should issue official documents addressing common concerns related to e-commerce.

Encouraging cashless payments to enhance transparency in economic transactions should be carried out, enabling tax authorities to easily monitor and manage revenue sources. Implementing this measure requires support and cooperation between banks and tax authorities. Using data provided by banks, tax authorities can identify individuals and organisations engaged in online business who have not declared or paid taxes.

Vietnam should also implement new IT applications to facilitate those engaged in e-commerce in completing tax procedures electronically.

The rapid development of e-commerce has also led to an increase in counterfeit goods and intellectual property right (IPR) violations. How will these be handled according to Vietnamese law, and how can sellers protect their ownership rights on e-commerce platforms?

The rapid development of e-commerce brings many business opportunities and gives rise to numerous issues related to counterfeit goods, fake products, and IPR violations.

According to Vietnamese law, depending on the nature and severity of the violations, these actions can be subject to administrative penalties or criminal prosecution. For producing and selling counterfeit goods, sellers can be fined around $400-850 for individuals and $850-1,600 for organisations.

If e-commerce platform providers fail to act on illegal activities detected or reported on their platforms, they can be fined $1,250-1,600 and may face additional penalties and remedial measures as prescribed by law.

The violations can be prosecuted under the Penal Code 2015 (amended and supplemented in 2017), including the crime of producing or trading in counterfeit goods, which also includes food and food additives.

Offenders may face fines, imprisonment, or even the death penalty, and may be prohibited from certain positions or professions, with possible property confiscation. Legal entities may be fined or face operational suspensions, business prohibitions, and capital mobilisation restrictions.

To protect IPR on e-commerce platforms, sellers can take several measures. It is advisable to use trademarks that have been registered. If the trademark in use has not been protected, it is necessary to file an application with the Intellectual Property Office of Vietnam.

Sellers should also regularly monitor products sold on e-commerce platforms to detect counterfeit goods; report violations to e-commerce platforms and request the removal of infringing products; and file complaints with relevant authorities when detecting violation of other entities.

E-commerce platforms also need to have stricter policies for identifying authentic official stores. For example, in the application process for registering as an official store, the e-commerce platform should require sellers, importers, or distributors to provide purchase invoices and certificates of origin for their products.

| Next era of e-commerce: Digital transformation with sustainable development E-commerce in Vietnam has entered a new era, focusing on sustainable development and digital transformation to become a driver of the economy. |

| E-commerce platforms help to spread agricultural value E-commerce is opening up a dynamic global playing field and bringing more opportunities for Vietnamese agricultural products. Nguyen Minh Tien, director of the Ministry of Agriculture and Rural Development’s Trade Promotion Centre for Agriculture, explained more to VIR’s Tra My. |

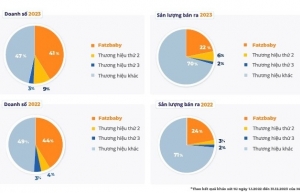

| Fatzbaby best-selling brand on e-commerce platforms According to research on e-commerce markets by data analysis platform Metric, Fatzbaby accounted for 41 per cent of the mother-and-baby care sector's revenue, the largest share for any company between 2022 and 2023. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version