ASEAN firms bullish on outlook amid trade tension risk

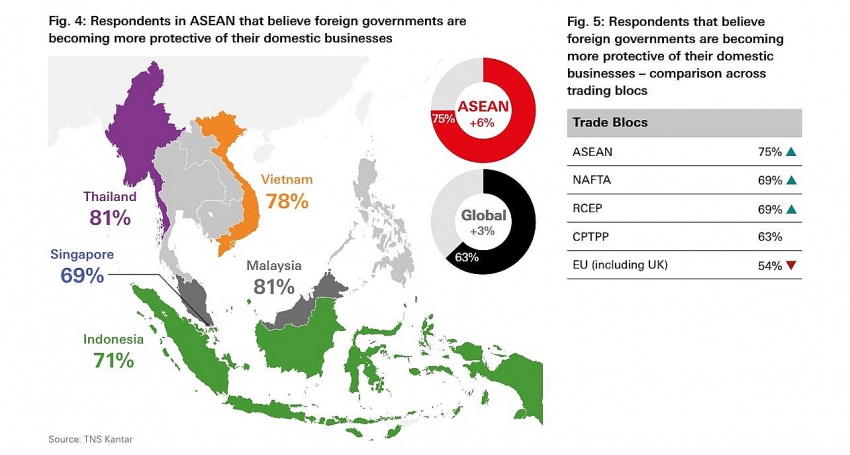

Accordingly, the HSBC report finds that some 86 per cent of ASEAN firms are positive about their company’s prospects in foreign trade – more than any other trade bloc and higher than the global average of 77 per cent. What is more, 75 per cent of ASEAN businesses in the survey say they believe that governments are becoming more protectionist in their key export markets – the highest reported of all trade blocs and much greater than the global average of 63 per cent.

|

| ASEAN firms anticipate more protectionism, yet are more optimistic than the rest of the world |

These findings come from HSBC Navigator conducted in the autumn of 2018 – a global survey involving more than 8,500 businesses in 34 markets. Within Southeast Asia, more than 1,000 views were sought across five ASEAN markets, including Singapore, Malaysia, Thailand, Indonesia, and Vietnam.

The ASEAN is thus one of the most bullish regions for trade and commercial activity, despite having the highest proportion of corporates who expect protectionism to rise.

Commenting on the report, HSBC Vietnam CEO Pham Hong Hai said, “ASEAN corporates are bullish on their commercial prospects while staying alert to rising protectionism. On the positive side, we can see the trade tensions may prompt an acceleration of production in lower-cost ASEAN countries. Countries with existing production capacity like the Philippines and Vietnam will benefit from this trend and from trade diversion.”

HSBC Navigator highlights that China and the US have so far been the focus of protectionist trade policies, but that there may be an indirect impact on the ASEAN bloc given the region’s high level of exports to both countries.

The report, however, finds that tariffs also open up opportunities for ASEAN markets in areas like electronics, textiles, and automobiles.

ASEAN countries like Thailand and Malaysia already have existing production networks in electronics, especially in hard disk drive (HDD) assembly. Thailand exports about the same amount of finished storage units to the US as China does, which would make it relatively easy to shift assembly there, especially since Chinese shipments of HDDs to the US are now subject to at least 10 per cent of US tariff.

Other members of the bloc like Singapore, the Philippines, and Vietnam also produce a variety of electronic components, while Vietnam and Indonesia have become increasingly competitive in light manufacturing and textile exports.

“Vietnam has strong commercial ties with both China and the US. While some local industries, like textiles and garments, may benefit through a demand shift from China, other industries, like machinery and steel, may see a tapering,” noted Hai.

Meanwhile, businesses around the world are becoming increasingly aware that all aspects of performance, from supply chain efficiency to overall technology innovation, can be improved through the use of data and analytics. Many ASEAN firms (84 per cent of survey respondents) are reporting the use of data to optimise their business, higher than the global average of 75 per cent, according to HSBC Navigator.

Technology is also a key element that ASEAN businesses believe will help boost supply chain efficiency. 37 per cent of survey respondents in the ASEAN are focused on increasing the use of digital solutions and technology within their business (versus 28 per cent globally). Moreover, the increasing use of technology is the top change planned to supply chains in the next three years amongst ASEAN respondents (34 per cent), which is higher than the global average (27 per cent).

“Despite some economies’ gain, a trade tension can be a lose-lose situation and ASEAN corporates should prepare for all scenarios. For those who consider to shift their supply chain, they need to assess a lot of factors, including the capacity of the receivers. Amongst all, technology will be a common thread for consideration and will be key to increasing competitiveness and appeal,” said Hai.

| HSBC: Local businesses cash in on international trade Vietnamese businesses are among the world’s most optimistic about international trade pacts and prospects and they are also among the most confident when it comes ... |

| Vietnam among top 3 regional destinations for Singapore companies: HSBC study Vietnam is among the top three investment destinations in Southeast Asia for Singapore-based companies in the next two years, according to the latest HSBC study. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Temporary relief for food imports as businesses urge overhaul of regulations (February 07, 2026 | 09:00)

- Opella and Long Chau join forces to enhance digestive and bone health (February 06, 2026 | 18:00)

- Vietnam-South Africa strategic partnership boosts business links (February 06, 2026 | 13:28)

- Sun PhuQuoc Airways secures AJW Group support for fleet operations (February 06, 2026 | 13:23)

- Pegasus Tech Ventures steps up Vietnam focus (February 05, 2026 | 17:25)

- The generics industry: unlocking new growth drivers (February 04, 2026 | 17:39)

- Vietnam ready to increase purchases of US goods (February 04, 2026 | 15:55)

- Steel industry faces challenges in 2026 (February 03, 2026 | 17:20)

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

Tag:

Tag:

Mobile Version

Mobile Version