28 years of MB’s customer-centric philosophy

Vietnam's financial sector has been served by MB for 28 years, and in that time the company has expanded into a multifaceted financial group with strong operations in banking, securities, fund management, asset exploitation, insurance, and consumer financing. Even during the terrible phase of the economy during the pandemic, its digital business plan was implemented, demonstrating its durability and adaptability.

MB Group's total assets increased by 26 per cent on-year in the first half of 2022, which is much higher than the average annual growth rate of 19 per cent seen from the 2018-2021 period.

"The diverse ecosystem with different large-scale subsidiaries, along with safe and efficient operations, have established a competitive advantage adding to MB Group’s strength," an MB representative emphasised.

|

| After 28 years, MB has evolved into a versatile financial behemoth |

Win over clients with first-rate services

MB has successfully deployed a full range of financial services to fulfil consumers' ever-evolving desires thanks to constant testing and research on its customer experience.

Customer satisfaction can be gauged with data. In particular, the MBBank App has processed approximately 391 million transactions in 2021.

The head of MB echoed the sentiment, "This is a significant figure, even for international banks."

Previously, only 65 per cent of financial transactions were conducted via digital channels. However, by the first half of 2022, this number had jumped to 94 per cent. The bank has completely revamped its internal operations, becoming completely paperless and switching all of its transaction processing to digital mediums.

|

| MB has made significant gains in its number of customers |

MB's drive toward digital transformation is the main reason for the bank’s significant increase in its client base. The number of customers using the MBBank app climbed by 3.1 per cent in 2021 compared to the previous year, digital banking transactions increased by 4.3 per cent, and the number of new customers joining MB in a single year was virtually equivalent to that of 26 years before.

The number of users of the MBBank App increased steadily over the first eight months of 2022, jumping by 1.5 times compared to the same period in 2021.

“There are just a few banks that can digitally transform as rapidly as MB," said Pham Tien Dung, deputy governor of the State Bank of Vietnam.

MB's digital transformation efforts have garnered several high-ranking accolades. In October, MB's three award-winning solutions at the Vietnam Digital Awards 2022 outperformed more than a thousand other innovations.

In particular, the charity app App Thien Nguyen was recognised in the category of Products and solutions for the digital transformation of the community, while Wealth Management, a financial investment platform on the MBBank App and BIZ MBBank, a digital banking solution for businesses, were honoured in the category of Prominent products, services, and digital transformation solutions.

The goal of being a top Asian bank

Entering its new strategic period from 2022-2026, MB has established a vision to become a leading digital and financial behemoth and reach the top 3 in the market in terms of efficiency, leading in Asia.

In conjunction with this, the bank has adopted the slogan Digital Acceleration - Customer Attraction - Corporation Synergy - Sustainable Safety as its guiding principle.

Moreover, MB continues to explore and extend partnerships with multinational organisations such as IBM, Prophet, and McKinsey in order to enhance corporate governance, particularly risk and smart financial management.

| MB received Corporate Excellence recognition at the Asia Pacific Enterprise Awards 2022 MB Bank has been recognised at the Asia Pacific Enterprise Awards (APEA) 2022 in the category of Corporate Excellence. This is a testament to MB's recent commitment to sustainable development and the digital revolution. |

| Dragon Capital partners with Digi Invest Powered by MB Dragon Capital has recently teamed up with MB to roll out professional fund management services in a centralised app by MB Bank, which would optimise retail customers’ experience and investment efficiency. |

| MB comes top at Vietnam Digital Transformation Awards 2022 MB's three award-winning solutions at the Vietnam Digital Awards 2022 outperformed more than a thousand other innovations. |

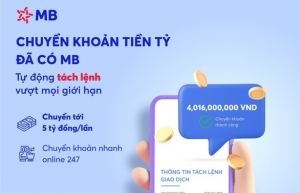

| MBBank App facilitates brand-new Split Order Automatically feature With the fresh release of Split Order Automatically on the MBBank App, customers now have instant, limitless, and always-available online monetary transactions at their disposal. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- PM sets five key tasks to accelerate sci-tech development (February 26, 2026 | 08:00)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Citi report finds global trade transformed by tariffs and AI (February 25, 2026 | 10:49)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

Tag:

Tag:

Mobile Version

Mobile Version