Driving massive business growth through financial sector communication

|

| Nguyen Dieu Cam, general director at T&A Ogilvy and director of Ogilvy Consulting Vietnam |

What role does communication play in building a successful financial brand?

We can all see that competition is fierce within the financial sector in recent years. Various new services are launched to meet the demand of customers, who are getting more and more sophisticated. Financial services are no longer a playground for traditional banking giants but a battlefield for all, with the rapid entrance of newcomers. During only four years, from 2014 to 2018, the number of traditional banks in Vietnam has increased by about 43 per cent, while new financial organisations also made an “explosion” with incredible growth. However, there is no substantial differentiation among their offered products or services, while no banking and finance organisation is powerful enough to dominate the overall market.

This existing landscape results in a more intensive battle for market leaders. In a highly selective and competitive market, companies are looking for ways to differentiate themselves to avoid a race to the bottom. The key lies in communication, a strategic solution for creating a brand that is perceived to be the best and offers more outstanding value than the rest.

Under this intense competition, the quality of financial products/services provided is no longer the only motivation behind the customer's purchasing decision. Recent research has shown that 20 out of 100 customers will register a bank’s service after being exposed to its advertisement. In addition, according to Mibrand’s latest report, three out of four banks with the most effective communication performance has achieved the top spots in business growth ranking in 2018 (Vietcombank: 62 per cent, Vietinbank: 52 per cent, Agribank: 50 per cent). Without a doubt, communication is becoming a “secret weapon” to win the competition of differentiation and business growth in this new era of finance.

How would you assess current brand communication activities in the Vietnamese financial sector?

Communication landscape in this compelling sector is getting more and more diversified across financial institutions. Communication activities are implemented on various platforms, shaping the dynamic transformation within this sector. While card associations such as VISA, MasterCard, or JCB are still loyal to traditional channels (TV, printed and online media), a more modern approach is adopted among emerging banks including TP Bank, MSB, and Techcombank – with the increasing favour towards social media and influencers. However, all of these communication activities are conducted on a seasonal basis, with a lack of strategic direction to connect them all. Instead of scattered marketing tactics, financial brands need a multidimensional and comprehensive approach to drive business growth by communication.

At Ogilvy, we support brand leaders tackle this common issue by an across-all-metrics operating system called OgilvyOS – a step towards establishing strategic communication that starts from the very core of their brand value. With our operating system, we are sitting with our clients to solve their problems together by creating ideas that make brands matter at every level –Platform ideas to make brands matter for years, Program ideas to make brands matter for quarters, and Pulse ideas to make brands matter right now.

Initially, Platform idea is presented to help businesses determine the core values that align with their corporate images for years. From that, communication programmes are utilised to leverage that value on a quarter basis. Last but not least, the best brands at this rapidly changing industry need to capture every pulse, even the tiniest one, throughout the journey of experience; then turn it into something remarkable to their customers. To drive massive growth, brands need “systematic thinking" to pull every growth lever, and OgilvyOS is our offering for that.

|

| The diversity of communication channels allows financial organisations to effectively reach their target customers |

What are the main channels for communication in finance and how do you think this will change?

According to recent reports, TVCremains one of the key communication channels for financial brands. This traditional channel still takes up around one-third of the communication budget of Vietnamese banking giants, namely Vietcombank (29.13 per cent), VietinBank (30.23 per cent), BIDV (29.91 per cent), and Agribank (28.77 per cent). However, in terms of efficiency, emerging communication platforms such as social media and website are increasingly outweighing all conventional channels, as indicated in a recent study from Mibrand. Digital transformation is happening right now, navigating the communication landscape of the financial industry towards change. Financial brands should understand the need for a transformation and get prepared for it.

With the support of augmented reality (AR), one among the unprecedented revolutions of communication in this new era, ZaloPay and its successful Tet campaign –Heo Chieu Tai – earlier this year is indeed a sound example for how financial brands can benefit from utilising digital advancement in communication. Undertaking the mission of achieving more active users and increasing the number of peer-to-peer transactions (or Lixi in Tet context), Ogilvy supported ZaloPay in developing a digital communication campaign with an engaging story and a creative platform. ZaloPay also partnered with VNG to create an interactive game using AR experiences, to bring lucky piggy – the hero of the campaign – to life and have “real" interaction with their users. Developed on the basis of Vietnamese traditional custom, with a little help of innovative technology, the campaign has brought great success in terms of business growth to ZaloPay, with an impressive growth rate of 400 per cent compared to Tet 2018.

|

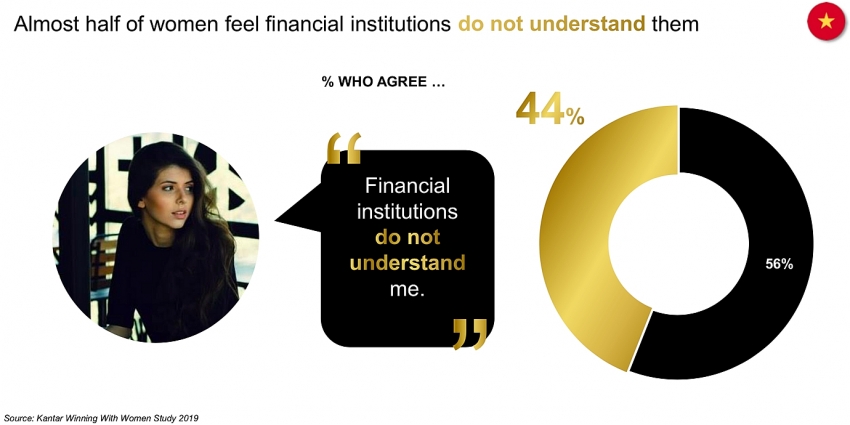

| Statistics show that financial brands are not communicating with women effectively (Source: Kantar Winning With Women Study 2019 |

What population segments are the most susceptible to communications campaigns on financial services?

It seems to be a common belief that men are more financially self-sufficient compared to women and always have the upper hand when it comes to financial matters, which explains why the communication of financial products and services is still male-skewed, despite the fact that women are having an increasingly important role in financial decisions during recent years.

According to Kanter Worldpanel's latest report, approximately 70 per cent of Asian women are fully controlling household finances. The report also shows that the majority of women perceived their knowledge about finance-related matters, from simple to complex categories, on par with men. While having much interest in exploring more financial products/services, women still feel that there is a gap in the way financial brands communicate with them. In short, it can be seen that gender stereotype communication has limited the ability for financial brands to exploit this highly potential segment – women.

Knowing that gender-balanced communication activities drive a far better brand value than male/female skewed ones, automotive brands, which are often perceived to be male-focused, are joining the race of winning women's hearts. The case of Mercedes-Benz and “She's Mercedes” campaign is a great example for that. Empowering the voice of modern women by creating a community hub in which women with different occupations and backgrounds can connect and share their experiences, exchange ideas, learn from one another, and support each other's ambitions, the campaign has done a great job in terms of captivating the deepest desire of women – to be heard, and to be recognised.

Conducted in China, where consumers have not witnessed any automotive brand experience that focuses on women’s values before, the “She's Mercedes" campaign has taken an integrated approach that embedded a mix of communication platforms from digital, KOLs, to interactive displays to deliver the inspiring message in the most comprehensive way to their audience. After the campaign, Mercedes-Benz achieved 75 million on-target reach in outdoor innovative display, 160 millions of interactions in online and offline activities, and became the top choice for female premium-car buyers in China. It is essential for financial brands to also recognise this and transform their communication approach to dive deeper into this potential target segment.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

Tag:

Tag:

Mobile Version

Mobile Version