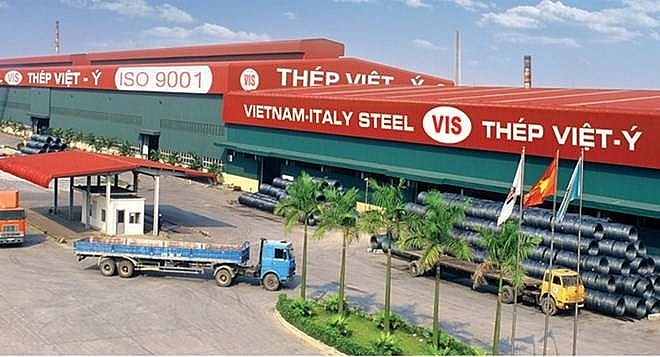

What does Kyoei hope to gain from loss-marking Vietnam Italy Steel?

|

| What does Kyoei hope to gain from loss-marking Vietnam Italy Steel? |

Most recently, Kyoei registered to purchase an additional two million shares of VIS. The transactions are expected to be carried out between July 19 and August 16, 2018.

Once successful, Kyoei will increase its ownership in VIS to 70.42 per cent from the existing 67.7 per cent.

In early July, Kyoei completed the purchase of another two million VIS shares via the put-through method to increase its stake in VIS to the current 67.7 per cent.

Kyoei became the strategic partner of VIS in late 2017 after buying more than 14.7 million shares, or 20 per cent ownership, from previous shareholder of VIS – Thai Hung Company.

In May 2018, the Japanese firm purchased another 33.2 million VIS shares from Thai Hung Company and replaced the latter as the strategic investor of VIS with 65 per cent ownership.

Continuing to purchase more VIS shares shows its ambition to acquire VIS, contributing to growing dominance in Vietnam’s steel manufacturing sector.

However, according to the business statement published by VIS, the firm reported a loss of VND68 billion ($2.94 million) in the second quarter alone.

Besides, VIS reported a decrease of 8 per cent in net revenue to VND1.37 trillion ($59.4 million) and suffered gross loss from the sales sector of VND16.7 billion ($724,455).

According to VIS, the bleak business result can be attributed to the demand for steel from the local market decreasing, causing a decrease in selling price, meanwhile the expenditure for the material sees continuous increase.

In addition, the firm reported a doubling in expenditure for sale to VND5.3 billion ($229,916), and an increase of managing expenditure to VND29.6 billion ($1.28 million). As a result, VIS suffered net loss of VND66.1 billion ($2.86 million) in first six months of this year.

In the second quarter alone, the loss reached VND68 billion ($2.94 million), the largest loss that VIS has experienced in a quarter since the firm listed its shares on the stock exchange.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Vietnam among the world’s top 15 trading nations (January 28, 2026 | 17:12)

- Vietnam accelerates preparations for arbitration centre linked to new financial hub (January 28, 2026 | 17:09)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

- Digital economy takes centre stage in Vietnam’s new growth model (January 28, 2026 | 11:43)

- EU Council president to visit Vietnam amid partnership upgrade (January 28, 2026 | 11:00)

- From Vietnam to the world: Pizza 4P’s global journey (January 28, 2026 | 10:58)

- Vietnam entering a new growth phase in 2026 (January 28, 2026 | 10:02)

- SHIFT project launched to steer capital towards green growth (January 28, 2026 | 09:52)

- GEVA a launchpad for Vietnam’s agricultural exports (January 26, 2026 | 12:03)

- France supports Vietnam’s growing role in international arena: French Ambassador (January 25, 2026 | 10:11)

Mobile Version

Mobile Version