Vietnam’s impressive vision for a cleaner energy future

Vietnam’s energy strategy, as found in its Power Development Plan VIII (PDP8), is perhaps the most important document guiding long-term capacity planning of the power sector. It serves as an anchor document, mapping out the trajectory of the nation’s energy development.

|

| Mishra Kumar Sameer, director of Deals Advisory for KPMG in Vietnam |

PDP8 serves as a north star guiding the expansion and modernisation of the country’s electricity generation, transmission, and distribution infrastructure to effectively meet growing energy demand and the supporting socioeconomic development of the country. It symbolises the strategic vision and the aspiration of the nation to attain carbon neutrality in the coming decades.

Under PDP8, there is a significant emphasis on boosting power generation capacity, catering to the nation’s planned economic expansion and population growth. Vietnam is one of the most energy-intensive economies in the region, and energy consumption must rise by 1.3 per cent to achieve one per cent change in national GDP.

The strategy highlights the strategic vision of the government to achieve decarbonisation of the electricity sector. It also underscores the significance of grid modernisation, advocating for the integration of smart technologies and the incorporation of distributed energy resources.

These enhancements are poised to elevate grid stability, minimise losses, and enhance resilience, facilitating greater integration of variable renewable energy in the grid.

In essence, PDP8 encapsulates Vietnam’s strategic course towards a robust and diversified energy landscape. The plan aligns national priorities and international commitments with responsible power sector development, aiming for the equitable socioeconomic development of the country.

Deconstructing PDP8

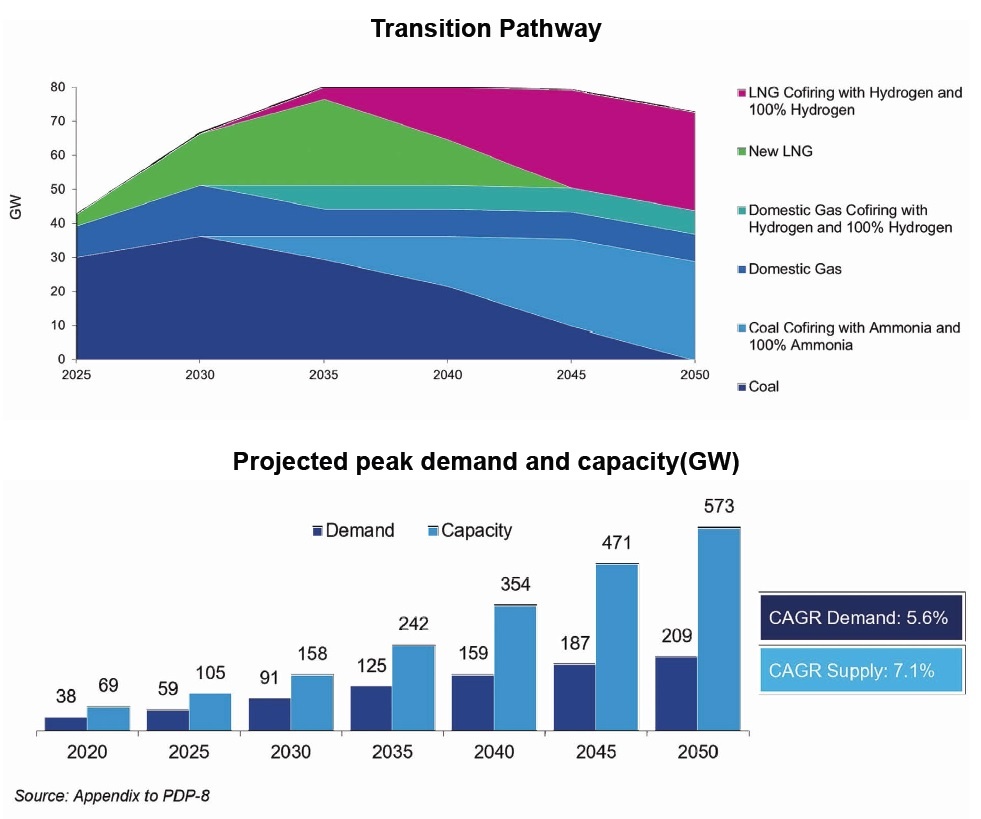

Under the plan, Vietnam’s power generation capacity is expected to more than double to over 158GW by 2030 from 69GW at the end of 2020. Power plants using domestic gas and imported liquefied natural gas (LNG) will account for 37GW, and wind capacity is expected to reach 28GW by 2030, including 6GW of offshore wind.

LNG is largely positioned as a transition fuel until there are affordable base load clean energy options available. The focus of capacity planning is primarily towards development of onshore and offshore wind and associated grid infrastructure.

For 2020-2030, the estimated capital requirement for the development of power sources and transmission grids is estimated at nearly $135 billion. Of which, $120 billion is required for development of power generation sources and around $15 billion is allocated towards development and strengthening of the transmission grid.

PDP8 envisages that overall generation capacity shall reach 573GW by 2050 with renewable energy comprising around 70-80 per cent of the total capacity. To put things into perspective, it envisages around an eight-fold increase in total installed capacity over the next 30 years. The total capital requirement for developing the generation resources and associated infrastructure to achieve carbon neutrality by 2050 is pegged at $658 billion.

While the plan lays out a well-thought-out strategic vision for Vietnam’s energy sector, it’s not without its share of challenges and considerations that demand attention.

|

Three key factors

The first consideration involves a robust commercial or market framework. The capital requirement to realise the capacity addition is huge, $135 billion, over the next 10 years. Vietnam is a developing economy, which has modest access to capital. The capital available to the state has often competing priorities, the state alone cannot contribute to any meaningful capital requirements for the capacity additions envisaged in PDP8.

The participation of the private sector shall be crucial in developing new greenfield capacities. Vietnam has had tremendous success in scaling up renewable generation in the past on the back of a rich feed-in tariff regime. The private sector was at the forefront in developing these renewable capacities.

The planned capacity addition in PDP8 and the corresponding fund requirement are multiples of what has been done in the past. Therefore, in addition to expanding private sector participation, unlocking offshore debt financing shall be critical for turning the plan into reality.

Given Vietnam’s track record of rapidly deploying renewable capacities at scale and the relative market maturity, there is a rightful expectation of optimising the future procurement cost of electricity.

A transparent framework for allocation of projects to investors, a balanced commercial framework for procurement of power and conducive regulations permitting flexibility of financial structuring shall be critical in attracting the right kind of capital to deliver planned capacity addition at an optimal cost to consumers.

The second consideration is leveraging offshore wind potential. The potential of offshore wind in Vietnam is estimated at 600GW. PDP8 envisages setting up 6GW of offshore wind capacity by 2030. The size and scope of offshore wind projects are materially different from that of other clean energy projects developed in the country so far. Developing offshore wind projects is a multibillion-dollar enterprise. Offshore wind projects have a significantly different risk profile as compared to onshore projects.

Attracting capital for offshore wind projects will require a curated commercial construct that is aligned with the risk reward realities of the sector. An objective and streamlined approval process shall be crucial in fostering investor confidence to deploy capital at the scale required for development of the sector.

The final consideration involves strengthening grid infrastructure. The rapid expansion of generation capacity in the past has not been met with a commensurate increase in evacuation capacity or investments in grid infrastructure, resulting in difficulties in integrating the increasing share of renewable energy in the grid.

Addressing the grid’s infrastructure challenge remains a cornerstone of Vietnam’s energy strategy. Substantial investments have been directed towards reinforcing transmission and distribution networks, enhancing interregional power connections, and bolstering energy transfer across the regions.

The issue of curtailment faced by Vietnam is not unique. Every major world economy, both developed and developing, has faced this challenge while integrating an increasing share of variable renewable energy within the grid. The average curtailment of renewable energy in China was 16 per cent in 2011. With massive investments in the grid and improvements in system planning, China was able to bring the curtailment of variable renewable energy down to 3 per cent in 2022.

Curtailment has the potential to become a key impediment in growth of renewable energy, and thus will require urgent intervention. It is an issue that cannot be solved by creating physical infrastructure alone; resolving curtailment will require a multipronged approach.

In addition to investments in the grid, resolving curtailment will need the developing of a robust system planning framework for permitting the future development of generation projects, developing regulation around demand side management and ancillary services to enhance grid resilience, as well as tweaking market design and technical regulations for creating adequate flexibility in the network facilitating enhanced variable renewable energy integration to the grid.

Vietnam has an incredible track record of delivering energy transition at scale. With the right policy prescriptions, curated risk reward frameworks and directed investments, the country has the potential to become as a trailblazer in Southeast Asia’s energy transformation journey.

| LNG conversion strategy ramps up to ensure power sources for Vietnam The plan to develop 22GW of liquefied natural gas-to-power projects, along with the government’s commitment to reduce emissions, is creating vast opportunities for Vietnam’s thermal power developers to make an energy transition and gradually phase out coal. |

| Vietnam to introduce criteria for national green development Vietnam is soon to introduce a new set of national criteria aimed specifically at speeding the development of green industries in line with international standards, according to the Ministry of Planning and Investment (MPI). |

| Poor progress made in Vietnam's power sector Vietnam's power landscape has seen a flurry of investment proposals, but on-the-ground progress hasn't met expectations. This underscores the crucial challenge of delivering consistent, reasonably priced electricity. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- KPMG launches tariff modeller in Vietnam to navigate US tariff risks (July 29, 2025 | 12:11)

- Removing hidden barriers to unlock ASEAN trade (June 29, 2025 | 11:31)

- New report charts path for Vietnam’s clinical trial growth (May 21, 2025 | 08:58)

- TTC Agris strengthens market position with investment in Bien Hoa Consumer JSC (May 19, 2025 | 10:14)

- World Bank to help SBV build shared database for banking industry (April 09, 2025 | 08:55)

- New trade alliances and investment hubs are redefining global power dynamics (April 03, 2025 | 17:00)

- ACCA and KPMG forge path for business leaders to pioneer ESG excellence (March 07, 2025 | 10:09)

- VietBank signs MoU with KPMG (February 26, 2025 | 18:47)

- Warrick Cleine MBE: an honour for services to British trade and investment in Vietnam (December 31, 2024 | 20:16)

- KPMG report offers fresh insight into leveraging AI (December 24, 2024 | 09:23)

Tag:

Tag:

Mobile Version

Mobile Version