US dollar to strengthen further following tariffs escalation: UOB

|

| UOB forecasts foreign exchange, and interest rates |

Going forward, UOB reported that financial markets and global investors will likely need to live with the constant threat of tariffs and last-minute brinksmanship negotiations in the months ahead. Such uncertainty and intra-day whipsaw are likely to be the new normal, and it begs whether financial markets have priced in the ongoing tariff threats in the form of a Tariff Risk Premium.

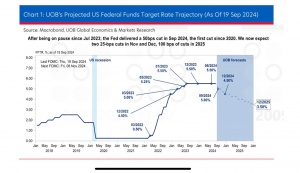

The immediate consequence of this increasing Tariff Risk Premium is the renewed rise in inflation expectations for the US. As a result, Fed Fund Futures have started to fade expectations of further rate cuts going forward, with various Federal Reserve officials now reiterating the prudent “wait and see” stance for now.

UOB said the US dollar was the key beneficiary of this Tariff Risk Premium and the accompanying renewed rise in US inflation expectations. In particular, two-year US inflation expectation has doubled from 1.5 per cent last November to the current level of about 3 per cent.

Overall, the US dollar index (DXY) has now risen about 9 per cent from its low of 100 before the US President election last November to its current level of about 109. UOB's base case assumes that by 3Q25, DXY will rise further towards 112.6 by 2Q25 accompanied by EUR/USD falling below parity and USD/CNY rising to 7.65 by 3Q25.

In a pessimistic case scenario of UOB, the risk is that DXY will jump to 115 and USD/CNY may well rally towards 8.0.

"It would not be prudent to fight this trend of US dollar strength, at least until later this year when we can have a better gauge of the breath and scope of the tariffs and the corresponding impact on the US economy," UOB said.

The US dollar pulled back for the first time in four months in January as President Trump stopped short of swift tariff action after he was sworn in on January 20. As markets previously bought up the US dollar anticipating day-one tariff action against key trade partners such as Canada, Mexico and China, the reprieve spurred some profit-taking in the DXY which had risen to two-year highs in early January.

The brief calm in financial markets was shattered when President Trump signed off the first tariffs in his new term against Mexico, Canada and China on 1 February, before agreeing to delay tariffs on Mexico and Canada by one month.

"However, currently, it appears that additional tariffs against China are proceeding, with China responding in kind. How do we navigate through this fluid tariff war? And will the US dollar strengthen further after stabilising in Jan?" UOB said in a press release

There was some reprieve for the VND in January, as the US did not impose the much-feared day-one Trump tariffs on China. Consequently, the USD/VND pulled back from its record high near 25,500 to about 25,100 across January. The brief calm was punctured after the US announced tariffs against Mexico, Canada and China in early February, sending the USD/VND back higher towards 25,300.

A more cautious Federal Reserve when it comes to rate cuts in 2025, tariffs, and China uncertainties will likely keep the USD/VND anchored to the upside. Overall, UOB's updated USD/VND forecasts are 25,600 in Q1 this year, 25,800 in Q2, 26,000 in Q3 and 25,800 in Q4.

| 'A good strong start' to Fed’s rate cut cycle The bumper 50 basis points (bps) interest rate cut announced by the US Federal Reserve at its September meeting may increase the likelihood and pressures of the State Bank of Vietnam (SBV) considering similar policy easing. |

| Economy on track to end year on upbeat note: UOB UOB (United Overseas Bank) maintains Vietnam’s full year growth forecast at 6.4 per cent, which implies 5.2 per cent on year in the fourth quarter. |

| US dollar dominance not under threat, despite risks: Fed official The status of the US dollar as the world's reserve currency is likely to continue, despite threats posed by China's rise and the growth of cryptocurrencies, a US Federal Reserve official said Thursday. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

- IFC to grant $150 million loan package for VPBank (February 13, 2026 | 09:00)

- Nam A Bank forms position as strategic member at VIFC through three key partnerships (February 12, 2026 | 16:39)

- Banks bolster risk buffers to safeguard asset quality amid credit expansion (February 12, 2026 | 11:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

Tag:

Tag:

Mobile Version

Mobile Version