Time to seize opportunity for FIE growth in Vietnam

At last week’s conference on foreign-invested enterprises (FIEs) in Hanoi, a number of associations and businesses claimed that the approval process for investment initiatives was too complicated, hindering project progress and affecting the country’s competitiveness.

|

| Representatives of businesses and organisations heard highlights of potential reform proposals, Photo: Le Toan |

John Rockhold, chairman of the American Chamber of Commerce (AmCham) in Hanoi said, “Vietnam should focus on such priorities as removing bottlenecks in business; addressing energy development; ensuring access in the health industry; unlocking the digital economy; upgrading from frontier to emerging market status; and promoting sustainable investment and supply chain integration.”

“With the recent relationship upgrade, this is a critical time and wonderful opportunity to work on how to also upgrade the policy framework and economic environment to attract new players and help current investors and businesses grow,” he added.

Rockhold pointed out some ways to improve the business climate overall and appreciated Vietnam’s efforts to streamline administrative procedures.

“Our members – like most businesses here today – face regular delays in approval procedures and time-consuming administrative burdens which hinder or stall their projects and impact Vietnam’s competitiveness,” he said.

AmCham, according to Rockhold, will continue to work with the government to identify and remove these bottlenecks and help work towards a regulatory environment that meets global standards.

“We encourage the government to clarify those elements of Vietnamese law that obstruct the efficient deployment of foreign investment and that any additional administrative burdens in draft regulations be carefully considered and avoided whenever possible,” he said.

Tackling issues appropriately

Gaur Dattatreya, managing director of Bosch Global Software Technologies, highlighted the importance of a stable, predictable, and favourable business environment.

“We appreciate the government’s persistent endeavours in improving the local business environment; notably in streamlining the administrative procedure and removing regulatory hurdles,” he said.

“Nevertheless, the evolving nature of regulatory regimes in Vietnam, combined with overlapping jurisdictions among government ministries, can, unfortunately, result in a lack of transparency, uniformity, and consistency in government policies and decisions,” he added.

As a long-term investor, Bosch is looking forward to working with the Vietnamese government to identify and tackle those issues thoroughly, Dattatreya said.

David Whitehead, vice chairman of the Australian Chamber of Commerce in Vietnam, agreed that to create a favourable business environment, Vietnam should make overall adjustments to licensing procedures.

“Regulations on land use, tax incentives, and work permit issuance need to be clearly stipulated, eliminating unnecessary procedures and conditions. This will mobilise large-scale foreign direct investment (FDI) into Vietnam, especially in industries like semiconductors,” he said.

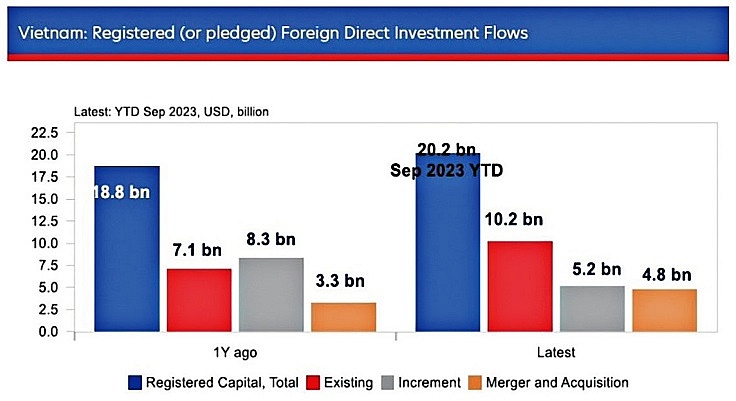

Amid a complex global situation, the Vietnamese economy is maintaining stability and growth. In January-September 20, the country drew $20.21 billion of registered FDI, up 7.7 per cent on-year, while $15.91 billion was disbursed, representing an on-year rise of 2.2 per cent.

Cumulatively as of the end of last month, 144 countries and territories had invested in Vietnam and pumped in over $455 billion, generating jobs for millions of workers, according to the Ministry of Planning and Investment (MPI).

Deputy Minister of Planning and Investment Nguyen Thi Bich Ngoc said that Vietnam had become the third-largest economy in ASEAN with a GDP of over $400 billion. “The business community appreciates the nation’s growth prospect, investment environment, and position. Many foreign economic groups believe that Vietnam has opportunities to become a key destination in global supply chains,” Ngoc said.

The cooperation and companion of FIEs with the government, ministries, relevant state management agencies, localities, and businesses are needed to realise opportunities. “Vietnamese authorities will continue accompanying enterprises to access markets, boost exports and local sales, reform administrative procedures, and improve the investment environment to draw in FDI,” she said.

Minister of Labour, Invalids, and Social Affairs Dao Ngoc Dung said the country would amend the decree on management and use of foreign human resources in Vietnam. Some new content has been set out, such as loosening conditions and criteria for experts, managers, and technical workers to enter Vietnam as much as possible.

“Work permits for CEOs, heads of departments, and divisions will be granted effortlessly and quickly. If they were granted previously, and then moved from an expert to a technical worker, there is no need to reissue. The time for submitting a statement of need is also being reduced from 30 to a maximum of 15 days, and most procedures are carried out online,” Dung said.

Deputy Minister of Natural Resources and Environment Le Minh Ngan highlighted some reforms to create better conditions for investors in leasing and using the land.

“For example, in the revised draft Land Law, when the land use term expires, investors can continue to use it in line with the planning purposes. This will reinforce the trust and confidence of investors to make long-term investments in the country,” Ngan said.

Companionship and development

Nakajima Takeo, chief representative of the Japan External Trade Organization in Hanoi, said that Vietnam was an attractive destination for global FDI inflows.

“Vietnam has been Japan’s second-largest FDI destination for six consecutive years. Some economists predict that the economic year 2024 will continue to decline. However, I think that Vietnam will continue to grow strongly,” Takeo said.

Vietnam should focus on manufacturing and innovation to become more prosperous and deal with some difficult situations, Takeo said, and the IT industry will lead the development of the Vietnamese economy.

“We would like to cooperate more closely with the MPI and the Ministry of Industry and Trade to make stronger changes in education, healthcare, and finance, cutting legal barriers to create a stronger and more favourable framework for investors,” he added. “This is not an easy task for any country, but I believe Vietnam will become one of the most attractive countries in the digital space.”

Josh Williams, chief representative of the UK-based private multinational Swire Group in Vietnam, said Vietnam is among its priority markets in the region thanks to its impressive track record of economic development and government policies that support business and foreign investment in Vietnam, among other things.

“We appreciate the support for our business activities from the Vietnamese government in general. We are optimistic about Vietnam’s future development, and we are actively exploring opportunities to expand our investments in Vietnam in our core business lines. We look forward to receiving the government’s continuing support in the years ahead,” Williams said.

Earlier this year, Swire Group completed its acquisition of the Coca-Cola bottling subsidiary in Vietnam, significantly expanding Swire’s presence up and down the country.

|

| Pham Minh Chinh, Prime Minister

Vietnam maintains three commitments to foreign investors. We protect the legal and legitimate rights and interests of investors in every case. The government accompanies foreign-invested enterprises (FIEs) to overcome problems, utilise opportunities and advantages so that they can ensure long-term benefits and stable operations in the country on the principle of sharing benefits, and risks. And we do not criminalise economic and civil relations, but still handle those who violate the law. We aim to create an open and transparent production and business environment, For all FIEs, we suggest building long-term and sustainable development strategies in accordance with the master plans of Vietnam, proactively innovating production and business models, and restructuring businesses in association with the green economy, digital economy, circular economy, knowledge economy. These plans are issued with strategic thinking, long-term vision, and promoting potential, while creating a development space for investors, and appropriate investor strategies. FIEs should implement a strong entrepreneurial culture, and welfare policies for employees for the benefit of businesses, investors, and contributions to Vietnam. Business associations need to perform their functions and tasks well; promptly inform and report on problems; as well as recommend and propose appropriate policies and requirements. Enterprises should improve the localisation rate, develop the supply chain with the participation of Vietnamese businesses, improve human resources training, invest in infrastructure, and contribute to perfecting institutions, while creating a strong corporate governance culture. I hope and believe that foreign investors will continue to trust and cooperate closely, and love Vietnam as their homeland. FIEs should implement all their promises, and commitments, and generate practical and measurable effectiveness, which will be shared with all stakeholders like businesses, the state, and local people so that no-one is left behind. |

| Ng Boon Teck, Representative, Singapore Business Association in Vietnam

Vietnam should strengthen connectivity with regional countries, become a central partner in transport between China and ASEAN member states, and facilitate transport in border areas. Thereby, two initiatives have been accelerated. The ASEAN Smart Logistics Network is a collaborative platform that aims to promote smart and sustainable logistics interconnectivity and integration within the bloc in line with ASEAN’s Connectivity Master Plan 2025, where member states have a shared goal of developing smart logistics infrastructure. Smart Growth Connect is ASEAN-BAC’s fifth legacy project launched in 2018 and aims to help create smart growth centres in each member state with advanced and smart supply chain tech, human capital talent development, and thought leadership to optimise resource productivity and efficiency. Additionally, we have Vietnam SuperPort, a strategic location in the northern province of Vinh Phuc over a huge area and connecting to Hanoi, Noi Bai International Airport, Haiphong Port, and border provinces. We would like to combine the developed logistics infrastructure system to turn this place into a transit area to reduce costs as much as possible. Singaporean businesses have many ambitions to build a logistics system as simple and modern as possible, connecting roads, information, and the economy. We will deliver new smart technologies and share how to optimise and further strengthen the industry. There are specific things that Vietnam can deploy, including promoting more trade flows with neighbouring countries, and reaffirming its central role and promotion of traffic among border provinces and between China and ASEAN. So we should look more closely at the process of implementing the single-window mechanism, so that the customs clearance process becomes simpler. Tadahiro Kinoshita, Chairman Japanese Chamber of Commerce and Industry in Vietnam

Japanese companies have attracted many supporting industries from overseas. However, local suppliers have yet to fully take part in the Japanese supply chain. A Japan External Trade Organization report notes that the local content ratio of Japanese companies expanded to 37 per cent last year, but this figure is far behind from other neighbouring countries. Only 16 per cent of goods and materials are procured from local firms, while 84 per cent are covered by FIEs or imported from overseas. The survey shows the top three challenges for local businesses in Vietnam are insufficient quality and technical capabilities of suppliers; lack of raw materials; and insufficient parts being available. So almost all Japanese manufacturers are eager to expand procurement from local companies. We offer three suggestions for supporting industries: identify strong local companies and connect them to foreign-led manufacturers; expand the pool of competent local companies; and make small- and medium-sized enterprises (SMEs) take support measures to be more accessible to local companies. Through business interaction with foreign companies, we believe local companies can achieve foreign-led manufacturers’ standards. The more the government supports SMEs in developing sales channels, the more promising that local companies can take part in the foreign investment supply chain, improving their capabilities. Secondly, we value industrial policies to encourage entrepreneurs and foster startups. As with Vietnam, Japan has developed its economy from a processing trade model. One of the successful factors is that numerous companies, like Panasonic and Honda, have started up business and improved their quality and technology through tough competition. The more local manufacturers become diversified and sophisticated, the more companies will be able to supply products that meet foreign investment quality standards. The number of suppliers of materials and parts will diversify and, eventually, lead to an increase in the local production ratio. Gaur Dattatreya, Managing director Bosch Global Software Technologies

In April, we celebrated 15 years of our high-tech factory in the southern province of Dong Nai and 10 years of our vocational training initiative. There have now been 10 classes with nearly 250 students enrolled and over 130 graduates, of which 97 per cent continue to work at Bosch. Regarding engineering and IT, in 2022, we initiated the Bosch Embedded Academy that offers 90 training hours at partner universities, focusing on building student’s competence with practical industry knowledge and increasing their readiness for the job market. We plan to keep investing in talents for high-tech areas such as semiconductors and chip design. People are a critical agent of change that facilitate spillovers in technology, innovation, and knowledge from foreign investors to local economic actors. Hence, people are a decisive factor in differentiating countries’ economic prospects. We would recommend the Vietnamese government to proactively take the lead as a system orchestrator between industry, academia, and other stakeholders, to collect and promote best practices and guidelines as well as support initial funding. The relentless government effort in building an ecosystem for innovation with the National Innovation Centre is a great example. Vu Thi Huong Giang, Government and public affairs director Nike Vietnam

Vietnam is Nike’s largest supplier country, and we are proud of our contribution to Vietnam’s employment and export turnover. We are also extremely excited about the Vietnam-US relationship elevation. The United States is the largest export market for Vietnam’s footwear and garment industry, so we hope the bilateral relationship will create a premise to enhance export opportunities to the US if the two sides have bilateral agreements on tariffs. We hope Vietnam will continue to utilise its negotiation experience in the process of opening its market to the US and other countries to promote important export markets for Vietnamese goods. To push ahead with growth in Vietnam, we hope it highlights sustainability as a top priority, which is no longer a beautiful slogan but has become the business foundation of all businesses. We are pleased to see that the government is actively discussing a direct power purchase programme and the factories in our supply chain will soon have access to more electricity from renewable energy. This will create a new competitive advantage for goods produced in Vietnam. As Vietnam’s economy hopes to grow rapidly ahead, the way we produce changes every day. Footwear and garment factories are constantly innovating technology and investing in human resources to match those changes. So we also look forward to the government as it seeks to invest much more in education and training, especially the skills the workforce needs to be competitive in the economy. |

| Import-export turnover of FIEs drops by $9 billion The import-export turnover of foreign-invested enterprises (FIEs) dropped by $9 billion in the first two months. |

| Widescale renovations needed for FIEs to thrive in Dong Nai Unfinished roads for industrial parks, dust pollution from airport construction, and lack of housing for on-site workers are just some of the difficulties facing foreign-invested enterprises in southern province of Dong Nai. |

| Fire safety regulation frustration lingers for FIEs Many foreign-invested enterprises are confused with the inconsistent regulations relating to fire prevention and safety, which may impact their factories’ construction and operation processes. |

| FIEs remain reluctant to take on stock listing Despite the substantial contribution of foreign direct investment to Vietnam’s overall economy, the presence of foreign-led groups in the stock market remains disproportionately meagre and fails to reflect its true significance, experts point out. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Pegasus Tech Ventures steps up Vietnam focus (February 05, 2026 | 17:25)

- The generics industry: unlocking new growth drivers (February 04, 2026 | 17:39)

- Vietnam ready to increase purchases of US goods (February 04, 2026 | 15:55)

- Steel industry faces challenges in 2026 (February 03, 2026 | 17:20)

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

Tag:

Tag:

Mobile Version

Mobile Version