Shell wants to become LNG supplier for PetroVietnam

|

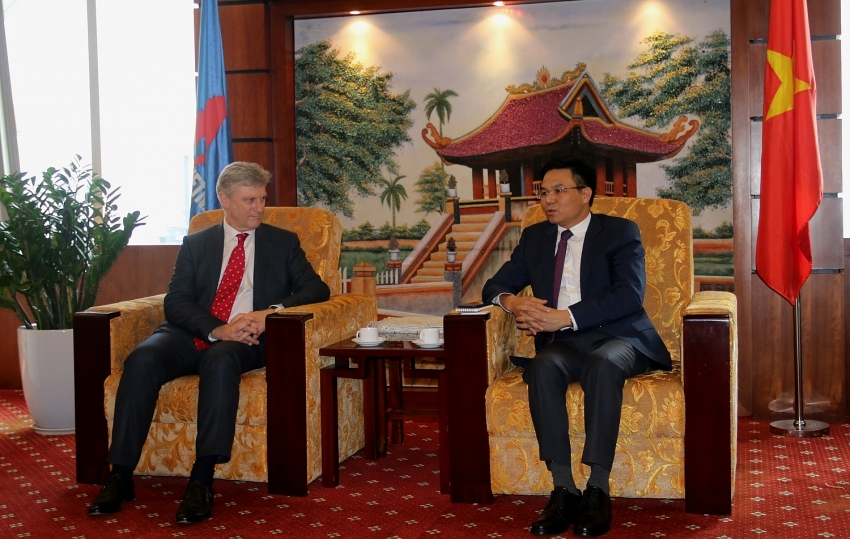

| Le Manh Hung, deputy general director of PetroVietnam, and Douglas Buckley, Shell deputy chairman, dicussing bilateral co-operation opportunities |

Responding to the proposal of Shell, Le Manh Hung, deputy general director of PetroVietnam, said that it is looking for LNG supplier for the Thi Vai LNG terminal in the southern province of Ba Ria-Vung Tau. Regarding the Son My LNG terminal in the central province of Binh Thuan, PetroVietnam is waiting for the Ministry of Industry and Trade’s approval for the project’s feasibility study.

Hung proposed Shell to work with PV Gas – the investor of Thi Vai LNG – to discuss the co-operation between the two parties.

Previously, in October 2012, Shell pulled its LPG business out of Vietnam after having transferred its entire share in a joint-venture in Haiphong, and a wholly-owned Ho Chi Minh City-based company to Thailand’s Siam Gas Co.

At the time, Shell Gas Vietnam said in a statement sent to its dealers nationwide that the stake transfer is in line with Shell’s business strategy, which is focusing on fewer markets but at a larger scale.

Regarding the intention to join PV Oil, Shell deputy chairman Douglas Buckley said that the company wants to buy the stake that PetroVietnam will divest from PV Oil. The company also wants to know the criteria of selecting a strategic investor for PV Oil.

Previously, in the middle of the year, Shell submitted the dossier to join the race to become the strategic investor of PV Oil. According to Decision No.1979/QD-TTg, PV Oil had to complete the sale of shares to strategic investors within three months after its equitisation plan was approved.

However, at the time, Cao Hoai Duong, general director of PV Oil, stated that this time the company issued stricter criteria for strategic investors, thus, it might be necessary to extend the deadline so that interested investors have time to negotiate.

PV Oil requested the Ministry of Industry and Trade and the prime minister to extend the deadline to early July, which was promptly refused. As a result, Shell and other interested companies lost the opportunity at strategic stake in PV Oil.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Tag:

Tag:

Mobile Version

Mobile Version