Several sectors expect to miss 2023 targets

Export revenue from the sector in the final two months is expected to be $2.5-$2.7 billion, bringing the total export value of this sector for the year to around $13.5 billion, far short of the full-year set target of $17.5 billion.

The sector generated $16.5 billion in total export value in 2022.

This has come amid reduced purchasing power in major export markets such as the US and EU, while in the domestic market, consumption has stood at a standstill due to a stagnant real estate market and a shortage of new developments.

|

In the same 10-month period, footwear exports stood at $16 billion, down $4 billion or just over 20 per cent on-year.

Businesses in the sector have estimated that even in the best-case scenario, footwear exports could reach $19 billion for the whole year, representing a decline of $4 billion compared to 2022.

| Based on current projections, handset exports will be nearly certain to fall short of the $58 billion record set last year. |

The total export value of phone handsets and associated devices for the 10-month period came to $44 billion, down over $6.3 billion on-year.

Based on current projections, handset exports will be nearly certain to fall short of the $58 billion record set last year.

The Association of Seafood Producers and Exporters forecast the country’s total seafood exports to amount to just $9 billion in 2023, down 17 per cent on-year.

As for the garments and textiles industry, coming into 2023, state-owned Vietnam National Textile and Garment Group (Vinatex) had already anticipated a troubling year, with a 50 per cent reduction in pre-tax profit projections compared to 2022, falling to $25.7 million, while its revenue target was set 11 per cent lower at $738.4 million.

Even still, the first nine months of this year saw Vinatex achieve just 40 per cent of its full-year profit target, and 71 per cent of its full-year revenue target.

As a result, in early November, Vinatex shareholders approved a scaling down of its full-year business targets, with consolidated revenue dropping 6 per cent to $696 million, and pre-tax profit shedding 39 per cent to just $15.6 million.

Do Thang Hai, Deputy Minister of Industry and Trade said, "Production output often far exceeds domestic market requirements, particularly for sectors such as garments and textiles, footwear, and electronics where up to 90 per cent of production is for export."

"So, when the global markets are experiencing a slowdown, this can have a severe and immediate impact on Vietnam's production and export activities," added Hai.

| Order reductions continue to hinder various sectors Vietnam’s industrial performance faces a reduction in export demand and other hurdles that are undermining the country’s economic outlook. |

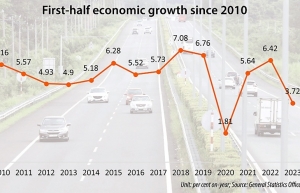

| Key sectors witness rise in performance Domestic industrial production has been gradually escaping the slowdown, with economic growth bouncing back over the past six months on the back of government efforts. |

| Textile apparel sector losing advantage in price competition Many producers in the textile apparel sector are on tenterhooks as export orders are increasingly shifting to other countries like Bangladesh or India for more favourable pricing. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

Tag:

Tag:

Mobile Version

Mobile Version