Seaport ambitions fail to hold water

|

| Seaport ambitions fail to hold water |

Nguyen Canh Tinh, CEO of Vietnam Maritime Corporation (VIMC), told VIR that VIMC is one of the logistics companies that have been hit the hardest by the ongoing health crisis. “Our seaports, logistics, and shipping business lines suffered in the first quarter of 2020, including our joint venture (JV) seaports due to interruptions in global trade links.”

Total container throughput shipped via Cai Mep International Terminal (CMIT) reached 414,000 twenty-foot equivalent units between January and March, leading to a total revenue of VND281 billion ($12 million) and a loss of VND1.4 billion ($61,000). The seaport, a JV between VIMC and Denmark’s APM Terminals in the southern province of Ba Ria-Vung Tau, saw its overall financial performance drop by 1 per cent on-year.

Similarly, the Cai Lan International Container Terminal (CICT), a JV between US-based Carrix and VIMC, saw an on-year fall of 85 per cent in container throughput during the same period, thus incurring a loss of around VND110 billion ($4.75 million).

Targets reachable?

With these drastic losses, CICT is VIMC’s worst-performing JV seaport. After reporting small improvements in 2018, the port witnessed a 47 per cent on-year drop in container throughput in 2019, resulting in 17 per cent less profit. The seaport is even forecast to face more difficulties in the coming months when more terminals are being put into operation at Lach Huyen International Seaport in the northern port city of Haiphong.

Meanwhile, this year’s first quarter was not rosy for SP-PSA, a joint venture between VIMC and Singapore-based PSA in the Cai Mep-Thi Vai area, which lost about VND50 billion ($2.15 million).

SP-PSA reported no container throughput, while its volume of goods in bulk fell 15 per cent on-year to around 710,00 tonnes. As a result, this JV recorded a revenue of VND36.3 billion ($1.6 million), equal to a mere 88 per cent of the same period last year.

Despite these losses, JV seaports somewhat improved during the first quarter of 2020. These improvements, however, are not ample enough to help them cover the huge losses incurred in the past and during the ongoing pandemic.

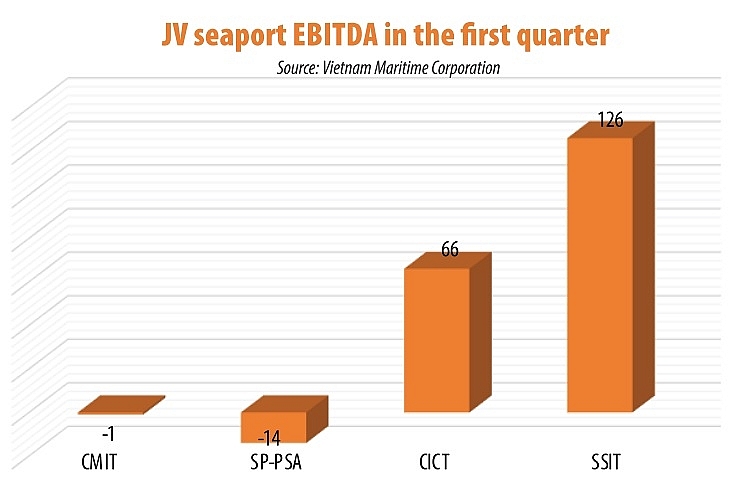

As shown in VIMC statistics, CMIT’s container throughput rose 8 per cent, while revenue went up 2 per cent. Also, CICT reported a 66 per cent on-year rise in the volume of goods in bulk and 66 per cent in its earnings before interest, tax, depreciation, and amortisation (EBITDA). With these figures, CMIT remains the most profitable JV for VMIC.

Meanwhile, SSIT – another JV between VIMC and SSA Marine in the Cai Mep-Thi Vai area – saw its volume of goods in bulk climb by 1 per cent on-year, while its revenue soared 49 per cent on-year.

“In 2019, VIMC’s total volume of goods shipped via its seaports reached over 106 million tonnes, up nearly 7 per cent on-year. This year, we aim to increase the figure to around 108 million tonnes. However, if the pandemic continues to spread, we will have to readjust our target,” Tinh of VIMC noted.

Promising divestment

Although CICT performed better this period, it had trouble attracting cargo for the following years. Therefore, VIMC still wants to offload its share in this JV.

“With mounting competition from Lach Huyen International Seaport, in the long term, CICT will be less competitive in both container throughput and goods in bulk. Possibly, we plan to divest our controlling stake,” Tinh elaborated.

This is good news for Carrix, SSA Marine, and other domestic and international investors who are eager to expand to and in Vietnam, where seaports attract the most foreign direct investment in the transport sector, thanks to the ability to control revenue sources, and favourable links to global supply chains.

Carrix, SSA Marine, and other players once showed their strong interest in buying stakes in the JV seaports when VIMC several years ago planned to divest state stakes in CICT and SSIT. Singapore-invested SP-PSA also wanted to raise stakes in VIMC while SSA Marine offered to buy VIMC’s entire stake in CICT. Their interest was damaged as the state-owned giant stopped the plan.

Industry insiders said that VIMC, which has stakes in 14 port companies and operates over 13,000 metres of piers with a total capacity of 75 million tonnes a year, is a springboard for international groups to venture further into the lucrative market amid growing trade.

Le Duc Khanh, director of market strategy department at PetroVietnam Securities, told VIR, “VIMC’s state stake divestment will be attractive to foreign partners, especially to those that are partnering in JV seaports. This is possibly successful as mergers and acquisitions are increasingly more attractive.”

According to the Ministry of Planning and Investment, such deals among foreign-invested enterprises rose 33 per cent in the first four months of 2020. Remarkably, the number of related deals among the US and EU partners grew significantly during the period, with those from the US climbing by nine times. Consultancy firms forecast that the trend will continue further, and seaports will benefit on the back of bilateral trade driven by the landmark EU-Vietnam Free Trade Agreement.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- The generics industry: unlocking new growth drivers (February 04, 2026 | 17:39)

- Vietnam ready to increase purchases of US goods (February 04, 2026 | 15:55)

- Steel industry faces challenges in 2026 (February 03, 2026 | 17:20)

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

Mobile Version

Mobile Version