Reimagining ASEAN's economy from the pandemic

|

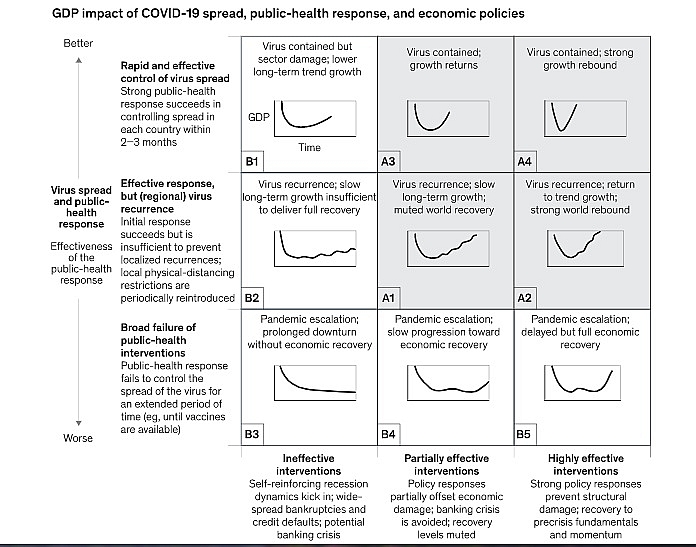

| Scenarios for the economy impacts of the COVID-19 crisis |

Also in the framework of the Vietnam Venture Summit 2020 (which will take place next week, on Wednesday, November 25 in Hanoi), the pre-event webinar named "Reimagining ASEAN's economy from the pandemic" took place on November 18 with the participation of experts in various countries like Bruce Delteil from McKinsey & Company, Dong Jun Im from Hanwha Life Vietnam, Jefrey Joe from Alpha JWC, Thieu Phuong Nam from Qualcomm Vietnam, Laos, Cambodia, Steven Okun from APAC Advisors, and Thiam Hee Ng from ADB.

Most experts said that no nation has escaped widespread disruption from COVID-19. While the pandemic has affected nearly every country, its timing, the degree of disruption, and the ability of countries to respond have varied significantly.

Larger, developed nations have generally had the resources and infrastructure to weather the pandemic and provide a solid foundation for recovery. Less-developed countries, including emerging ASEAN (Indonesia, Malaysia, the Philippines, Thailand, and Vietnam) began the crisis at a disadvantage, and COVID-19 exposed and often heightened their challenges.

McKinsey's research on emerging ASEAN countries explored a series of trends that the pandemic has caused or accelerated. Within these trends lie the potential recipe for recovery but stakeholders must be prepared to reimagine their country’s economy. Five key levers – manufacturing hubs, green infrastructure, investments in digital, talent reskilling, and high-value food industries – could not only speed up the economic recovery in these countries but also lay the foundation for extended growth.

Bruce Delteil from McKinsey & Company shared some potential economic outlook scenarios that reflected the effectiveness of virus containment and economic response. A survey of 100 ASEAN executives found that 40 per cent of respondents favoured the A1 scenario, in which economic interventions would be effective in shoring up essential consumption but a recurrence of the virus was likely, leading to the second round of lockdowns. 18 per cent of executives agreed with the A3 scenario, where initial measures would contain the virus and prevent repeated lockdowns. These results were in line with a larger survey of 2,500 global executives.

Under the A1 scenario, the global economy’s growth rate would be -11.1 per cent compared with the late quarter 2019 growth rates. Several emerging ASEAN countries could see a more drastic slowdown: Thailand (-13 per cent), Malaysia (-13.5 per cent), and the Philippines (-13.6 per cent). Meanwhile, Indonesia’s economy could see a decline of -10.3 per cent, roughly on par with the global average. All of these countries are estimated to record annual GDP growth below that of the 2008 global financial crisis (-11.5 to -5.3 per cent forecasted for 2020 compared with -2.2 to 4.5 per cent in 2009).

Experts also pointed out five growth levers for emerging ASEAN that could be an engine propelling ASEAN’s growth in the coming years. Of which, Intra-Asia trade is expected to fall 13 per cent from 2019 to 2020 compared with a drop of 20 per cent in east-to-west trade. The inclination of senior global executives to diversify supply chains from China to other Asian countries has intensified. Based on a survey of 150 global businesses by QIMA, 67 per cent of EU executives and 80 per cent of US executives said they intend to shift sourcing to other Asian countries.

In the opinion of Steven Okun, founder and CEO of APAC Advisors, Vietnam is the hub of free trade agreements, an advantage that few countries have to diversify their supply chains. Moreover, Vietnam is trying to update cut-edge technologies, so this is one of the most attractive destinations in the region. Vietnam ranks third among leading countries receiving venture funds.

Sharing this opinion, Thieu Phuong Nam, country manager of Qualcomm Vietnam, Laos, and Cambodia, said that Vietnam is one of the fastest developing innovation centres in the region, and there is a promising land for technology companies in Vietnam. So Qualcomm has developed an R&D centre there to research the Internet of Things, 5G, and machine learning.

Also at the webinar, experts recommended that ASEAN countries should keep together to recover after the pandemic. "The most important factor to recover after COVID-19 is to expand upgrade healthcare system, especially for poor and disadvantaged people in society," Thiam Hee Ng from ADB said.

Meanwhile, Jefrey Joe, co-founder and managing partner at Alpha JWC said that tax is an issue for new business models. Startups are facing a lot of challenges, and need the support of big corporations like in Vietnam Venture Summit to strengthen the connection, update, and building some successful cooperation.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: Drive ASEAN Forward

Related Contents

Latest News

More News

- France supports Vietnam’s growing role in international arena: French Ambassador (January 25, 2026 | 10:11)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- Russian President congratulates Vietnamese Party leader during phone talks (January 25, 2026 | 09:58)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

- Int'l media provides large coverage of 14th National Party Congress's first working day (January 20, 2026 | 09:09)

- Vietnamese firms win top honours at ASEAN Digital Awards (January 16, 2026 | 16:45)

Tag:

Tag:

Mobile Version

Mobile Version