Key trading partners feeling the brunt of poor indicators

|

| Key trading partners feeling the brunt of poor indicators, photo Le Toan |

The latest figures announced last week by the General Department of Vietnam Customs (GDVC) showed that in the first five months of this year, the country’s total export-import turnover reached $262.54 billion, down 14.7 per cent on-year compared to the same period last year. Export turnover sat at $136.17 billion, down 11.6 per cent, and import turnover stood at $126.37 billion, down 17.9 per cent.

According to the GDVC, the biggest reasons behind Vietnam’s export and import values are attributed to a slash in demand and production in the country’s main overseas markets, including China, the US, ASEAN, South Korea, the EU, and Japan.

Economic indicators look poor across the globe, which will undoubtedly affect Vietnam. The Organisation for Economic Co-operation and Development forecasted that South Korea’s GDP growth will likely decline to 1.5 per cent in 2023 before picking up to 2.1 per cent in 2024.

The International Monetary Fund predicts that the world economy will fall from 3.4 per cent in 2022 to 2.8 per cent in 2023, before settling at 3 per cent in 2024. Advanced economies are expected to see an especially pronounced growth slowdown, from 2.7 per cent in 2022 to 1.3 per cent in 2023.

The respective growth forecasts are 1.6 and 1.1 per cent for the US in 2022 and 2023, lower than the 2.1 per cent last year. The projected rates are 0.8 and 1.4 per cent for the eurozone in 2023 and 2024, down from 3.5 per cent last year. For Japan, the rates will be just 1.3 and 1.1 per cent, basically flatlining

The main cause is the unwinding of supply chains, while the Russia-Ukraine war continues tensions. Simultaneously, consumers are tightening their belts, with enterprises suffering high prices in input materials and a lack of output markets, leading to high unemployment.

Drop in spending

The eurozone slipped into a recession early this year amid the shock of high food and energy prices, according to Europe’s statistics agency Eurostat. The eurozone declined both 0.1 per cent in Q4 of 2022 and Q1 of 2023. A recession is defined as two consecutive quarters of negative growth.

It was the first six-month contraction in the eurozone since early in the pandemic, creating a technical recession.

Experts said stubbornly high inflation tipped many consumers across the continent into a cost-of-living crisis, prompting them to pull back considerably on spending. Spending in the eurozone fell 0.3 per cent in Q1 of this year after dropping 1 per cent in Q4 of 2022. Imports were also down sharply as demand for goods and services shrank.

Public spending, which soared during the pandemic lockdowns, also posted a sharp decline, contracting in Q1 of 2022 by 1.6 per cent from a year earlier. Reduced consumption has led to stagnation in industrial production.

The downturn mirrors a contraction in Germany, the eurozone’s largest economy, which reported last month that industrial output in this nation dropped 0.3 per cent in the first three months of this year, following a 0.5 per cent contraction in Q4 of last year amid the energy price shock, according to Germany’s Federal Statistical Office.

According to the Organisation for Economic Co-operation and Development, the eurozone will grow only 0.9 per cent this year, while the World Bank’s forecast is still at 0.4 per cent.

“The world economy is facing massive difficulties, with slow recovery. This will continue affecting the Vietnamese economic performance, especially exports,” said Phan Thi Thang, Vietnamese Deputy Minister of Industry and Trade.

The Vietnamese National Assembly Economic Committee also reported that this grey global economic would continue negatively affecting the Vietnamese economy, especially its exports and imports, which have a huge impact on its GDP. The committee forecast that in the second quarter of this year, the country’s trade landscape will “not get better due to continued shortages of export orders, and if there are orders, they are small scale with a limited number and low value,” and the situation would continue until the end of Q3. The biggest sectors continuing to be hit hard will be electronics, garments and textiles, footwear, furniture, and metal.

|

On the wane

Meanwhile, in the first five months of this year the number of enterprises kicked out of the market was higher than the number entering, a first for Vietnam.

The nation saw more than 61,900 newly established businesses registered with $24.72 billion, employing 405,900 workers. This was down 1.6 per cent in the number of enterprises, 25.3 per cent in registered capital, and 7.2 per cent in the number of labourers compared to the same period last year.

Meanwhile, the total five-month number of businesses leaving the market was 88,000, which is 27 per cent higher than the number of those newly established.

“This is an unprecedented situation. According to data since 2020 when the revised Law on Enterprises was enacted, the annual number of enterprises entering the market has always been far higher than those leaving the market,” said lawmaker Tran Thi Hien representing the northern province of Ha Nam.

Further, the number of enterprises leaving the market in the first five months of 2023 is also far higher than those in the same periods of 2019-2022. According to the GDVC’s Department of Export-Import Tax, this has led to a five-month reduction in export-import tax revenues of 19.7 per cent on-year.

The department cited many item groups seeing a slash in this type of tax, including industrial materials; machinery and equipment; coal; chemical; plastics, steel; as well as garments and textile.

The department added that in the first five months of this year, the customs sector’s state budget revenue hit about $6.37 billion, down 18 per cent on-year. These revenues registered big falls in many key localities with big industrial production, such as Hanoi, Ba Ria-Vung Tau, Dong Nai, Binh Duong, Bac Ninh, and Ha Tinh, which all recorded drops from 17 to 33 per cent.

The government earlier set a target that this year, Vietnam’s total goods export-import value would be about $795 billion, up about 8 per cent against on-year. In which the export turnover will be $398 billion, up over 8 per cent. The trade surplus will stay at about $1 billion, far lower than the $11.2 billion recorded last year.

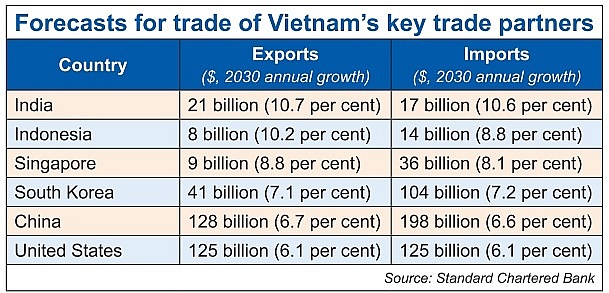

A research report released two weeks ago by Standard Chartered Bank projected that global trade is set to reach $32.6 trillion with a growth rate of 5 per cent by 2030. Trade corridors anchored in Asia, Africa and the Middle East will outpace global trade growth rate by up to four percentage points, driving combined trade volume in these regions to $14.4 trillion to account for 44 per cent of global trade by 2030.

“Vietnam will be a key driver of this global trade growth, with its exports projected to reach $618 billion by 2030 - an annual growth rate of 7 per cent, outpacing the global average of 5 per cent by a significant 2 percentage points,” the report said.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Mobile Version

Mobile Version