Huge volume of shares flock to HoSE despite current overload

|

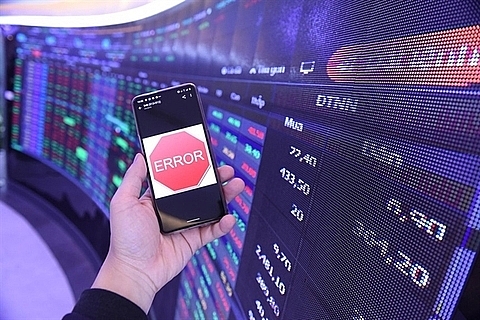

| HoSE’s trading system, which has remained mostly unchanged for the last 20 years, has been overwhelmed after a huge number of new investors began trading in recent months. - Photo tinnhanhchungkhoan.vn |

Southeast Asia Commercial Joint Stock Bank (SeAbank) has been approved to list its 1.2 billion shares on the bourse on March 24, equivalent to charter capital of VND12 trillion (US$520 million).

SeABank shares on the over-the-counter market are being traded at around VND14,400 (62 US cents) apiece.

HoSE last week also gave the green light for 15.18 million shares of Vnsteel - Vicasa Joint Stock Company to list on the bourse.

Nearly 1.1 billion shares of Orient Commercial Joint Stock Bank (OCB) had also got approval in the last days of 2020. They were officially listed on the southern bourse since January 28.

HoSE’s trading system, which has remained mostly unchanged for the last 20 years, has been overwhelmed after a huge number of new investors began trading in recent months. Many complain about the overload trouble while they are placing orders, especially in the afternoon when trading value rises to VND15 trillion ($652 million).

Concerted efforts

Market regulators need to work with HOSE to solve congestion, said General Director Trinh Hoai Giang of HCM City Securities Corporation (HSC).

“It is time for the regulator to re-organise listed stocks according to their capitalisation as the group of large and medium stocks accounted for a trading value of 85-90 per cent,” he said.

“However, the number of transaction orders for small stocks is huge. Therefore, we should send the entire group of small stocks to the Ha Noi Stock Exchange as a temporary solution. We should only consider the plan to increase the minimum trading lot if the congestion problem still does not end.”

“Regarding increasing the minimum trading lot, it is not advisable to do it simultaneously but to divide stocks based on market price. For stocks with a market price below VND20,000 per share, the lot can be increased from 100 to 1,000, while for stocks with higher market prices, the lot should be kept at 100.”

Some companies have volunteered to move their shares from HoSE to HNX following the instruction of the State Securities Comm (SSC) to alleviate system overloads that have troubled traders.

They included VNDirect Securities Corporation, BIDV Securities JSC (BSC) and PAN Group (PAN), while a number of other securities companies agreed to change the floor to reduce the load on HOSE's trading system.

VietinBank Securities Company and Agribank Securities Company said that they supported this exchange switching plan but they must submit the switching process to the shareholders during the General Meeting of Shareholders, expected to be held in April this year.

“Transferring to HNX is a temporary plan to help mitigate congestion on HOSE,” said Ta Thanh Binh, Director of Market Development Department under the State Securities Commission.

“When the new trading system is fixed, these shares will return to HoSE. The transfer from HOSE to HNX will not change the listing standards as well as the quality of the transferred shares,” she said.

Consequences

“Some Singapore funds have sold out recently partly due to concerns about the errors on the trading system of HoSE,” said Quan Trong Thanh, director of market analysis and institutional investors at Maybank Kim Eng Securities (MBKE).

“These funds themselves have a great position on the global market, in the context of global volatility and concerns about inflation, they need to prepare to withdraw capital in time. Due to recent worries over HoSE system problems, they decided to sell first to ensure capital flow.

“If there is no problems of system congestion, it is likely that they will not decide to sell early because of the promising economic outlook of Viet Nam and stable profit growth of the businesses,” he said.

“Trading congestion is different from traffic congestion, as in the former if orders cannot be placed, the opportunity is lost and will not come back again,” said Le Ngoc Nam, Deputy General Director of Tan Viet Securities Company.

“Securities companies can not only not collect fees but also face the risk of being sued by investors. Their revenues are not only sourced from fees for transactions, but also from margin lending fees and other services,” Nam said.

“If securities companies cannot collect fees, the exchange will also lose revenue,” he said.

Liquidity on HoSE could have reached an average of VND20 trillion per session if no congestion happened, higher than the current average of VND15 trillion.

As HOSE collects 0.027 per cent of the transaction value from both buying and selling sides, it is estimated to have lost VND2.84 billion in fees every day due to congestion, assuming an average value transaction of VND20 trillion per day, Nam said.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

Tag:

Tag:

Mobile Version

Mobile Version