HSBC: Firms favour ‘home’ as protectionism bites

HSBC's report found that 77 per cent of 6,000 firms surveyed globally are rather optimistic about their international business prospects and expect trade to increase over the next 12 months. The proportion of Vietnamese businesses that focus on growth is 90 per cent, significantly higher than the world average.

The confidence is based on an increase in demand for their products from consumers and businesses (33 per cent), favourable economic conditions (31 per cent), and the greater use of technology (22 per cent) in driving growth.

For Vietnam, the demand from consumers accounts for 40 per cent, while 42 per cent cite favourable economic conditions. The greater use of technology as the third driver of growth, however, is a minor reason for confidence.

|

| The opinions on protectionism, government policies, and trade agreements |

"Vietnam has been resilient through challenging periods and remains among the fastest-growing countries in Southeast Asia. Companies in Vietnam maintain that favourable economic environment and increasing demand for their products are the top growth factors for cross-border trade. A low-wage workforce, an improving business climate and the implementation of trade deals such as the EVFTA and the CPTPP are also seen as strengths and will further encourage foreign investment into the country,” said Pham Hong Hai, CEO of HSBC Vietnam.

| An increase in protectionist sentiment has not hampered the optimism of firms globally, but is causing concerns about the cost of doing cross-border trade and international business. |

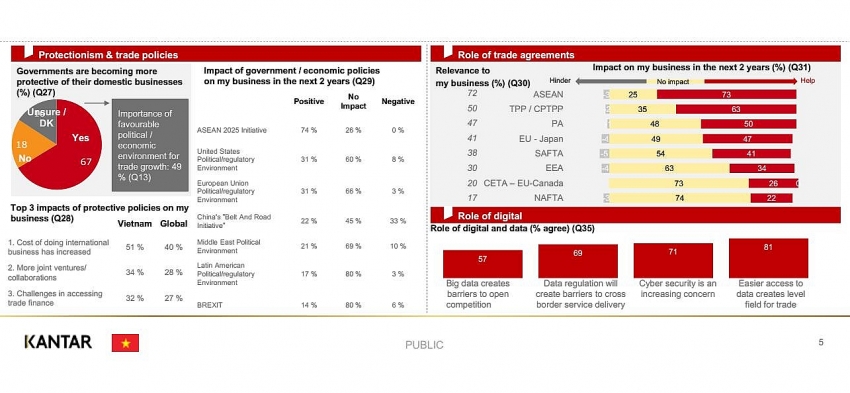

Three in five companies surveyed think governments are becoming more protective of their domestic economies. This sentiment is strongest among companies in the Middle East and North Africa region (MENA) (70 per cent) and the Asia-Pacific (68 per cent).

In Vietnam, three quarters (67 per cent) of businesses agree that governments are becoming more protective of their domestic businesses.

To cope with this challenge, the majority of firms are looking for regional partners to develop trade opportunities, with more than three quarters (74 per cent) of overseas trade in Europe and the Asia-Pacific being conducted within their ‘home’ region.

This trend is set to continue with regional ties being prioritised in firms’ expansion plans for the next three to five years.

According to Noel Quinn, chief executive of Global Commercial Banking at HSBC, overall, companies are showing remarkable agility in navigating the changing trade policy landscape. They are getting on with adapting business plans and relationships to participate in shifting supply chains. Strategies include increasing regional trade, establishing joint ventures or local subsidiaries in more markets, and capitalising on trends in consumer demand and digital technologies.

“An increase in protectionist sentiment has not hampered the optimism of firms globally, but is causing concerns about the cost of doing cross-border trade and international business,” Quinn said.

The Asia-Pacific is projected to be the strongest area for growth across the world in the next three to five years and Europe to be the second most important.

Relevant to the growth projection, 62 per cent of companies expect an increase in need for trade finance. 88 per cent of respondents in Vietnam agree with this and 86 per cent expect an increase in accessibility to trade finance.

Three major challenges the businesses cite to meet trade finance needs are high transaction costs (Vietnam: 52 per cent), exchange rate volatility (Vietnam: 44 per cent), and political environment. Thanks to political stability, Vietnam is not in the top ten markets who say that the political environment is the third challenge.

Vietnam, meanwhile, focuses on major trading partners in Asia as well as the US as the key partner outside of Asia. On the impact of government policies, those designed to strengthen regional ties such as China’s ‘Belt and Road Initiative’ (40 per cent) and the ASEAN’s 2025 strategy (37 per cent) were cited most frequently as having a positive impact on international business.

Companies in Vietnam see ASEAN 2025 (74 per cent) and the CPTPP (63 per cent) as the top two government policies that have positive impact on their business. 50 per cent of survey participants in Vietnam cite that the CPTPP is relevant to their business.

| A low-wage workforce, an improving business climate and the implementation of trade deals such as the EVFTA and the CPTPP are also seen as strengths and will further encourage foreign investment into the country. |

“Vietnam is well positioned to enjoy high growth in trade and investment. Apart from supporting pro-trade government initiatives such as RCEP and the ASEAN Vision 2025, understanding the implications of trade initiatives such as the CPTPP, business leaders should seek ways to move up the value chain, adopt digital technology, collaborate with both local and foreign businesses, and reduce reliance on low-wage workforce to be able to seize sustainable benefits from this trend,” noted Hai.

Economic analysis supports the strength of business confidence, pointing to a 7 per cent growth in trade value in 2018 (goods and services combined).

Forecasts by Oxford Economics on behalf of HSBC show the economic indicators underpinning this estimate include an upturn in investment and consumer demand, a weaker US dollar, and the recovery of the Eurozone.

“By taking time to understand the emerging drivers and impediments to trade, business leaders can identify risks and opportunities and make informed decisions for future growth,” said Quinn.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: EVFTA & EVIPA

Related Contents

Latest News

More News

- Vietnamese businesses diversify amid global trade shifts (February 03, 2026 | 17:18)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Vietnam startup funding enters a period of capital reset (January 30, 2026 | 11:06)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- PM inspects APEC 2027 project progress in An Giang province (January 29, 2026 | 09:00)

- Vietnam among the world’s top 15 trading nations (January 28, 2026 | 17:12)

- Vietnam accelerates preparations for arbitration centre linked to new financial hub (January 28, 2026 | 17:09)

Tag:

Tag:

Mobile Version

Mobile Version