GlaxoSmithKline seeking to validate EU-GMP standards

|

| Highly sought-after branded drugs made at EU-GMP facilities in Vietnam can be sold at prices 10-20 times higher than those of generic drugs |

The world’s largest vaccine maker GlaxoSmithKline (GSK) is busy with new supplementation document requests from the Drug Administration of Vietnam (DAV) for its proposal to get PIC/S-GMP and EU-GMP recognition for its manufacturing site.

Daniel Millard, chief representative of GSK Vietnam, told VIR, “We have submitted the documents which were requested. Subsequently, we have received the full recognition from the DAV in Dispatch No.3518.”

However, in Annex 2 of the dispatch dated mid-April, GSK’s site with the registered name of GlaxoSmithKline Consumer Healthcare Australia Pty. Ltd. has been asked to make further clarifications, including providing supplementary documents proving the manufacturing site has the scope of effervescent drugs. In early March, the same registered name had already been requested to make supplementation documents in Annex 2 of the DAV’s Dispatch No.1976 because its certificate of pharmaceutical product does not include the validity period.

The DAV, run through the Ministry of Health (MoH), said that it contemporarily announced it in the list of manufacturing sites meeting PIC/S-GMP, and EU-GMP standards, and asked the company to supplement the documents to clarify the validity period within three months dating from the announcement date – otherwise it would be removed from the list.

Hot race begins

GSK is performing well in Vietnam, and when fully recognised it will be responsible for manufacturing and producing medicines, vaccines, and consumer healthcare products. Its priorities will be to strengthen Vietnam’s pipeline by launching innovative medicines and vaccines, with the ambition of becoming one of the most innovative, best performing, and trusted healthcare companies.

Millard of GSK emphasised, “We duly comply with and align to the MoH’s regulation on PIC/S-GMP and EU-GMP recognition. GSK manufacturing sites have been assessed, verified, and certified with those or equivalent standards by reference or stringent regulatory Authorities such as the US, Belgium, the UK, France, Switzerland, Germany, Australia, Italy, and Poland.”

Along with GSK, a number of the world’s pharmaceutical leaders such as Sanofi, Novartis, Pfizer, F.Hoffmann-La Roche Ltd., Merck Sharp & Dohme Corporation, and Santen Pharmaceutical Co., Ltd., among others, are heading to seek both PIC/S-GMP and EU-GMP recognition.

However, like GSK, several multinational corporations (MNCs) are finding it a tough task to attain the valuable acknowledgement.

For instance, in Annex 2 of the DAV’s Dispatch No.1976 announced in early March, the Vietnamese representative office of Pfizer (Thailand) Ltd., which seeks recognition for SwissCo Services AG, is being asked to submit the certificate of consular legalisation and notarisation in line with the regulations. And in Annex 2 of the DAV’s Dispatch No.3518, Pfizer, which seeks recognition for Pfizer Pharmaceuticals LLC, is also required to produce further supplementary documents.

Similarly, F.Hoffmann-La Roche Ltd. has been requested to further clarify matters as it provided the GMP certificate of a manufacturing site located in Basel, Switzerland, but at MA products the production facility address is slightly different.

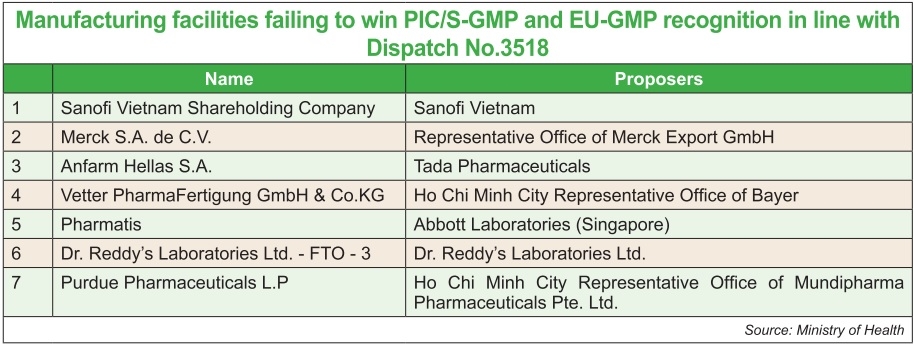

French pharmaceutical giant Sanofi Vietnam Shareholding Company, proposed by Sanofi Vietnam, and Pharmatis proposed by Abbott Laboratories (Singapore) Plc. and Dr. Reddy’s Laboratories Ltd.-FTO-3 are even on the list of those failing to receive the standards recognition.

Despite the challenges, the list of groups aiming for recognition is lengthening. Industry insiders attributed the trend to their ambition to increasingly approach tenders of Group 1 of brand-name drugs which go to the hospital system, or the ethical drugs channel (ETC), which is the most profitable segment.

At present, ETC is the main distribution channel in the local pharma market, accounting for around 70 per cent, while the remainder comprises of over-the-counter or non-description drugs. Foreign players hold the majority of the ETC market due to ownership of brand-name drugs, which operate in a monopolistic manner and sell at high prices.

It is expected that the race will become more heated when the EU-Vietnam Free Trade Agreement is ratified and comes into effect as the landmark deal will make pharmaceuticals imports from the EU into Vietnam more favourable, accessible, and direct. The EU is currently Vietnam’s biggest pharmaceutical import market. It is estimated that the Southeast Asian country imports around 55 per cent of total demand.

|

Profitable but challenging

Despite the attraction, the local pharmaceutical market is also challenging, with a number of regulations and stricter rules, aiming to ensure safety and high-quality drugs for locals.

According to one VIR source, the DAV is working on a draft circular guiding registration and circulation of outsourced pharmaceuticals. The draft is expected to make some changes to Circular No.23/2013/TT-BYT released in August 2013 providing guidance on drug processing activities. According to the draft, factories undertaking outsourcing of brand-name drugs must possess similar formulations, processing, and materials of EU-GMP standards, as well as equipment to ensure quality and safety.

The stricter draft rules have concerned MNCs, including members of the Pharma Group of the European Chamber of Commerce in Vietnam, which currently has 25 members such as AstraZeneca, Bayer Vietnam, Novartis Pharma, and Zuellig Pharma.

MNCs have always eyed tenders of Group 1 of brand-name drugs when they transfer technology of branded drugs to WHO-GMP factories in Vietnam. However, it is difficult to upgrade from WHO-GMP to EU-GMP.

“Upgrading a factory through this process takes around three to five years, excluding inspection and licensing times by authorised EU agencies,” a representative of one MNC said, proposing that brand-name drugs produced at WHO-GMP facilities are recognised during the transition period to encourage corporations to produce branded drugs in Vietnam.

According to a leader of the MoH, “Even if brand-name drugs are produced at WHO-GMP manufacturing facilities in Vietnam they are not considered brand-name drugs, meaning that they cannot join tenders of Group 1 of such items. In order to name branded drugs, they must be produced at EU-GMP facilities in Vietnam.”

At present, there is no difference in tax incentive treatments in domestically-owned and foreign-invested facilities conducting outsourcing in Vietnam, all being subject to VAT exemption.

Together with that exemption, currently the cost of brand-name drugs is 10-20 times higher than generic products, thus bringing in high profit for MNCs. Because of this, any possible change in the regulations of brand-name drugs is bound to attract strong attention.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version